Forex Calls Recap for 6/8/11

A news spike triggered the new trade that might not have made a fill possible. See GBPUSD below. Also, we closed out the final half of the EURUSD from the prior session in the money.

US Dollar Index intraday with market directional tool:

New calls and Chat tonight, but Trade Balance in the morning is one of our big three.

EURUSD:

Stopped out of the second half of the prior day's long at A for about 80 pips:

GBPUSD:

Triggered short at A (but this was a major news spike and a rare example where you might not have been filled); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES hit first target at B, closed last piece at C if you got any:

Tradesight Market Preview for 6/9/11

The SP was lower by 8 on the day, expanding the selloffs decline. Price is now 6 days down and getting closer to critical support at the 0/8 level and 200dma. There are also two other cortical support areas to consider. The MOB study projects support off the April low right at Wednesday’s settlement and the second line of defense off the March low projects support at the 1220 level.

Naz lost 25 on the day and was much weaker than the broad market. Price settled below the 4/8 Gann level and April low. Key support lies at the 200dma which lines up with the MOB off the 4/18/11 low.

Multi sector daily chart:

The put/call settled at a marginal new high:

The OSX was top gun, helped by higher oil prices. Price settled right at the lower edge of the trading range. A beak below and follow through would be very bearish for the broad market.

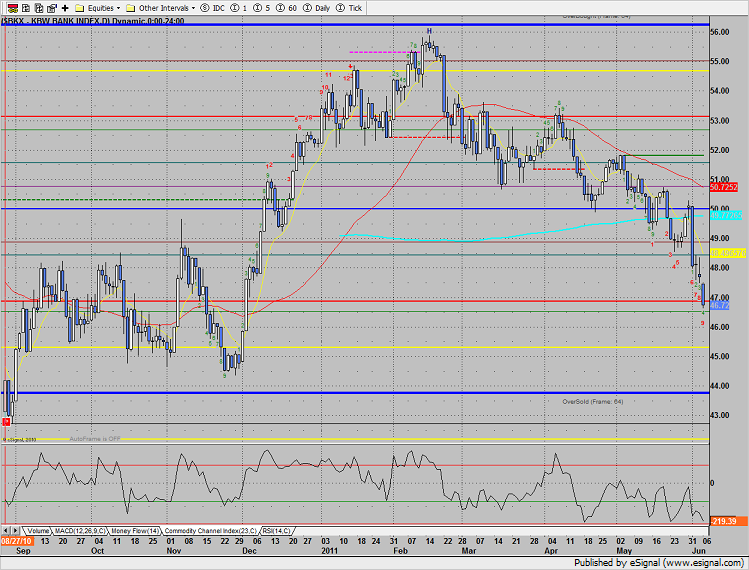

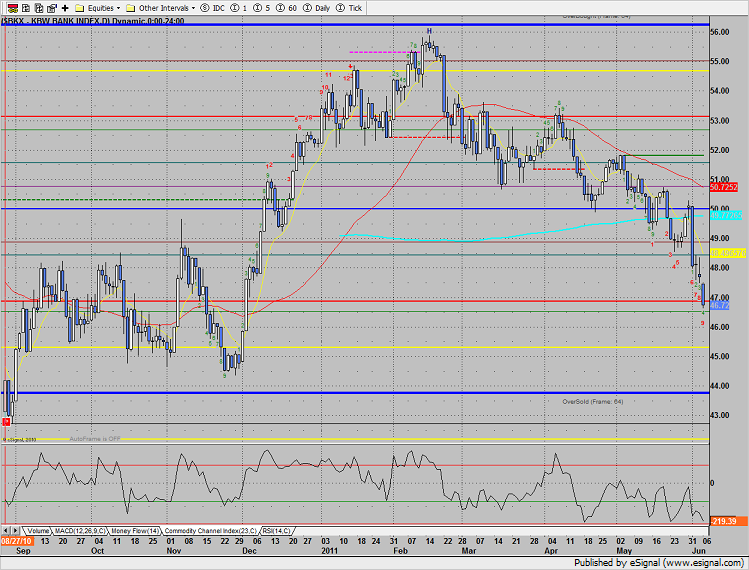

The BKX continues to leak and is now 11 days down.

The BTK used the 50dma as support but is close to a beakdown. Set an alarm for a move under 1436.50 which should kick in some high probability shorts in the sector.

The SOX recorded its lowest close of the year. This is a very bearish development. Expect some gaming of the 200dma after which there will be good short setups.

The XAU also recorded a new low close for the year. Keep in mind that the divergence between the XAU and the gold futures is bearish for gold.

Below, note the huge divergence between gold (green) and the XAU (magenta).

Oil:

Gold:

gold

Tradesight Market Preview for 6/8/11

The SP posted a mostly inside day, closing unchanged. Price was higher for much of the session before a hard selloff in the last half hour after comments by Ben Bernake.

Naz recorded an almost identical day to the SP though it did reach a little deeper below Monday’s settlement.

Multi sector daily chart:

The 10-day Trin remains elevated and full of oversold energy:

The SOX was top gun leading the other major averages. Key support is just below at the 0/8 level and 200dma.

The BTK is still range bound with key support just below at the 50dma.

OSX is again back at the low of the recent range. A break lower would be a real blow to the health of the broad market.

The BKX remains very oversold and has been a real drag the SP. The Seeker is now 10 days into the exhaustion countdown.

The XAU was the much weaker than the broad market and was a source of funds.

The computer hardware index, the HWI was the weakest sector and last laggard on the day. Price has settled below the boundary of the regression channel. A downside follow through puts the 200dma in jeopardy.

Oil remains boxed up;

Gold looks to be working on a lower high:

Stock Picks Recap for 6/7/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

A really nice day if I do say so myself with some good futures calls and also some nice stock winners despite the light market volume.

From the report, AKAM triggered short (with market support) and worked enough for an easy partial:

PAAS triggered short (with market support, although it is a metals stock) and didn't work:

BIDU triggered short (with market support) and worked enough for a clean partial that we called in the Lab:

MELI triggered short (without market support due to opening five minutes) and worked:

In the Messenger, Rich's AAPL triggered short (without market support) and worked great:

His FFIV triggered long (with market support) and worked great:

His JNPR triggered long (with market support) and didn't work:

AMZN triggered long (with market support) and worked great:

Late day AAPL triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Stock Picks Recap for 6/7/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

A really nice day if I do say so myself with some good futures calls and also some nice stock winners despite the light market volume.

From the report, AKAM triggered short (with market support) and worked enough for an easy partial:

PAAS triggered short (with market support, although it is a metals stock) and didn't work:

BIDU triggered short (with market support) and worked enough for a clean partial that we called in the Lab:

MELI triggered short (without market support due to opening five minutes) and worked:

In the Messenger, Rich's AAPL triggered short (without market support) and worked great:

His FFIV triggered long (with market support) and worked great:

His JNPR triggered long (with market support) and didn't work:

AMZN triggered long (with market support) and worked great:

Late day AAPL triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Forex Calls Recap for 6/7/11

Stopped out of the prior day's trade well in the money, then entered an early trigger and stopped, then entered a new trade that worked great again. Nice start to the month. See GBPUSD and EURUSD below.

Here's the US Dollar Index intraday with our market directional tools:

New calls and Chat tonight.

EURUSD:

Stopped out of second half of prior day's short at A. Triggered long at B, hit first target at C, still holding with a stop under the black line at 1.4660:

GBPUSD:

Triggered short early (half size) and at A and stopped at B:

Tradesight Market Overview for 6/7/11

The SP lost 11 on the day, settling below the most recent swing in April. This is the lowest level that the SP has so far traded in Q2. There is a very obvious area of important support where the 200dma aligns with the 0/8 Gann level. Note that the MACD has matched the low reading in March and that the CCI is -222 slightly above the climatic threshold of -250. The takeaway is that the market is oversold but any market can get more oversold.

Naz was lower by 13 after showing relative strength until the lunch time doldrums. Monday’s candle broke under the active static trend line and is now 2 days into a Seeker buy setup. There is a key area below where the April low is exactly the current 4/8 level.

The put/call ratio has been spiking higher and is sustaining elevated levels. This condition rarely persists and is usually reckoned by a sharp bounce.

The 10-day Trin is very oversold at 1.75. This important reading can always go further but there is plenty of gas in the tank for an oversold bounce.

The weekly cumulative advance/decline line is rolling over but not leading price which implies that when the market turns back up, the current highs will be challenged. This is very different than when the A/D line rolls over ahead of the equity indexes and then all rallies are shorts.

Multi sector daily chart:

The SOX down on the day but also the best performing sector. Price is getting close to very important support at the 405 area where there is convergence with the 200dma and 0/8 level.

The BTK remains above key support at 1440.

The BKX continues to hemorrhage losing twice as much as the broad market on the day. The Seeker buy countdown is now 9 candles.

The XAU was a source of funds even though gold was higher on the day. This continues to be negative for gold prices.

The OSX was the last laggard on the day which should be very concerning to the stock market bulls. At this point in the recovery, weakness in the financials is typical because rates are usually on the rise and the market discounts a less accommodative central bank. This is typically associated by the energy stocks performing very well as the economic activity begins to accelerate and demand for energy improves. More airline tickets sold, families driving far away from home to a “non-staycation” destination. The OSX has retreated to the low of the recent range which means that is at support. Is this alarming? No, the broad market is making lower lows but energy stocks are not. If this support level at 256 is violated on a closing basis, look out below. And, if the market takes a turn for the better, this is a sector that is worth overweighting.

Tradesight Market Overview for 6/7/11

The SP lost 11 on the day, settling below the most recent swing in April. This is the lowest level that the SP has so far traded in Q2. There is a very obvious area of important support where the 200dma aligns with the 0/8 Gann level. Note that the MACD has matched the low reading in March and that the CCI is -222 slightly above the climatic threshold of -250. The takeaway is that the market is oversold but any market can get more oversold.

Naz was lower by 13 after showing relative strength until the lunch time doldrums. Monday’s candle broke under the active static trend line and is now 2 days into a Seeker buy setup. There is a key area below where the April low is exactly the current 4/8 level.

The put/call ratio has been spiking higher and is sustaining elevated levels. This condition rarely persists and is usually reckoned by a sharp bounce.

The 10-day Trin is very oversold at 1.75. This important reading can always go further but there is plenty of gas in the tank for an oversold bounce.

The weekly cumulative advance/decline line is rolling over but not leading price which implies that when the market turns back up, the current highs will be challenged. This is very different than when the A/D line rolls over ahead of the equity indexes and then all rallies are shorts.

Multi sector daily chart:

The SOX down on the day but also the best performing sector. Price is getting close to very important support at the 405 area where there is convergence with the 200dma and 0/8 level.

The BTK remains above key support at 1440.

The BKX continues to hemorrhage losing twice as much as the broad market on the day. The Seeker buy countdown is now 9 candles.

The XAU was a source of funds even though gold was higher on the day. This continues to be negative for gold prices.

The OSX was the last laggard on the day which should be very concerning to the stock market bulls. At this point in the recovery, weakness in the financials is typical because rates are usually on the rise and the market discounts a less accommodative central bank. This is typically associated by the energy stocks performing very well as the economic activity begins to accelerate and demand for energy improves. More airline tickets sold, families driving far away from home to a “non-staycation” destination. The OSX has retreated to the low of the recent range which means that is at support. Is this alarming? No, the broad market is making lower lows but energy stocks are not. If this support level at 256 is violated on a closing basis, look out below. And, if the market takes a turn for the better, this is a sector that is worth overweighting.

Stock Picks Recap for 6/6/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, SOHU triggered short (without market support due to opening five minutes) and worked, also worked better later:

SPRD triggered short (without market support due to opening five minutes) and worked:

SANM triggered short (with market support) and didn't work:

ETFC triggered short (with market support) and worked:

EBAY triggered short (with market support) and worked:

In the Messenger, Rich's FCX triggered long (with market support) and worked enough for a partial:

His FSLR triggered long (with market support) and didn't work:

NFLX triggered short (with market support) and worked great:

GS triggered short (with market support) and did not work:

AAPL triggered short (with market support) and worked great:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Forex Calls Recap for 6/6/11

A loser and a winner and a really flat overnight session to start the week.

See EURUSD below.

Here's the US Dollar Index intraday chart with market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target finally at C, holding second half: