Tradesight Market Preview for 11/29/11

The ES gained 37 on the day all of which came from a huge gap up. The oversold energy took trade up to a key area just below the 50dma and below the 1197 gap window. The technicals remain negative but there is enough oversold energy in the pattern to continue higher.

NQ futures posted a stronger day because there was some positive distance between the open and close (note how this is seen in the white body of the NQ candle while the ES candle was a doji). 2225 is the key level here which is the gap level where a vacuum lies until price reaches 2250.

Multi sector daily chart:

The 10-day Trin is retreating from the extremely oversold reading above 2 and still has a ton of potential upside energy. In the chart below note how the previous spikes lead to multi-day advances that covered good range.

The BTK was the top performing major sector pivoting off the 0/8 Gann level.

The XBD Broker-Dealer index also bounced off a key level. Keep an eye on MS, GS and the others.

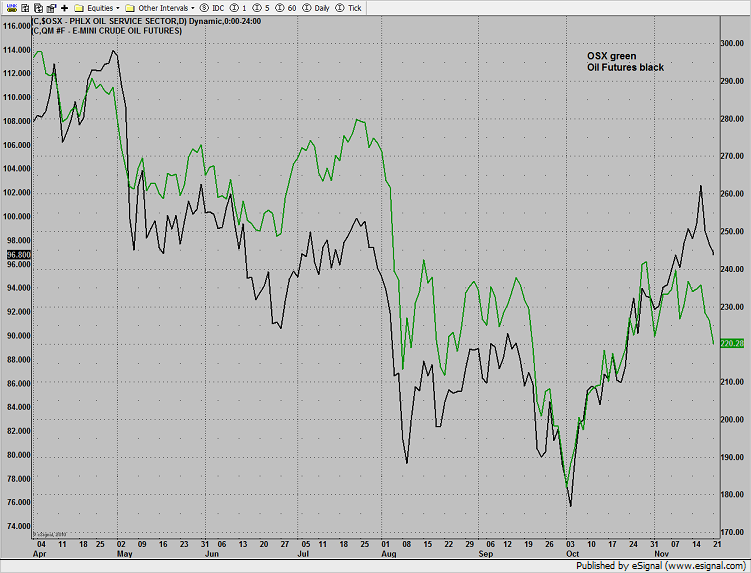

The OSX found support exactly at the lower window of the right shoulder. The pattern is still intact.

The SOX traded with the market and is still below all the minor and major moving averages.

The BKX was weak relative to the market and continues to be a concern. Index member BAC barely closed up on the day.

Gold was higher by 28:

Oil was much higher intraday but settled up some. The 100 level is the level that needs to be taken. Price remains above the major ma’s.

Stock Picks Recap for 11/28/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

With the gap up, nothing triggered off of the report.

In the Messenger, Rich's WYNN triggered long (without market support due to opening five minutes) and didn't work:

His AAPL triggered short (without market support) and didn't work:

His SODA triggered long (with market support) and worked enough for a partial:

GOOG triggered long (with market support) and worked great:

Rich's DECK triggered short (without market support) and didn't work:

BIDU triggered short (without market support) and worked:

GS triggered short (with market support) and worked enough for a partial, then worked better later but probably after you exited:

GOOG triggered short (with market support) and didn't work:

We had a ton of additional calls in the Messenger, but nothing else triggered.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Forex Calls Recap for 11/28/11

One early stop out and then a couple of winners in the European session to bring us back from the Holiday. See EURUSD and GBPUSD below, including the perfect Value Area move on the GBPUSD. Classic.

Here's the US Dollar Index intraday with market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered long early (half size) at A and stopped. Triggered long at B in the European session, hit first target at C, raised stop in the morning and stopped at D:

GBPUSD:

Look at this perfect Value Area play, bouncing above the VAH/R1 in the Asian session, then triggering short into the Value Area at A, hit the Value Area Low EXACTLY at B, and stopping the second half at C:

That's definition of a Value Area move.

Traedesight Market Preview for 11/23/11

The ES lost 8 on the day, mostly trading inside yesterday’s range. Note that the MACD has broken the zero line.

The NQ futures traded with relative strength vs. the ES posting a true inside day. The bias is lower and the gap window at 2225 is key.

Multi sector daily chart:

The 10-day Trin pushed higher making the third highest close of the year. This loads the market with oversold energy.

The defensive XAU was top gun on the day:

The BTK was the only other major sector up on the day which is a small consolation because this is just an oversold bounce.

The OSX was down 1% and continues to game the 50dma.

The SOX is right at last support. If this level is lost the door is open for downside momentum to develop. Note that the MACD is right at the zero line.

The BKX expanded the range to the downside. The bias remains negative.

Gold was higher by 21:

Oil is still holding above the 200dma:

Stock Picks Recap for 11/22/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, PWRD gapped under the short trigger, no play.

In the Messenger, Rich's AAPL triggered long (without market support due to opening five minutes) and worked great:

His GS triggered long (without market support due to opening five minutes) and didn't work:

His WYNN triggered long (with market support) and worked:

His BIDU triggered long (with market support) and worked:

His FSLR triggered short (with market support) and worked:

His APA triggered short (with market support) and worked:

EBAY triggered long (with market support) and didn't work:

GOOG triggered short (with market support) and didn't really work:

AMZN triggered short (with market support) and didn't really work:

Rich's GILD triggered long (with market support) and worked:

His CF triggered long (with market support) and worked:

In total, that's 9 trades triggering with market support, 6 of them worked, 3 did not.

Forex Calls Recap for 11/22/11

Amazingly flat session on most of the pairs, although the GBPUSD was rude enough to trigger both of our trades and then wind up back where it started. See GBPUSD section below.

Here's the US Dollar Index intraday with our market directional lines:

New calls and Chat tonight, but Japan on Holiday (not that the JPY moves anymore) and we're heading into the busiest travel day of the year.

GBPUSD:

Triggered long at A and stopped. Triggered short at B and stopped:

Tradesight Market Preview for 11/22/11

The ES lost 23 on the day decisively breaking last week’s range and losing the 50dma in the process. Fibs have been added to the chart from the swing low to high of the recent move. A loss of the 50% level would be very bearish and put the October low in play. One small positive is that the MACD is still above the zero line.

The NQ futures used the 3/8 Gann level as support but surrendered the 4/8 Gann level. The breakdown was confirmed on Friday and Today’s price action was genuine follow through. The MACD has bearishly penetrated the zero level. Next support is the active static trend line around 2162 (red line).

Multi sector daily chart:

The 10-day Trin is getting very oversold. The most recent reading has it at 1.92. This tells us that the market is very short-term oversold and could see a meaningful turn..

The NDX has quickly lost a great deal of its relative strength and the near-term performance of index overweighed AAPL should be watched closely.

The OSX continues to bearishly underperform the crude futures.

There is still a divergence in the XAU/gold cross where the XAU is bearishly underperforming the underlying commodity.

The BTK broke to a new low on the move. Keep a close eye on the Gann 0/8 level at 1k.

The XAU bounced off the active static trend line. This Seeker setup is only 4 days down with the potential for a velocity break of the STL.

The SOX broke back below the 50dma and should find minor support at the 360 level where the trend channel resides.

The OSX has broken the triangle pattern and has minor support at the 50dma. Key support is at the 210 area which is the where the reverse H&S patter traces out.

The BKX was the last laggard on the day losing a full 3%. As long as this sector remains weak the broad market is anchored.

Gold was very weak and a source of funds for the margin sellers. Price settled below the 62% fib and has next support at the 50% level.

Oil also got whacked. The key near-term level is the 200dma and then the active static trend line. Note that the MACD has just rolled over.

Stock Picks Recap for 11/21/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SWKS triggered short (with market support) and didn't work:

CYOU triggered short (with market support) and worked:

ROVI gapped under the short trigger, no play.

In the Messenger, FSLR triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) and didn't work:

NTAP triggered short (with market support) and didn't work:

Rich's GS triggered long (with market support) and worked:

AXP triggered long (with market support) and didn't work:

BIDU triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 4 of them worked (some very nice); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES 4 did not.

Forex Calls Recap for 11/21/11

Nice winner to start the week in the GBPUSD, see below.

Here's the US Dollar Index intraday with market directional lines:

New calls and Chat tonight.

GBPUSD:

Triggered short clean at A, hit first target at B, lowered stop in the morning and stopped at C for about 80 pips:

Stock Picks Recap for 11/18/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, BCSI gapped over the long trigger, no play.

PDCO triggered short (with market support) and worked:

HOLX triggered short (with market support) and didn't do enough either way to count:

In the Messenger, Rich's CRM triggered short (with market support) and worked:

His BIDU triggered short (with market support) and didn't work:

FSLR triggered long (without market support) and went enough for a partial, but it was over very quick:

NFLX triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.