Stock Picks Recap for 2/15/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, CELG triggered long (with market support) and worked great:

CTXS gapped over, no play.

From the Messenger, Rich's BIDU triggered short (with market support) and worked:

His CLF triggered short (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and worked great:

AMZN triggered short (without market support) and didn't work:

Rich's CMG triggered short (with market support) and worked for a point:

His LULU triggered short (with market support) and worked:

His UA triggered short (with market support) and didn't work:

His TEVA triggered short (with market support) late in the day and didn't have time to work so doesn't count either way:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Tradesight Market Preview for 2/16/12

The ES registered a range high distribution day with price recording a new high, but settling lower on the day. Note that while this leaves a sloppy candle on the chart, this was not a classic key reversal day where price settles below the low of the prior candle. Keep a close eye on the short term trend defining 10ema (blue).

Below is a weekly chart of the ES that clearly shows the importance of this price area. There are a number of technical features. The chart is working on 9 weeks up in the Seeker setup and the prior sell signal is still in effect because there was no downside 9 bar setup and the risk level hasn’t been broken.

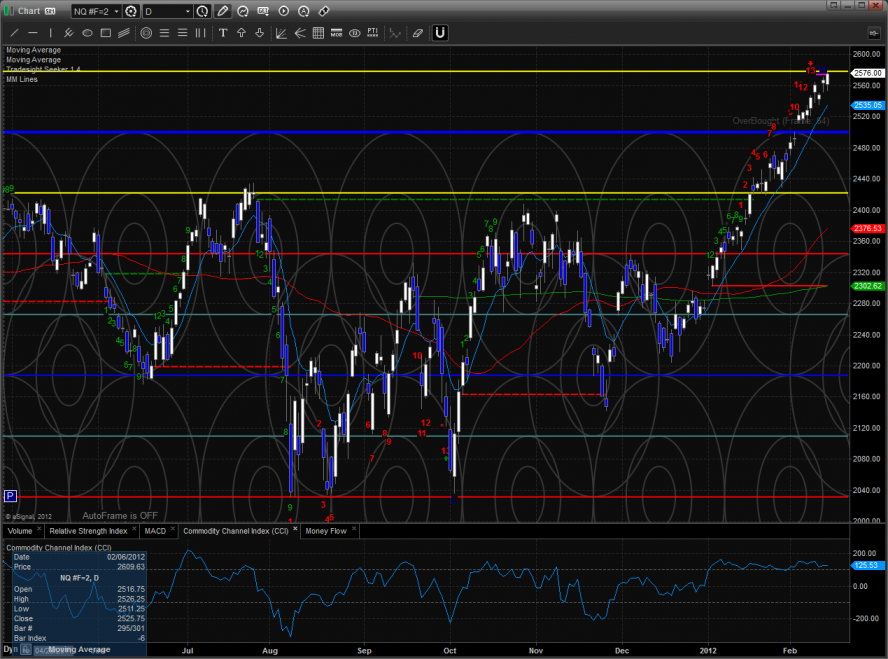

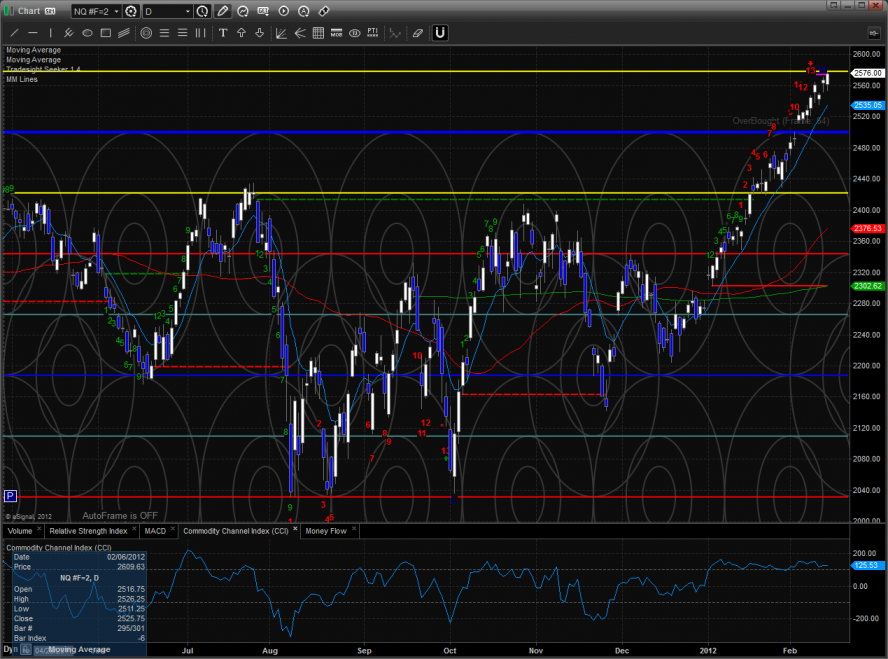

The NQ made a new high on the move but closed lower on the day. Like the ES it was a nasty candle but not a key reversal candle. The 800lb gorilla in the room, read AAPL, did record a classic key reversal day and continued downside momentum will weigh on NQ like a Nantucket sleigh ride.

