Forex Calls Recap for 8/5/11

Winner and a loser to close out the week. See GBPUSD below. Our FX results for July will be posted to the Blog this weekend. It was a good month.

Here's the US Dollar Index intraday with market directional lines:

As usual on the Sunday report, we'll look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then discuss the US Dollar Index.

GBPUSD:

After a flat night, triggered long just barely at A and stopped at B. Re-entered and gave you two chances in the US session just before C to take it. Hit first target at D and closed final piece at E:

Stock Picks Recap for 8/4/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, NTAP triggered short (with market support) and worked:

AMLN triggered short (without market support due to opening five minutes) and worked:

In the Messenger, Rich's BIDU triggered short (without market support due to opening five minutes) and didn't work, although it worked later:

His AMZN triggered short (with market support) and worked:

COST triggered long (without market support, although in a brief period where the market looked to be heading up) and worked:

FSLR triggered short (with market support) and worked, it also triggered short later on a separate trigger and worked enough for a partial:

AAPL triggered short (with market support) but didn't work initially, worked on a second attempt that we took, but we only count the first officially:

JPM triggered short (with market support) and didn't work:

Rich's VRTX triggered short (with market support) and didn't work:

An additional NTAP short call triggered (with market support) and worked:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Forex Calls Recap for 8/4/11

Clean, simple trigger for a 100 pip winner in the EURUSD, see below.

New calls and Chat tonight, but Friday morning is NFP data, one of our Big Three releases each month, so I'm half size.

Here's the US Dollar Index intraday with market directional:

EURUSD:

Pretty simple. Triggered short at A, hit first target at B, lowered stop twice and stopped at C for 100 pips:

Tradesight Market Preview for 8/4/11

The SP closed higher on the day after posting some steep intraday losses. The bulls were able to reclaim the 1250 0/8 level which means little unless price follows through after the Friday NFP #.

Naz also posted a higher close keeping on the north side of the 200dma. Note that if price continues higher this will be a higher low on the Naz chart where the SP side was a lower high. This favors the Naz and the relative strength should be used as an opportunity.

Multi sector daily chart:

The relative performance of the NDX vs. the SPX has developed a very bullish divergence--bullish in general for equities.

The SOX continues to lag the NDX which is usually bearish for the NDX which implies that the market is not going to breakout but be range bound with a positive divergence so favor a bounce in broad market equities.

The XAU was in the middle of the pack, closing right at the 200dma.

The SOX was top gun on the day, opening and then closing above the 0/8 Gann level. Note that the Seeker exhaustion buy signal is still active.

The XAL closed at the high of day after making a new low on the move. Watch this sector for a continuation of the bounce in progress.

The BKX used a double level for support. The 0/8 level and the lower channel should provide support in the short term.

The BTK was very weak and was one of the few sectors to close lower on the day. The chart is very short term oversold and could bounce back to the 200dma.

The OSX was last laggard on the day but remains relatively strong vs. the broad market. Price remains on the positive side of the 200dma.

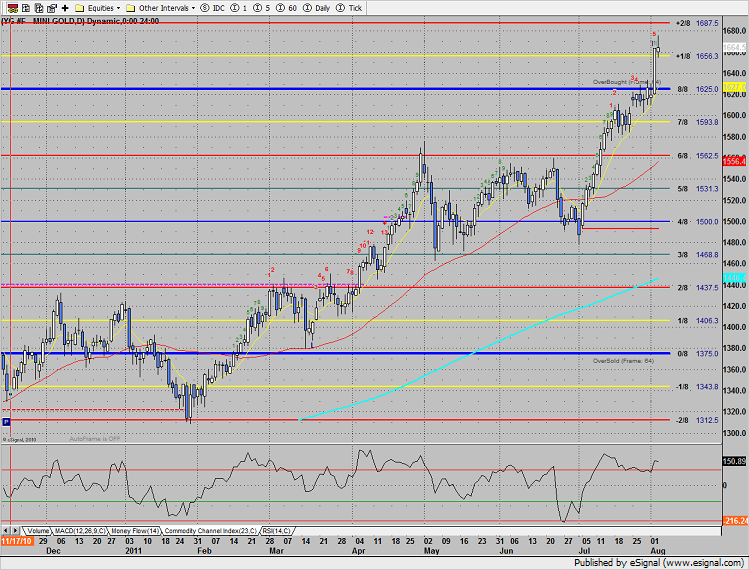

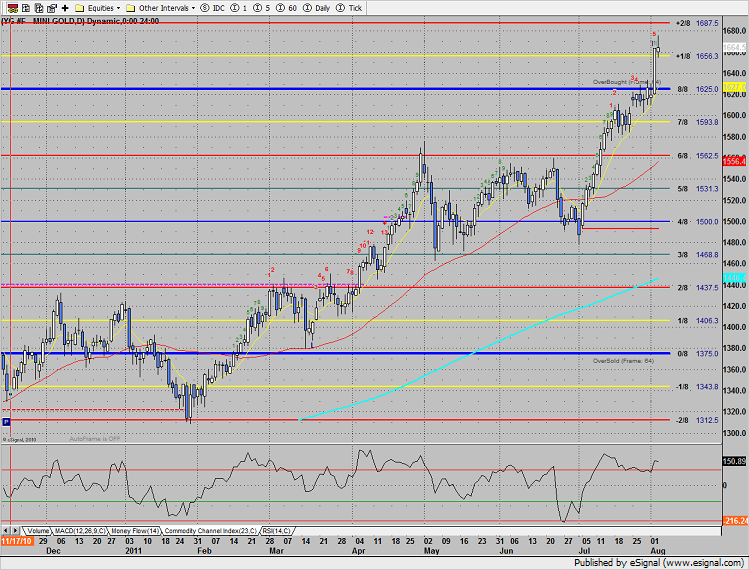

Gold continues was high very close to the over bought +2/8 level

Oil was lower on the day, closing at the 2010 high.

Tradesight Market Preview for 8/4/11

The SP closed higher on the day after posting some steep intraday losses. The bulls were able to reclaim the 1250 0/8 level which means little unless price follows through after the Friday NFP #.

Naz also posted a higher close keeping on the north side of the 200dma. Note that if price continues higher this will be a higher low on the Naz chart where the SP side was a lower high. This favors the Naz and the relative strength should be used as an opportunity.

Multi sector daily chart:

The relative performance of the NDX vs. the SPX has developed a very bullish divergence--bullish in general for equities.

The SOX continues to lag the NDX which is usually bearish for the NDX which implies that the market is not going to breakout but be range bound with a positive divergence so favor a bounce in broad market equities.

The XAU was in the middle of the pack, closing right at the 200dma.

The SOX was top gun on the day, opening and then closing above the 0/8 Gann level. Note that the Seeker exhaustion buy signal is still active.

The XAL closed at the high of day after making a new low on the move. Watch this sector for a continuation of the bounce in progress.

The BKX used a double level for support. The 0/8 level and the lower channel should provide support in the short term.

The BTK was very weak and was one of the few sectors to close lower on the day. The chart is very short term oversold and could bounce back to the 200dma.

The OSX was last laggard on the day but remains relatively strong vs. the broad market. Price remains on the positive side of the 200dma.

Gold continues was high very close to the over bought +2/8 level

Oil was lower on the day, closing at the 2010 high.

Stock Picks Recap for 8/3/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, ARBA triggered short (with market support) and worked:

RMBS triggered short (with market support) and did not work:

NTAP triggered short by two cents (with market support) and did not work:

ESRX triggered short (with market support) and did not work:

IPXL triggered short (with market support) and worked enough for a partial:

VPHM triggered short (with market support) and worked enough for a partial:

CSTR triggered short (with market support) and didn't work:

In the Messenger, Rich's IBM triggered short (with market support) and worked for over a point:

RIMM triggered short (with market support) and worked:

Rich's FSLR triggered short (with market support) and worked:

Rich's GMCR triggered long (with market support) and didn't work:

His EXAM triggered short (with market support) and worked:

GOOG triggered long (with market support) and worked:

In total, that's 13 trades triggering with market support, 8 of them worked, 5 did not.

Forex Calls Recap for 8/3/11

A pure loser on a news spike, which is unfortunate because the trade worked after that overall. See EURUSD below.

Here's the US Dollar Index intraday with market directional lines as the Dollar got a bit weaker during the session:

New calls and Chat tonight.

EURUSD:

Triggered long on a huge news spike at A and then stopped at B. That was a bummer because clearly after that (and if you were awake, you go again); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES it triggered and worked very nice. Look how it used R1 and R2 after that:

Stock Picks Recap for 8/2/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, INCY triggered short (with market support) and didn't work:

PLCM triggered short (with market support) and didn't work:

ERTS triggered short (with market support) and worked enough for a partial:

SIAL triggered short (with market support) and worked huge:

In the Messenger, GOOG triggered long (without market support) and worked for over a point:

TEVA triggered short (with market support) and worked:

AMGN triggered long (without market support) and worked enough for a partial:

Rich's SLB triggered long (without market support) and didn't work:

AAPL triggered short (with market support) and worked great:

AMZN triggered short (with market support) and worked:

Rich's AMGN triggered short (with market support) late in the day and worked enough for a partial before running out of time:

In total, that's 8 trades triggering with market support, 6 of them worked (several really nicely); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES 2 did not.

Tradesight Market Preview for 8/3/11

The SP lost 32 handles making a new low close on the year. Price settled below the key 0/8 Gann level and in now below both the 50 and 200dmas. The CCI indicates that there is a short-term oversold condition present.

The Naz side lost 57 settling just above the 200dma. This is a very key area of support for the bulls because of the relative strength that the Naz has vs. the SP. If the Naz continues lower, this positive divergence will be null.

The 10-day Trin now indicates that he market is oversold.

The Dow/gold ratio is in a area not seen since the height of the crisis in 2009. Money continues to favor gold (hard assets) over stocks. Keep in mind that the Dow/gold ratio historically bottoms around 2.

Multi sector daily chart:

Investors took refuge in the gold stocks, the XAU was the only green sector on the day.

The OSX lost the 50dma and has next support at the 200dma. The CCI has more room before it gets climatically oversold.

The SOX was down 3% making a new low on the year. Price settled right at the 0/8 key support area.

The BTK broke below the 2011 highs and next support is the 0/8 level.

The BKX broke and settled below the -2/8 Gann level. This will cause the next daily candle to bearishly frame shift. Keep in mind that lower price channel boundary is some support.

The transports collapsed 3.7% and are grossly lagging the performance of the Dow industrials.

The XAL was the last laggard on the day down almost 4%.

Oil was lower on the day:

Gold made a new high on the move and is now into overbought territory on the Gann frame.

Forex Calls Recap for 8/2/11

More good ranges and another nice winner as the US Dollar gets stronger two days in a row. See EURUSD below, where we had a new winner, plus closed out a 100 pip winner on the second half of the trade from Sunday, which was the last trade of July.

Here's the US Dollar Index intraday with market directional levels:

New calls and Chat tonight.

EURUSD:

Lots to recap here. Triggered short under VAL at A per our call but gave you through B and the European open to enter. Hit first target at C, note the use of the green tri-star level precisely at D and E. Lowered stop in the morning and stopped at F both the second half of that trade and the trade from the prior session, which was a 100-pip winner to the final exit. Also, for fun, note the exact use of our UBreak red line at G and H, 12 hours apart: