Forex Calls Recap for 6/29/11

Another winner for the week in the EURUSD. See below.

Here's the US Dollar Index intraday with market direction levels:

New calls and chat tonight.

EURUSD:

Triggered long at A, hit first target at B, raised stop to entry and stopped at C:

GBPUSD:

Added an additional call long at A which didn't get going, closed even:

Forex Calls Recap for 6/29/11

Another winner for the week in the EURUSD. See below.

Here's the US Dollar Index intraday with market direction levels:

New calls and chat tonight.

EURUSD:

Triggered long at A, hit first target at B, raised stop to entry and stopped at C:

GBPUSD:

Added an additional call long at A which didn't get going, closed even:

Tradesight Market Preview for 6/28/11

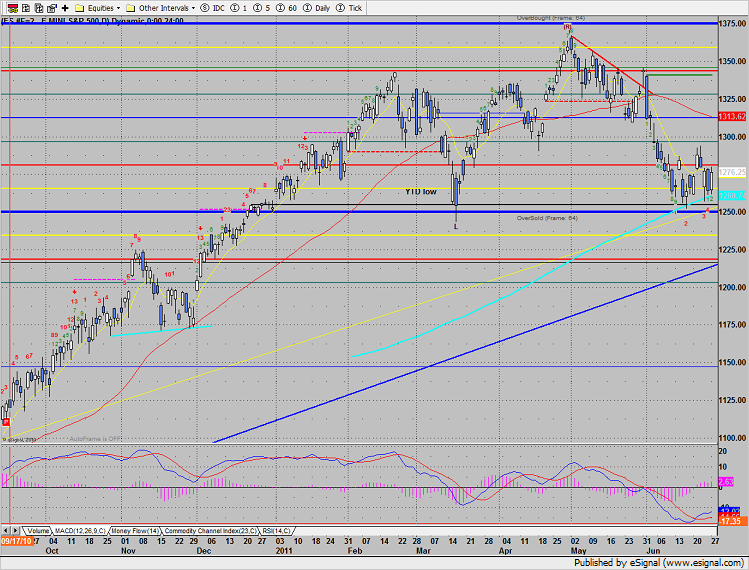

The SP is making good on improving technicals. On light volume, more on that later, the futures gained 18 on the day marking the best close in weeks. Many of the financial commentators will dismiss today’s rally as unimpressive because of the low volume but be prepared for more of the same. There is an unusually large amount of institutional cash on the sideline. This is the perfect environment for a low volume summer walk up of stock prices. As long as the technicals remain positive and the trend bias is up, look to trade the long side of the market regardless of the volume. We’ll all have a chuckle in August if the “feeble, lackluster and uninspiring” volume carries price back to 1350 and we’ve been long the whole way even as the financial commentators continue to dismiss the move as “unsustainable”.

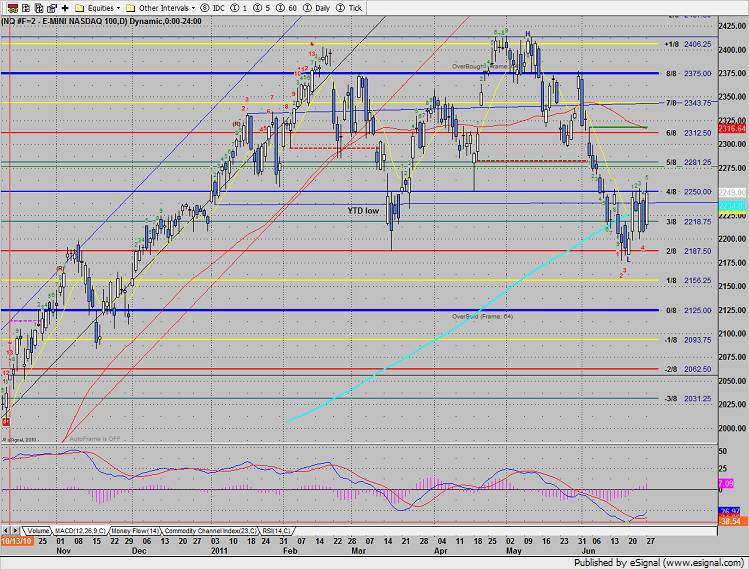

Naz added 35 on the day which was a slight underperformance to what is should have done. This is really the only technical compromise from the markets today. The static trend line and 50dma are the trade-to-target.

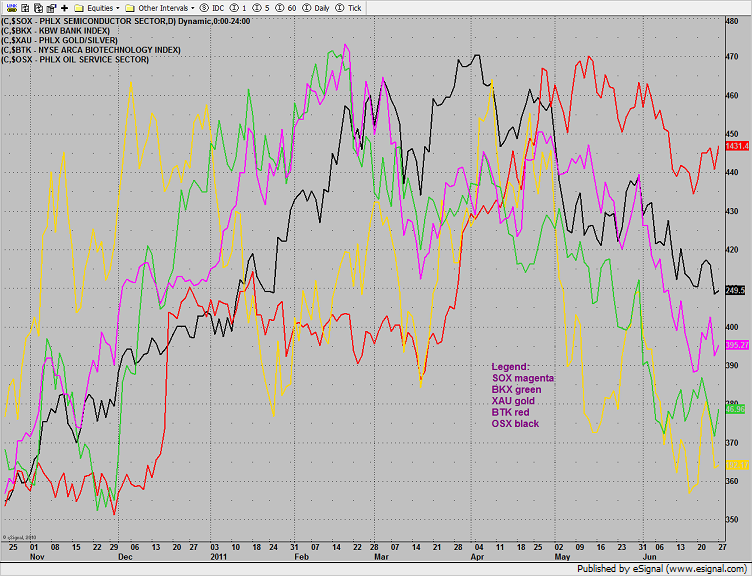

Multi sector daily chart:

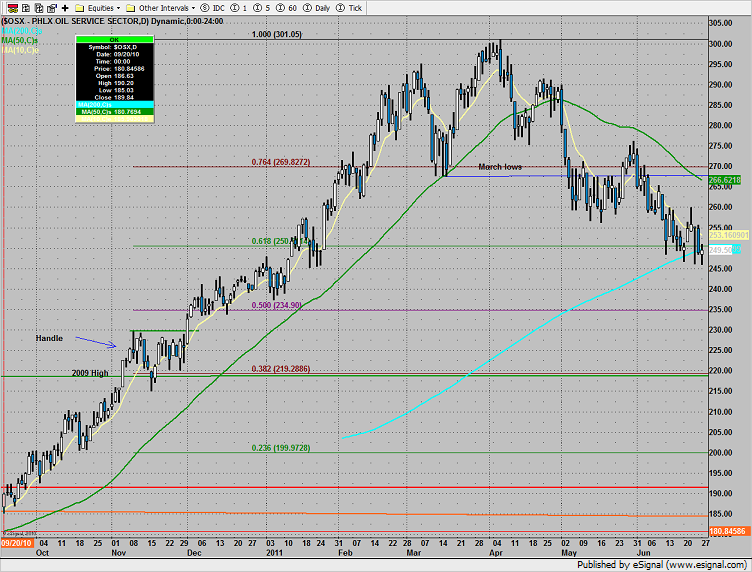

The OSX was top gun on the day, outperforming all other major sectors. If the market gets in gear for a summer rally, this sector should break the DTL. Set an alarm.

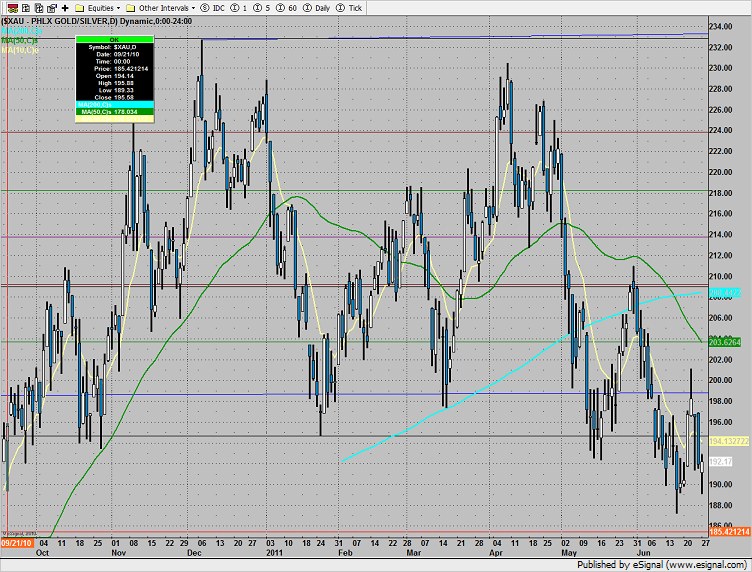

The XAU was stronger than the broad market with an implied first bounce target of 200.

Be sure to overweight the Transports for the next few weeks. They are typically the best late cycle performer. Truckers, airlines and shippers should all be evaluated for long trades. Note that the TRAN is already back above the 50dma

The SOX is still a problem. They are still well below the midpoint of trade for the month and underperformed both the broad market and Naz today. There will be a big pop soon but follow through will be bumpy and uneven. The pigs will get their lipstick but continue to underweight.

The XAL underperformed on the day and is now 9 days up. When this DTL gets taken out they should begin to fly.

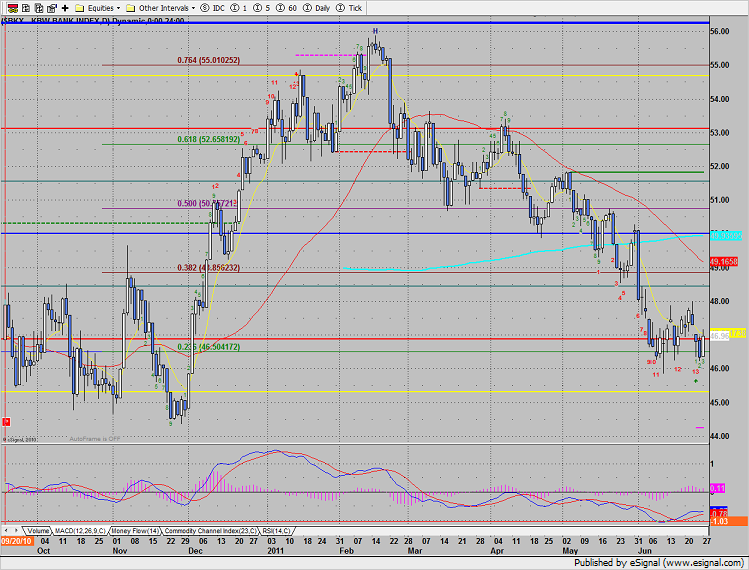

The BKX was last laggard on the day but should soon pivot and make good on the 13 exhaustion signal. 200dma by Labor Day? The BKX is the big early cycle sector which means that they are typically not top performers late in the cycle where we currently reside. This means that if the banks can turn positive it is a confirmation signal that the market has made a real turn and that even the less desirable sectors are attracting money. These confirming signals define the “rising tide” of true bias.

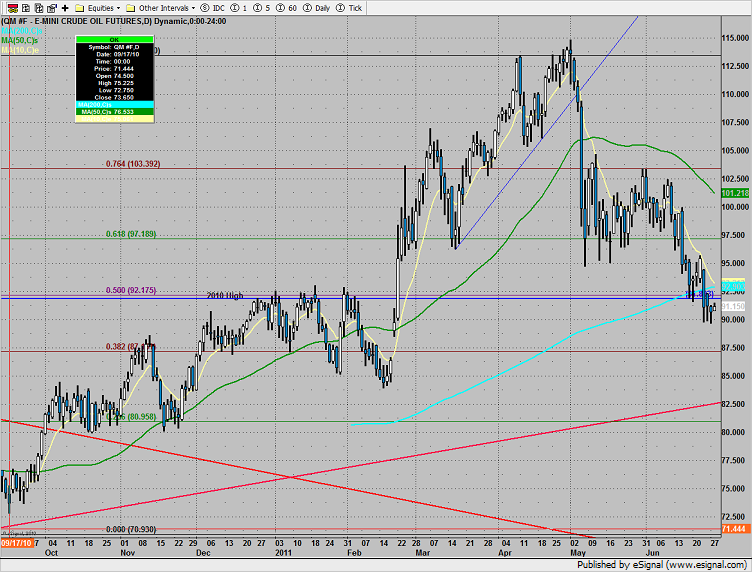

Oil bounced back to the 200dma.

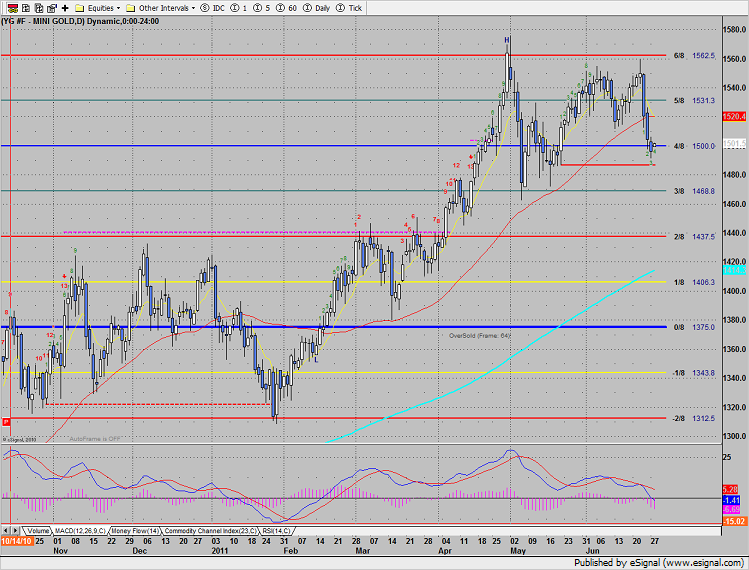

Gold has broken trend and is a source of funds.

Tradesight Market Preview for 6/28/11

The SP is making good on improving technicals. On light volume, more on that later, the futures gained 18 on the day marking the best close in weeks. Many of the financial commentators will dismiss today’s rally as unimpressive because of the low volume but be prepared for more of the same. There is an unusually large amount of institutional cash on the sideline. This is the perfect environment for a low volume summer walk up of stock prices. As long as the technicals remain positive and the trend bias is up, look to trade the long side of the market regardless of the volume. We’ll all have a chuckle in August if the “feeble, lackluster and uninspiring” volume carries price back to 1350 and we’ve been long the whole way even as the financial commentators continue to dismiss the move as “unsustainable”.

Naz added 35 on the day which was a slight underperformance to what is should have done. This is really the only technical compromise from the markets today. The static trend line and 50dma are the trade-to-target.

Multi sector daily chart:

The OSX was top gun on the day, outperforming all other major sectors. If the market gets in gear for a summer rally, this sector should break the DTL. Set an alarm.

The XAU was stronger than the broad market with an implied first bounce target of 200.

Be sure to overweight the Transports for the next few weeks. They are typically the best late cycle performer. Truckers, airlines and shippers should all be evaluated for long trades. Note that the TRAN is already back above the 50dma

The SOX is still a problem. They are still well below the midpoint of trade for the month and underperformed both the broad market and Naz today. There will be a big pop soon but follow through will be bumpy and uneven. The pigs will get their lipstick but continue to underweight.

The XAL underperformed on the day and is now 9 days up. When this DTL gets taken out they should begin to fly.

The BKX was last laggard on the day but should soon pivot and make good on the 13 exhaustion signal. 200dma by Labor Day? The BKX is the big early cycle sector which means that they are typically not top performers late in the cycle where we currently reside. This means that if the banks can turn positive it is a confirmation signal that the market has made a real turn and that even the less desirable sectors are attracting money. These confirming signals define the “rising tide” of true bias.

Oil bounced back to the 200dma.

Gold has broken trend and is a source of funds.

Stock Picks Recap for 6/28/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SBUX triggered long (with market support) and worked:

FAST triggered long (with market support) and worked:

In the Messenger, Rich's APKT triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked great:

Rich's P triggered long (with market support) and worked enough for a partial:

Rich's JPM triggered long (with market support) and didn't work:

His NKE triggered long (with market support) and worked great:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not. Lot of big winners again though.

Forex Calls Recap for 6/28/11

Couple of losers early and on the European session, but we came back with a winner for the US session. See EURUSD below. New calls and Chat tonight.

US Dollar Index intraday with market directional tool lines:

EURUSD:

Triggered long early (half size) at A and stopped. Triggered long for European session at B and stopped. That trade would have worked if you were awake to take it again, but under our rules, the next trigger was the additional call long over R1 at C, hit first target at D, moved stop under entry and stopped at E:

Tradesight Market Preview for 6/28/11

The SP again tested and held the 200dma. The futures added 12 on the day but have yet to clear the 3 day range that they have now been trapped within. Keep in mind that end of quarter window dressing begins midweek.

On a relative basis the Naz was much stronger than the broad market. Monday, the Naz gained 41, closing at a multi day high. Note that the oscillators have turned positive. A settlement above the 4/8 level should kick in upward momentum.

Multi sector daily chart:

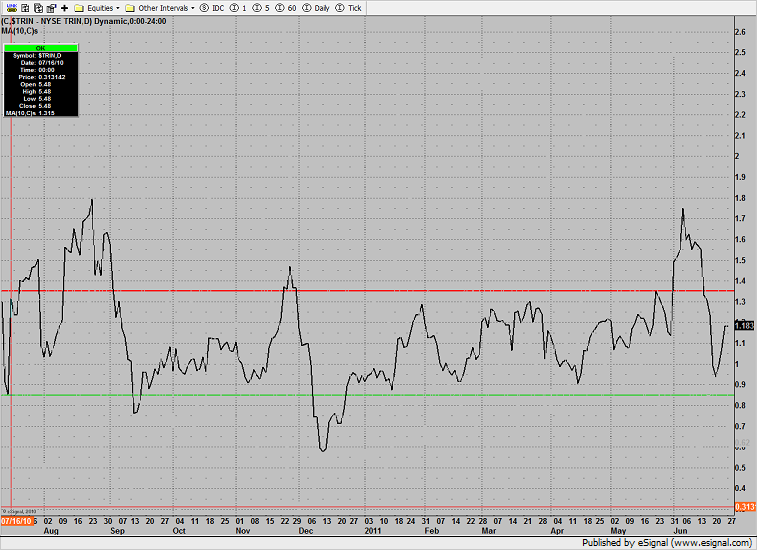

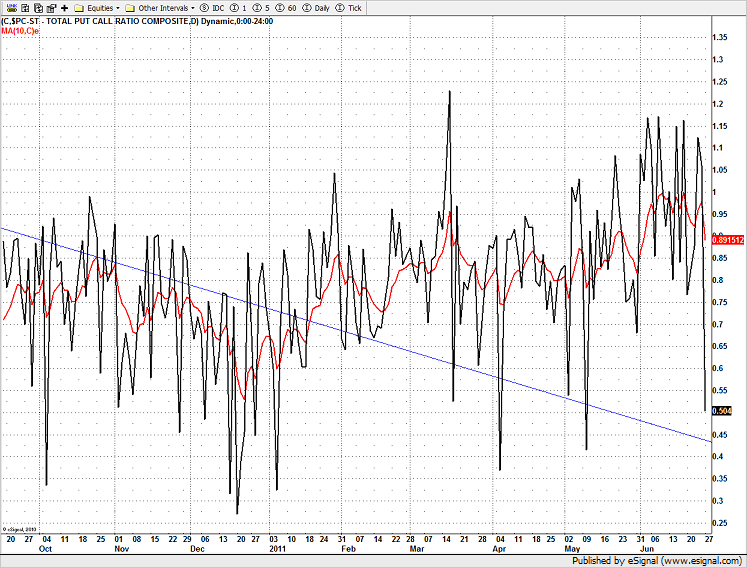

The 10-day Trin is neutral:

The put/call ratio recorded a near extreme reading:

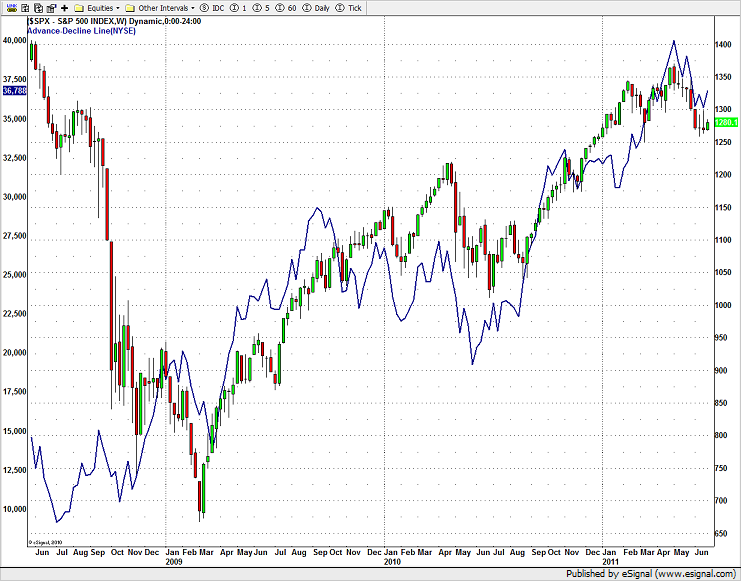

The weekly NYSE cumulative advance/decline line remains very constructive and long term bullish for traders.

The BKX was top gun, note the Seeker buy signal that registered late last week.

The SOX was weaker than both the broad market and the Naz.

The OSX recouped steep midday losses and settled right at the 200dma.

The XAU was the last laggard on the day and a source of funds.

Oil still has a downward bias:

Gold is gaming 1500 level. Note that this is the 4/8 level.

Stock Picks Recap for 6/27/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, PLCM triggered long (with market support) and worked great:

EGOV triggered long (with market support) and worked great:

SYNA triggered short (without market support) and didn't go $0.10 either way, so not counted:

In the Messenger, Rich's TZOO triggered short (without market support) and worked enough for a partial:

AIG triggered long (with market support) and didn't go $0.10 in either direction, so not counted:

GOOG triggered long (with market support) and worked great:

BIDU triggered long (with market support) and worked:

AAPL triggered long (with market support) and worked enough for a partial:

Rich's CLF triggered long (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, all 6 of them worked, some of them huge.

Forex Calls Recap for 6/27/11

A winner and a loser to start the week, so pretty much a wash either way. Almost pulled off two winners, but the revised long stopped out (before later triggering again and working). Here's the US Dollar Index intraday with our market directional tool lines:

New calls and Chat this evening.

EURUSD:

Triggered short at A, hit first target at B, lowered stop and stopped over LBreak (red line) at C. Also, new long entry was at C, but that stopped at D (if you were awake in the European session, a re-entry of that would have worked):

Stock Picks Recap for 6/23/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, CSIQ triggered long (with market support) and worked enough for a partial:

QLGC triggered short (with market support) and did not work:

NTRS and NUVA gapped under their short triggers, no play.

In the Messenger, AAPL triggered long early (with market support) and worked:

Rich's CMG triggered long (without market support) and worked for over a point:

AMZN triggered short (with market support) and didn't work:

NFLX triggered long (without market support) and worked over a point, worked better later when the market turned up:

BIDU triggered long (with market support) and did not work:

Both AAPL called in the afternoon triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.