The 10-day Trin is close but has not reached the overbought threshold.

Multi sector daily chart:

It’s time to start monitoring the relative performance of the NDX vs. the SPX very closely. If the NDX becomes relatively weak then stocks are ripe for a correction.

The SOX was the top gun on the day and recorded 11 days up in the Seeker count.

The BTK was higher on the day. Set an alarm for a break under the 10ema.

The BKX was flat on the day. The level to watch is the 8/8 Gann level which was previously resistance and now critical support.

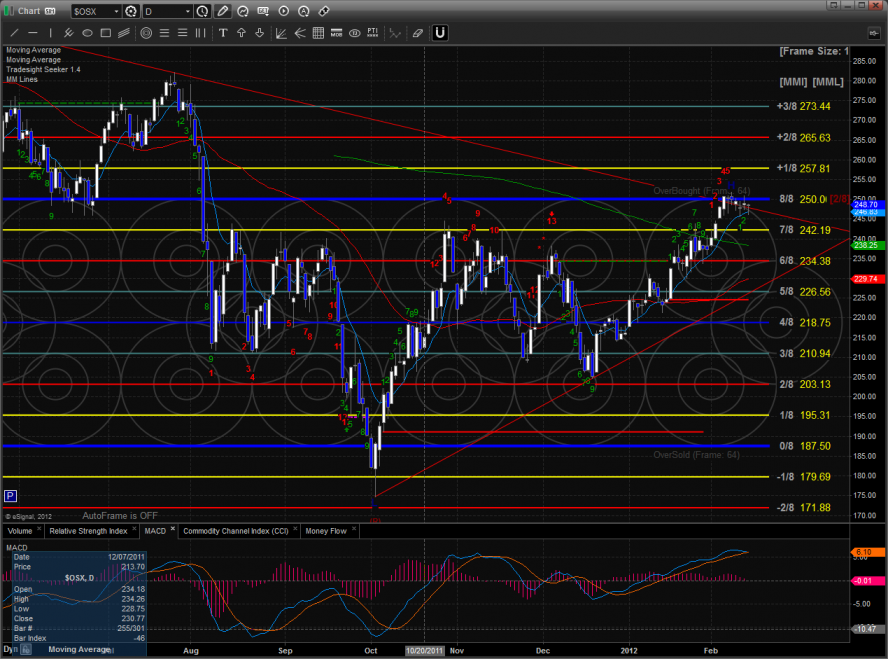

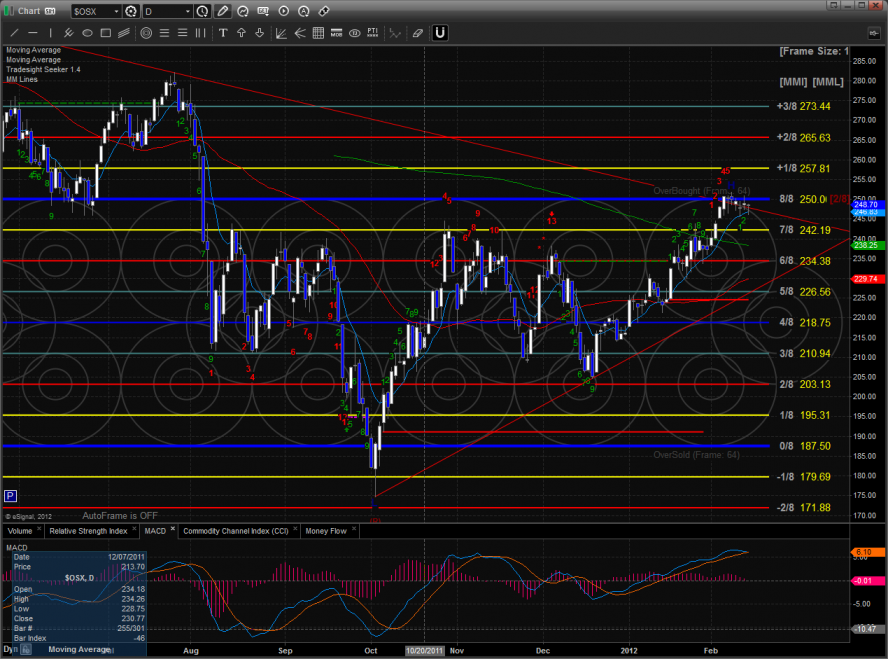

The OSX looks like it’s ready to roll. Price settled below the 10ema and the MACD is now showing sell.

Oil:

Gold:

Forex Calls Recap for 2/15/12

A very interesting lesson for some in the session. We had trades trigger in GBPUSD and EURUSD. See both sections below.

Here's the US Dollar Index intraday with market directional lines:

New calls and Chat tonight as we head into options expiration and a 3-day weekend.

