Forex Calls Recap for 9/27/11

Ranges were up a bit and after two false starts, we ended up with a winner on the EURUSD. See below. New calls and Chat tonight. Here's the US Dollar Index intraday with market directional:

EURUSD:

Triggered long early (so half size) at A and stopped. Triggered long at B and stopped. Note the precise use of the Pivot at C and D, which would have been our short if it broke. Triggered long at E, hit first target at F, raised stop in the morning and stopped at G:

Forex Calls Recap for 9/27/11

Ranges were up a bit and after two false starts, we ended up with a winner on the EURUSD. See below. New calls and Chat tonight. Here's the US Dollar Index intraday with market directional:

EURUSD:

Triggered long early (so half size) at A and stopped. Triggered long at B and stopped. Note the precise use of the Pivot at C and D, which would have been our short if it broke. Triggered long at E, hit first target at F, raised stop in the morning and stopped at G:

Stock Picks Recap for 9/26/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, ARUN gapped over, no play.

CREE triggered short (with market support) and didn't work:

FMCN triggered short (with market support) and didn't work:

In the Messenger, Rich's AAPL triggered long (with market support) and didn't work:

His LVS triggered short (with market support) and worked great:

NFLX triggered short (with market support) and worked great:

COST triggered short (with market support) and didn't work:

SINA triggered long (with market support) and didn't work, although it worked later:

AMZN triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked:

GS triggered long (with market support) and worked:

In total, that's 10 trades triggering with market support, 5 of them worked, 5 did not.

Forex Calls Recap for 9/26/11

Two winners to start the week, one on the EURUSD and one on the GBPUSD, see below. Interestingly, the US Dollar index ended up right where it started again anyway. Here's the Index with our market directional lines:

New calls and Chat tonight.

EURUSD:

Triggered short early (so half size) at A, hit first target at B, lowered stop and stopped at C:

GBPUSD:

Triggered long new calls at A, hit first target at B, raised stop and stopped (just barely) at C:

Tradesight Market Preview for 9/27/11

The SP gained 28 on the day filling the gap form last week. Note that the pattern is 12 days down with a Seeker exhaustion signal on deck.

The NAZ is also 12 days down but much stronger than the SP because the trend channel is still intact.

The XAU has lost all its relative strength:

The put/call ratio is back into the neutral area.

The 10-day Trin is back down into the neutral area but still has oversold energy in it to be released.

The BKX was higher by an impressive 5%. Note that the Seeker exhaustion signal is active.

The OSX outperformed the market and also has an active Seeker buy signal in place. Note that Monday’s candle was a classic range low outside up day.

The XAU printed new YTD lows and did not post a reversal candle.

The BTK has an active Seeker exhaustion signal. Look for a reclamation of the triangle pattern.

The SOX was a huge laggard on the day and is a source of concern for the bulls. Price needs to break decisively above the trend channel high.

Gold made a new low on the move as the liquidations continue. There was an erroneous print in the overnight futures so below is the GLD etf.

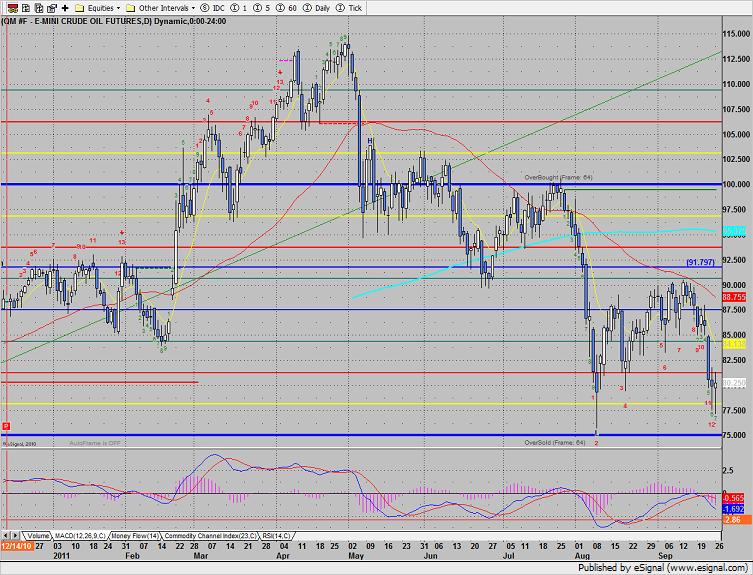

Oil was little changed on the day and did not make a new low on the move. Note the nice long tails that the last 2 candles have formed.

Stock Picks Recap for 9/23/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered off of the report.

From the Messenger, Rich's YOKU triggered long (without market support due to opening five minutes) and worked great:

His FCX triggered long (with market support) and worked:

His JPM triggered long (with market support) and didn't work:

His GS triggered long (without market support due to opening five minutes) and worked:

His ALXN triggered long (with market support) and worked for over a point:

His CLF triggered long (with market support) and didn't work:

His DECK triggered long (with market support) and worked:

NFLX triggered long (with market support) and didn't work:

EOG triggered short (without market support) and didn't work:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Stock Picks Recap for 9/23/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

Nothing triggered off of the report.

From the Messenger, Rich's YOKU triggered long (without market support due to opening five minutes) and worked great:

His FCX triggered long (with market support) and worked:

His JPM triggered long (with market support) and didn't work:

His GS triggered long (without market support due to opening five minutes) and worked:

His ALXN triggered long (with market support) and worked for over a point:

His CLF triggered long (with market support) and didn't work:

His DECK triggered long (with market support) and worked:

NFLX triggered long (with market support) and didn't work:

EOG triggered short (without market support) and didn't work:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Forex Calls Recap for 9/23/11

Fairly dull session with a winner for us on the GBPUSD, see below. As usual on the Sunday report, we will look at the action on all pairs from Thursday night/Friday, then look at the daily charts heading into the new week (not much new to see); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES and then glance at the US Dollar Index.

Speaking of, here's the US Dollar Index intraday with our market directional tool:

New calls and Chat Sunday evening.

GBPUSD:

Triggered long at A, gave you all the way to B to enter without stopping, hit first target at C, raised stop twice, note the bounce off VWAP at D, and closed for end of week at E:

Stock Picks Recap for 9/22/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, TEVA, QSFT, ITMN, and IFSIA gapped under their triggers, no plays.

MBFI triggered short (with market support) and did not work:

In the Messenger, Rich's AAPL triggered long (without market support due to opening five minutes) and worked:

GS triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) and worked for over a point:

Rich's IBM triggered long (with market support) and worked enough for a partial:

His BG triggered short (with market support) and worked:

His GOOG triggered short (with market support) and worked:

His FSLR triggered short (with market support) and worked:

His SODA triggered short (with market support) and worked:

SINA triggered short (with market support) and didn't work:

COST triggered long (without market support) and didn't work:

AMZN triggered short (with market support) and worked for over a point:

In total, that's 10 trades triggering with market support, 8 of them worked, 2 did not.

Forex Calls Recap for 9/22/11

Just barely stopped on a trade that otherwise worked. See EURUSD below. New calls and Chat tonight to wrap a nice week.

Here's the US Dollar Index with market directional lines:

EURUSD:

Triggered short at A, gave you all the way to European session start to enter, but then right under B is a spike that goes about 25 pips against the entry, which is probably enough to stop out under our rules unless you really stagger your stops:

Unfortunate, because the trade worked great otherwise.