Forex Calls Recap for 9/19/11

Awkward session with a big gap that never filled and took us away from the key Levels. We don't see that very often. I made some calls anyway, but it wasn't based on the usual types of setups. See EURUSD below.

Here's the US Dollar Index intraday with market directional:

New calls and Chat tonight.

EURUSD:

Triggered short at A and most likely stopped you (went 25 pips against the Level); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES which is a bummer because it ultimately worked to the first target:

Tradesight Market Preview for 9/20/11

The SP lost 14 on the day after recovering bigger losses from a large gap down. Price settled near but under the midpoint of the trend channel.

Naz was lower by 6 on the day and there was one interesting nuance. Price traded at a new high on the move but settled lower. Note that the upper boundary of the channel was tested.

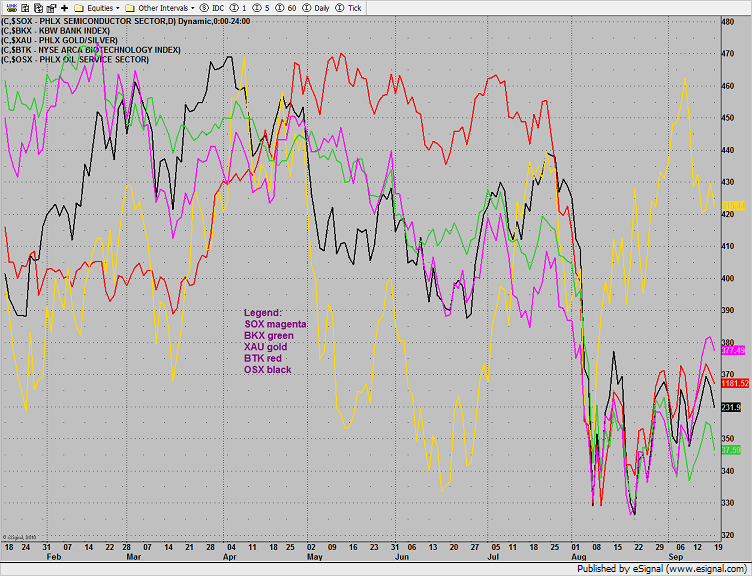

Multi sector daily chart:

The put/call ratio rebounded from an extreme low on the expiration.

The BTK was the top sector though it was still lower on the day. The pattern is getting mature and price is nearing the apex.

The XAU was stronger than the broad market and still above all the major moving averages.

The SOX settled right at the upper trend channel and was in-line with the performance of the Naz

The oil services stocks are nearing the break point of the triangle. The move on the exit of the pattern should be tradable.

The BKX was weak and is still scratching for the Seeker exhaustion signal.

Gold is working lower in price and nearing the 4/8 Gann level at 1750.

Oil was lower on the day, breaking below the triangle.

Stock Picks Recap for 9/16/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SIMO triggered long (without market support) and worked:

PAYX triggered long (wihtout market support due to opening five minutes and didn't work):

NTAP triggered long (without market support due to opening five minutes and didn't work):

In the Messenger, KLAC triggered long (with market support) and worked enough for a partial:

AAPL triggered long (with market support) and worked great:

GOOG triggered short (with market support) and did not work:

FSLR triggered short (without market support) and worked a little:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 didn't.

Stock Picks Recap for 9/16/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SIMO triggered long (without market support) and worked:

PAYX triggered long (wihtout market support due to opening five minutes and didn't work):

NTAP triggered long (without market support due to opening five minutes and didn't work):

In the Messenger, KLAC triggered long (with market support) and worked enough for a partial:

AAPL triggered long (with market support) and worked great:

GOOG triggered short (with market support) and did not work:

FSLR triggered short (without market support) and worked a little:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 didn't.

Forex Calls Recap for 9/16/11

What a great setup and clean winner on the EURUSD to close the week. See below.

Here's the US Dollar Index intraday with our market directional lines:

We resume with new calls and Chat Sunday as triple options expiration is behind us. As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then discuss the US Dollar Index, which is interesting for sure.

EURUSD:

It's possible that a leg of your trade triggered very early at A (although the whole trade at that time would have only been half size in the Asian session) and stopped. But the main run was a clean trigger at B, hit first target at C, lowered stop and might have stopped at you D on the spike depending on how close to the level you put it. We will call it stopped there, or you just close it out later for a weekend:

Stock Picks Recap for 9/15/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SIMO triggered long (without market support) and didn't do much:

CTSH triggered long (without market support) and didn't work:

MLNX gapped over, no play.

CRUS triggered long (with market support) and didn't work:

In the Messenger, AMZN triggered short (with market support) and worked enough for a partial:

SINA triggered short (with market support) and worked:

Rich's VMW triggered short (with market support) and worked enough for a partial:

AAPL triggered long (with market support) and didn't work:

Rich's UA triggered long (with market support) and didn't work:

His CRM triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

Forex Calls Recap for 9/15/11

A half-size night ahead of the CPI, but a winner that is still in play on the EURUSD. See below.

New calls and Chat tonight, back to normal size. Here is the US Dollar Index intraday with market directional lines:

EURUSD:

Early trigger (so quarter size since it was a half size night for CPI) at A that barely triggered and stopped. Didn't trigger again (never even went 2 pips under the entry Level on the bid though it bounced along it nicely). Triggered long at B, hit first target at C, raised stop in morning twice, currently holding with stop under R1, which it bounced off of at D:

Tradesight Market Preview for 9/15/11

The SP had a very strong upside option unraveling bias gaining 17 on the day. The 1180 gap has been filled and traders should target the midpoint of the channel next.

Naz was higher by 31 handles and expanded and almost tested 200dma. The next channel is the 200dma.

Multi sector daily chart:

The SOX was by far the strongest sector on the day. The upper trend channel should be resistance.

The BKX is still trapped and only performed in-line with the market.

The OSX was higher on the day but is still contained within the pattern.

The BTK is still staging in the pennant pattern, nothing new technically until the pattern is resolved.

The XAU was last laggard and a source of funds.

Gold was slightly lower on the day.

Oil was weak on the day despite a weaker dollar and higher equity prices.

Stock Picks Recap for 9/14/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, MCHP barely gapped over, so no play.

In the Messenger, NTAP triggered long (without market support) and worked enough for a partial:

GOOG triggered short (with market support) and worked great:

Rich's GS triggered short (with market support) and didn't really work:

Rich's AAPL triggered short (with market support) and worked fine:

NTAP triggered short (with market support) and worked enough for a partial:

Rich's JPM triggered short (with market support) and didn't work:

In the afternoon, GOOG triggered long (with market support) and worked huge, I got six points to the final exit:

GS triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Stock Picks Recap for 9/14/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, MCHP barely gapped over, so no play.

In the Messenger, NTAP triggered long (without market support) and worked enough for a partial:

GOOG triggered short (with market support) and worked great:

Rich's GS triggered short (with market support) and didn't really work:

Rich's AAPL triggered short (with market support) and worked fine:

NTAP triggered short (with market support) and worked enough for a partial:

Rich's JPM triggered short (with market support) and didn't work:

In the afternoon, GOOG triggered long (with market support) and worked huge, I got six points to the final exit:

GS triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.