EURUSD:

Triggered short very early (half size) at A and stopped. Triggered short again at B, hit first target at C, currently holding second half with a stop over 1.3100:

GBPUSD:

This trade shows you a little about how our Advanced Forex course can help you make adjustments on the fly. Triggered long at A. First target was VAH, which was right at the top of the screen at 1.5741 (you can't quite see the line). We came within 5 pips, so if you stagger your orders correctly as we teach in the main course, you could have gotten a piece off. However, we got a Seeker 13 sell signal (the red 13 on the chart) right up there too, which I pointed out in the Messenger, which should make you take a piece off if your price hadn't hit. Second half stopped:

Forex Calls Recap for 2/15/12

A very interesting lesson for some in the session. We had trades trigger in GBPUSD and EURUSD. See both sections below.

Here's the US Dollar Index intraday with market directional lines:

New calls and Chat tonight as we head into options expiration and a 3-day weekend.

EURUSD:

Triggered short very early (half size) at A and stopped. Triggered short again at B, hit first target at C, currently holding second half with a stop over 1.3100:

GBPUSD:

This trade shows you a little about how our Advanced Forex course can help you make adjustments on the fly. Triggered long at A. First target was VAH, which was right at the top of the screen at 1.5741 (you can't quite see the line). We came within 5 pips, so if you stagger your orders correctly as we teach in the main course, you could have gotten a piece off. However, we got a Seeker 13 sell signal (the red 13 on the chart) right up there too, which I pointed out in the Messenger, which should make you take a piece off if your price hadn't hit. Second half stopped:

Stock Picks Recap for 2/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered off of the report.

In the Messenger, RIMM triggered short (with market support) and didn't work:

AMGN triggered long (with market support) and didn't work:

SINA triggered short (with market support) and worked:

COST triggered short (with market support) and didn't work:

Rich's CRM triggered short (with market support) and didn't work:

His GPRO triggered long (without market support) and worked enough for a partial:

His CF triggered short (with market support) and worked great:

In total, that's 6 trades triggering with market support, 2 of them worked, 4 did not. First non-Holiday session under 50% winners in months.

Stock Picks Recap for 2/14/12

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered off of the report.

In the Messenger, RIMM triggered short (with market support) and didn't work:

AMGN triggered long (with market support) and didn't work:

SINA triggered short (with market support) and worked:

COST triggered short (with market support) and didn't work:

Rich's CRM triggered short (with market support) and didn't work:

His GPRO triggered long (without market support) and worked enough for a partial:

His CF triggered short (with market support) and worked great:

In total, that's 6 trades triggering with market support, 2 of them worked, 4 did not. First non-Holiday session under 50% winners in months.

Tradesight Market Preview for 2/15/12

The ES finished the day about unchanged. Momentum seems to be waning but price must break before any downside consideration can be given. The 9th candle of the current setup recycled the Seeker countdown so the process must start over.

The NQ aggressively surged at the end of the day to close up on the day by 8. Keep a close eye on the active Seeker risk level.

The 10-day Trin is still not overbought:

Multi sector daily chart:

The NDX continues to bullishly keep its relative strength vs. the SPX.

The SOX was the top performing major sector on the day. Price remains boxed up in the recent range and below the boundary of the upper channel. Keep in mind that a break higher will likely produce a Seeker sell signal.

The OSX was little changed and continues to ride the wedge without breaking.

The BKX was a cause for concern from the day’s performance. Much weaker than the broad market and closing a new 5 day low.

Set an alarm for a break under last week’s low in the BTK. If the market rolls this could be a very nice sector to find overbought stocks that have room to fall before real support.

Oil:

Gold:

Tradesight Market Preview for 2/15/12

The ES finished the day about unchanged. Momentum seems to be waning but price must break before any downside consideration can be given. The 9th candle of the current setup recycled the Seeker countdown so the process must start over.

The NQ aggressively surged at the end of the day to close up on the day by 8. Keep a close eye on the active Seeker risk level.

The 10-day Trin is still not overbought:

Multi sector daily chart:

The NDX continues to bullishly keep its relative strength vs. the SPX.

The SOX was the top performing major sector on the day. Price remains boxed up in the recent range and below the boundary of the upper channel. Keep in mind that a break higher will likely produce a Seeker sell signal.

The OSX was little changed and continues to ride the wedge without breaking.

The BKX was a cause for concern from the day’s performance. Much weaker than the broad market and closing a new 5 day low.

Set an alarm for a break under last week’s low in the BTK. If the market rolls this could be a very nice sector to find overbought stocks that have room to fall before real support.

Oil:

Gold:

Forex Calls Recap for 2/14/12

A better session than the last, but still no consistent movement in the pairs, and not a ton of range. See EURUSD for trade call reviews.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered short at A and stopped. Triggered long at B, hit first target exactly at C, second half stopped. Put both trades back in in the morning per the Messenger, triggered short at D and hit first target at E. Still holding second half with a stop over S2:

Forex Calls Recap for 2/14/12

A better session than the last, but still no consistent movement in the pairs, and not a ton of range. See EURUSD for trade call reviews.

Here's a look at the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered short at A and stopped. Triggered long at B, hit first target exactly at C, second half stopped. Put both trades back in in the morning per the Messenger, triggered short at D and hit first target at E. Still holding second half with a stop over S2: