Forex Calls Recap for 7/15/11

Fairly tame session for options expiration, as expected. See EURUSD for recap of another winner, and that was that. Here's the US Dollar Index intraday with market directional lines:

New calls and Chat Sunday to start the new week. As usual on the Sunday report, we'll take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then look at the US Dollar Index daily chart.

EURUSD:

Triggered short at A, hit first target at B, lowered stop over entry and stopped second half at C:

Stock Picks Recap for 7/14/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SPPI triggered long (with market support) and didn't work:

AAPL gapped over, no play.

CIEN triggered short (with market support) and worked great:

NXPI triggered short (with market support) and worked:

AMAT triggered short (with market support) in the last few minutes of the day, so doesn't count.

CTAS triggered short (with market support) and didn't work:

In the Messenger, GS triggered long (with market support) and didn't work:

KLAC triggered long (with market support) and didn't work:

RIMM triggered short (with market support) and worked great:

BIDU triggered short (with market support) and worked great:

In total, that's 8 trades triggering with market support, 4 of them worked, 4 did not. Most of the winners were really nice.

Forex Calls Recap for 7/14/11

More winners. See EURUSD below. New calls and Chat tonight, but expiration tomorrow slows all markets, plus we have CPI.

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered long at A early, hit first target at B, raised stop under entry, second half stopped. Triggered long again at C, hit first target at D, second half stopped:

Forex Calls Recap for 7/14/11

More winners. See EURUSD below. New calls and Chat tonight, but expiration tomorrow slows all markets, plus we have CPI.

Here's the US Dollar Index intraday with market directional lines:

EURUSD:

Triggered long at A early, hit first target at B, raised stop under entry, second half stopped. Triggered long again at C, hit first target at D, second half stopped:

Forex Calls Recap for 7/13/11

Average session until after Bernanke gave his opening comments to Congress. See GBPUSD below for the trade review.

US Dollar Index intraday with market direction tools:

GBPUSD:

There was a really early trigger at A that stopped but I was on the road. Triggered long at B, hit first target at C, second half stopped at D. Triggered again in the morning at E, hit first target at F, holding with stop under G:

Stock Picks Recap for 7/12/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, not much triggered, LEAP triggered short (without market support) and didn't work:

In the Messenger, Rich's DANG triggered long (with market support) and did not work:

His GS triggered short (without market support) and did not work, although it worked later:

CRM triggered short (with market support) and worked enough for a partial:

Rich's JPM triggered long (with market support) and didn't work:

AMZN triggered short (with market support) and did not work (went about $0.50, might have gotten a partial, but not really enough under our rules for AMZN):

Rich's AGU triggered long (with market support) and did not work:

NFLX triggered long (with market support) and worked:

SINA triggered long (with market support) and did not work:

First day with less than 50% winners in a long time.

In total, that's 7 trades triggering with market support, only 2 of them worked, 5 did not. Bad session from that perspective.

Forex Calls Recap for 7/12/11

Another set of winners, see below in EURUSD for the description of all of the calls. Half size for everything due to Trade Balance, but it still worked overall.

Here's the US Dollar Index with market directional:

New calls and Chat tonight.

EURUSD:

Note the nice use of S1 and S2. Triggered short at A, hit first target at B, made an additional call for European session, that triggered short at C and hit first target at D (and went exactly to S2 beyond that). That last play stopped second half at E if you didn't make an adjustment overnight, and the initial stopped at F. New long triggered at G and stopped. Triggered again in the morning at H and closed even at I (phew!):

The Debt Ceiling Debate

Here's a little report that no one will want me to post, but I'm going to anyway.

Do you want to know the best way to prevent job growth and kill market volume in one move? Simple. Mess around with raising the debt ceiling.

I don't tend to hold back, so let me be clear. There are too many idiots that don't understand what the debt ceiling is, much less the Federal debt and deficit (separate issues, some don't even know that). You want to fix the Great Recession? You don't do it by crippling the economy, which is exactly what happens when you mess with the debt ceiling.

There are a bunch of people out there that want us to think that the US Federal Government should be run like a business.

I happen to agree and be one of them. That's 100% up my alley. When I see the Department of Defense spending thousands of dollars on toilet seats, I think, whoops, not being run like a business. If I had a business worth even a few hundred million dollars a year, I wouldn't spend that. Have you seen the new $800 toilet seats out of Japan and what they do? Who in the world needs to spend $20,000. Enough said.

But here's the problem. 90% of the folks that say that government should be run like a business...don't mean it or understand it. And that's just plain dangerous and uneducated.

Imagine the CEO of a business saying: "Here's how we're going to grow. I'm going to cut all R&D (that's Research and Development) and Marketing costs. I'm going to lay off 25% of the employees. Then, we will be more profitable."

Think that through. Be thoughtful and think it through. Instead of saying, "I want to spend more to make a better product and more on marketing to sell our product to the world," a CEO said, "Let's stop trying to grow what we do and stop trying to expand our pool of customers."

Does that sound like running a business? To me, that sounds like the opposite. Do you think you can beat Apple or Google or even RIMM by shrinking up to nothing?

But it is funny, because the same people that tend to think government is wasteful and "isn't run like a business" are the ones that want government to only address spending and not revenue and only cut but not be thoughtful and smart.

The problem isn't government. It's the dumb saps that don't understand any of it. The proof is in the events of this last weekend.

After weeks and weeks of the Republicans saying that we should cut billions and billions from the Federal government over the next decade, to the tune of $2 trillion over a decade, when Obama proposed $4 trillion in savings to fix the budget via a combo of spending cuts that Republicans wanted, plus spending cuts in Defense that they didn't want to address, plus spending cuts in Social Security and Medicare that Republicans have wanted for decades, plus HIGHER TAXES for the top 2%, suddenly, Republicans changed their tune.

Why?

Because Obama was suggesting that we should address the spending AND revenue of the corporate entity that is the US Government. And the Republicans have pledged never to do that. They will only address spending, or, to be clear, from a corporate perspective, they have promised that they will never try to grow the company or make it better. They will make it profitable through only one means: cutting costs. No more roads. No more healthcare. No more food safety. No more education. Cut whatever can be cut and whatever it takes to make the "company" not lose money, just don't return us to the days of taxation that Ronald Reagan and Bill Clinton and George H. W. Bush had us at. That was a horrible world. Make sure there are tax loopholes for corporate jet owners and more.

So what does this mean to current day America? Well, let let explain it this way. If I'm a small or medium or large business trying to understand if the US is going to pay its obligations or not, going to spend within its means or not, or going to pay back its debts or not, I'm at a loss. There's talk that for the first time in 240 years, the US government might default on its debts, even though the current debt to GDP ratio is far lower than we saw in the 1940's and 1950's. In other words, we aren't close to being at a point of crisis...unless we decide that we are not going to make payments. This is something that the US government has NEVER FLIRTED with doing in the past. Visit Food Catering Singapore for more info.

We raised the debt ceiling 12 times under Reagan, twice under the first George Bush, 6 times under Clinton, and 8 more times under the second Bush. The concept of raising the debt ceiling has never been in doubt...until now.

Under Reagan, we raised taxes 10 times. Under the first Bush...once (he might have lost his job because of it). Under Clinton, 16 times (and I made a FORTUNE in the Clinton years in the stock market). Under the second Bush, almost never did we raise taxes. Job growth was the worst in history over 8 years. We borrowed from China to pay out bills, or to be blunt, we borrowed from China to pay for the tax cuts for the rich, so the rich got richer from China and the rest of the country suffered and went into debt.

And what are the consequences of this new game? Simple. No jobs. What employer, large or small, would hire in the face of this junk? Let's set aside tax loopholes for corporations that hire overseas instead of here in America. Let's set aside technological improvements making many jobs unnecessary. Let's just focus on the key factor: Since the government has even started to flirt with the idea of not raising the debt ceiling and not meeting our obligation...job growth in the recovery has slowed, and for good reason. Too much uncertainty about whether the Dollar and markets and economy are going to tank when we default...why would businesses hire? Congress' inability to do what it has always done is causing the recent employment problems...period.

So if we don't hire, what happens? Well, the unemployment data will suck. Non-farm payroll jobs created will suck (see last Friday). People will be out of work. And then, after weeks of delay in getting this moving, someone might try to say, "Well, clearly, the government programs aren't working, and taxes on the job creators, those in the top 2%, should be LOWER."

LOL. Terrific.

And also, you might hear, "we should lower taxes on the rich so that they hire."

There is ZERO, and when I say ZERO, what I mean is ZERO, evidence that when you lower taxes for the wealthy, they employ more people. The years 2000 to 2008 prove this.

If you go state by state today, you can fish out the BS from the reality.

For example, my state of Arizona is a mess, but we are trying to deal with the mess through cost cutting and more.

Meanwhile, California is a disaster because it spends so much money, but the budget gap in California is tiny as a percentage of GDP. In other words, you don't need to do anything in California if the GDP grows by 2.9 percent versus the current non-growth. It's problems will self-correct.

Meanwhile take a state like Texas, where the Legislature meets only once every two years, and suddenly, there are issues.

The state is in financial trouble, and its employment rate, which is applauded by many, isn't so hot. In fact, Texas has one of the highest job creation rates in the country...and of that, it has the single highest temp job creation rate in the country. In other words, the state has one of the biggest budget deficits that was disguised by the fact that the state government met...never, and it's job creation rate is all temp work with no long term security or benefits. The state government is in shambles. Nothing but trouble ahead.

Meanwhile, Amazon continues to operate without sales tax, which is costing all of the states hundreds of billions in revenue. But I digress.

What we care about most, however, as traders, is the market, and we've seen for about six weeks now the same thing...light volume. The big players ran the market up for the last few days of June to peg their end of quarter statements to higher prices, but volume was weak then and it remains weak as things start to head downward. It's a bad situation for traders, but we aren't the only ones hurt.

Congress needs to act and act now. This isn't one way or no way. Everything has to be on the table and everyone should get a little of everything. Cut some costs in discretionary spending, cut some costs in the Department of Defense, tinker with some longer term changes to Social Security, and let the Bush tax cuts for those making over $250,000 a year expire. Problem solved. The market will like it and we can get back to trading.

But more importantly, getting this behind us like big boys and girls will get people back to work. The idea that it won't just because the government also expands its R&D number over the next decade while cutting other costs is nonsense.

Tradesight Market Preview for 7/12/11

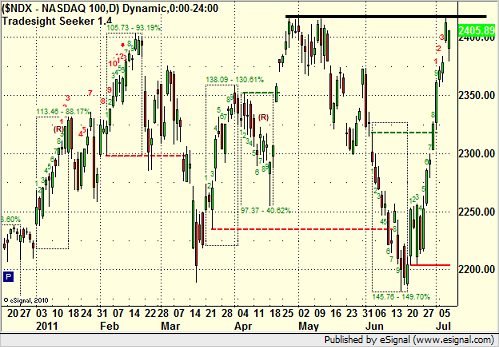

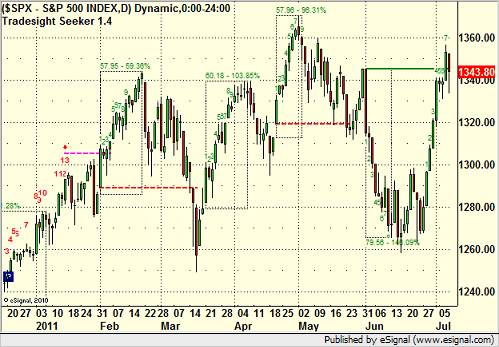

The SP gapped sharply lower and never recovered, losing 23 handles on the day. Intraday price used the 4/8 Gann level and 50dma for support. The MACD is far from a cross over but the CCI is overbought. A settlement below the 50 and the 4/8 will possibly put in place a failing retest of the high.

Naz lost 42 on the day after recording a new high late last week. Note that the Naz is relatively strong vs. the SP, price is well above the 4/8 level, the 50dma and even the 10ema. Tuesday, the FOMC will release the minutes from the prior meeting which should shed some light on the prospects of any further quantative stimulus and could be a key catalyst.

The banks continue to be the laggard on the multi sector daily chart;

The NYSE weekly cumulative advance/decline line was lower on Friday even though the market was higher on settlement. This is a very, very concerning divergence and should be monitored very closely. If the A/D line falters regardless of what the short term equity prices are doing they are ultimately headed lower. Please read the prior sentence again.

The Trin closed at 5.14 which was elevated enough to record an oversold reading of 1.358 for the 10-day Trin.

The Naz is leading the SP which is a bullish condition:

The OSX still has relative strength vs. crude futures which is bullish for oil:

The SOX is still grossly underperforming the NDX, a classic bearish divergence.

The XAU continues to, well, “suck eggs” vs. the underlying commodity. This is a very wide disconnect. Note that even with the strength of gold futures on Monday, exceeding the May and June highs the XAU did not.

The SOX was lower by 7 on the day, settling below the 200dma.

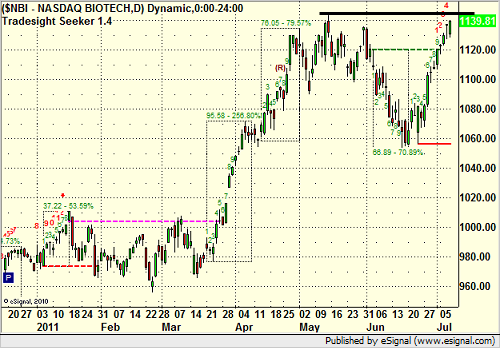

The BTK was weaker then both the Naz and the SP;

The OSX closed right at the 50dma;

The BKX was the weakest sector on the day, rejected by the upper boundary of the trend channel.

Oil:

Gold settled at the second highest level of the year.

Market Preview for 7/11/11

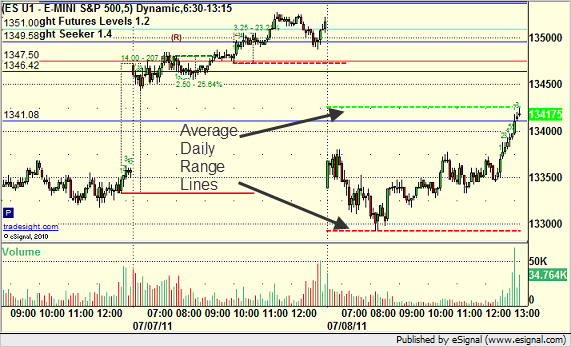

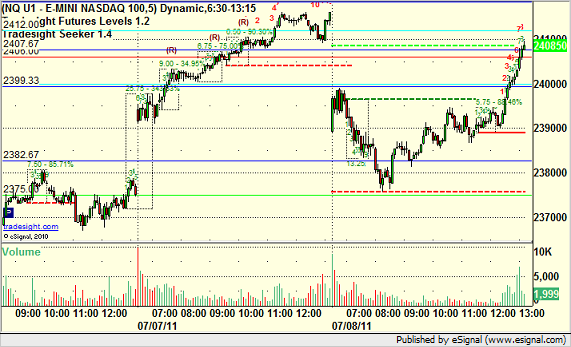

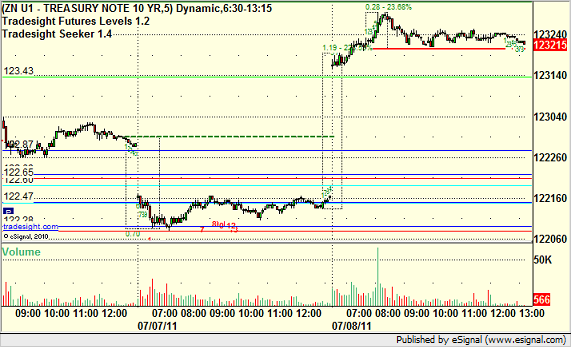

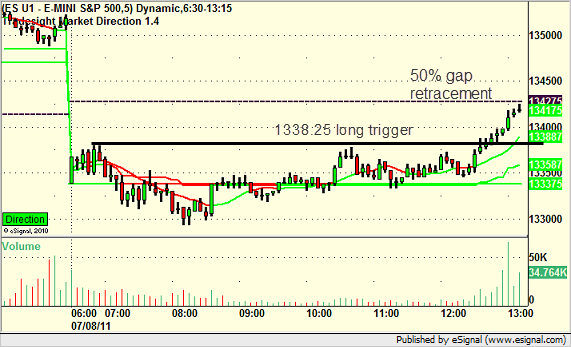

Let's talk about island reversal formations. The concept is that the market is heading one direction (we will use up in this example); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES then gaps UP further one day and holds, then gaps down ENTIRELY below the range of that day the next and never trades into the range of that prior day. This leaves you with a floating island on the daily chart. A break under the lows of that pattern is then a short trigger. ES with Tradesight Levels:

NQ with Tradesight Levels:

ZN (10-year Treasury Note) with Tradesight Levels:

ES with Tradesight Market Directional Tool:

So what does that island formation discussion above mean for the daily charts? A few things to consider. First, the NDX recovered enough Friday that there is no island there, and it looks ripe for a breakout:

The SOX is the major index that is lagging the tech sector here (software and biotechs are much stronger):

The biotechs are breaking out:

The S&P looks strong too, but you can't see the gap on the S&P chart the way that open and closing action works to not show gaps:

Most of this is very bullish action that looks good for a breakout, and certainly if the NDX takes out the highs, that could lead to a run (that would be the trigger.

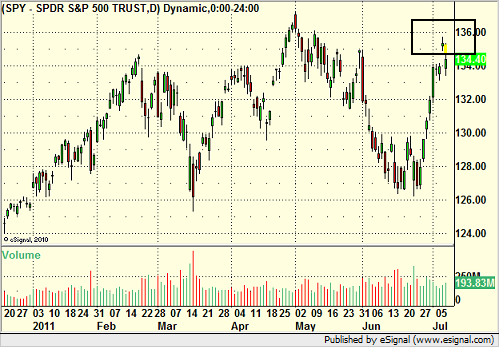

However, let's remember that in any real sense, there is an island on the S&P, which you can see in the chart of the SPY:

That is an extremely negative topping pattern when it confirms, and the confirmation, as I stated in the section above, would be a trade through the low of Friday. So, NDX making new highs, major buy signal. S&P under Friday's lows...maybe even a more powerful sell signal.