Tradesight Market Preview for 4/14/11

The SP treaded water, closing unchanged, and showing no sign of option unraveling. The 1317 overhead gap was filled, but otherwise there were no new technical features. Higher prices traded, but at the end of the day the chart recorded another distribution day.

Naz was higher by a full 15 handles which made the Naz relatively strong vs. the SP. Since Naz tends to lead the SP, this difference, or “bifurcation” as it is known, can be a tell that a change in bias is forthcoming. One day does not make a trend but if this follows through and the condition persists, then the long side will be more profitable.

Multi sector daily chart shows the poor performance of the financials:

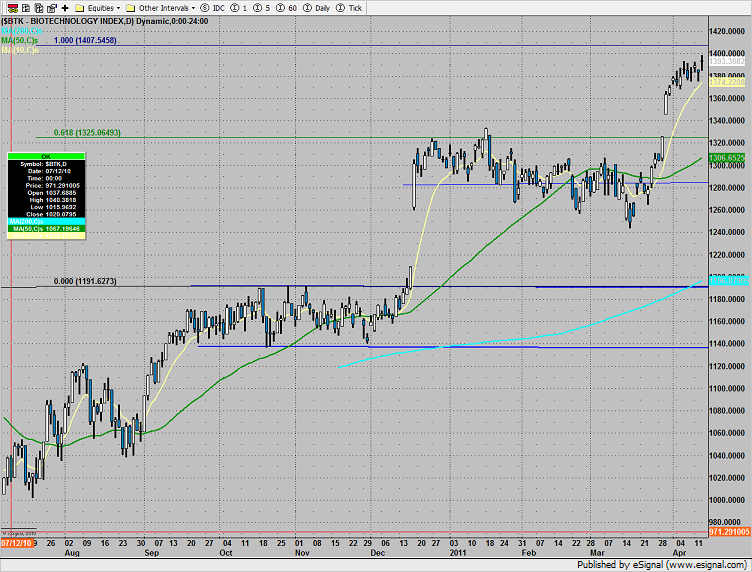

The BTK was top gun, closing at a new high and just shy of the measured move target. Keep looking to this sector for long continuation/breakout trades.

The OSX posted an inside day, using the static trend line as support. Be sure to alarm the high/low form Tuesday which will breakout the mini-pattern.

The SOX was slightly higher on the day but greatly underperformed the Naz. Wednesday’s candle was inside the prior day.

The XAU was weaker than the broad market and is closing in on key support at the 50% fib retracement. A close and follow through below the 50% line would validate the double top on the chart.

Following JPM’s earnings, the BKX was the last laggard on the day. The Seeker buy setup is only 2 days down and within striking distance of the static trend line. A break of the STL this early in the setup phase would be very bearish.

Oil was higher by about a dollar, perhaps working off the velocity and large range of the previous candles. A break below Wednesday’s low is an excellent short opportunity.

Gold was slightly higher on the day, trading inside yesterday’s range. Key support at 1440.

Tradesight Market Preview for 4/13/11

The SP followed through to the downside losing 11 handles on the day. Price has settled below the rising 50dma and has a Seeker buy setup in progress, currently 3 days down. Tomorrow is the Wednesday before options expiration so be on guard for stocks moving towards pegs.

Naz lost 15 on the day and in so doing, pushed the CCI below the zero line implying acceleration of downward momentum. The one bright point is that price closed at the midpoint of the day’s trading range.

The multi sector daily chart looks similar to yesterdays with the BTK exerting relative strength.

Interestingly, the NYSE 10-day Trin dropped and broke below the zero line. This should be read that there is plenty of selling fuel if the bears get proactive.

The BKX was top gun, settling unchanged after ranging both higher and lower intraday. Note that the price action was a price flip and the first day down in a Seeker buy setup.

The BTK did very little but was relatively strong vs. both the ES and NQ.

The XAU was again a source of funds. As discussed in last night’s report, the intermarket technicals are bearish for gold.

The SOX broke decisively below the near-term DTL and now must use the 2010 highs at 420 for support.

The OSX was the last laggard on the day losing 2.6%. Price closed right at the static trend line. Note that the CCI has move aggressively lower and is near the first oversold threshold around -100.

Oil followed through on the outside day down. Retracement fibs have been added to the chart which indicates first support at 103.39.

Gold was lower by $14 and could easily move much lower if the XAU continues to weaken.

Stock Picks Recap for 4/12/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, JDSU triggered short (without market support) and worked:

In the Messenger, Rich's AMZN triggered long (with market support) and didn't work:

His FCX triggered short (with market support) and worked:

His HANS triggered short (with market support) and worked enough for a partial with no risk:

His AMGN triggered long (without market support) and didn't work:

AMZN triggered short (with market support) and worked great:

BIDU triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Forex Calls Recap for 4/12/11

An early trigger that worked (see GBPUSD below) and that was it. US Dollar declined during the session. Here's the index with the market directional tool:

New calls and chat tonight for subscribers.

GBPUSD:

Triggered short early at A (half size); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES hit first target at B, lowered stop and most likely stopped at C overnight:

Tradesight Market Preview for 4/12/11

The SP was lower by 4 on the day which puts settlement below the recent trading range. While not decisive down side momentum is gathering as evidenced by the lower high in the CCI moving towards the zero line.

Naz also broke to new low ground, more decisively losing the 10ema than the SP side. On the day, Naz was lower by 10 handles with a similar condition in the CCI.

The multi sector daily chart shows the BTK exerting its typical late cycle strength.

The weekly cumulative NYSE advance/decline line took a hit since the last reading. This leading indicator suggests that the last weekly candle in the SP was pure distribution. A break under the January highs would be a clear signal that broad market prices are headed much lower but until then pullbacks in equities should be view as buying opportunities.

The 10-day Trin remains neutral around 1.00, neither overbought nor oversold.

The BTK was the top performer on the day, settling at a new high on the move. Use the 100% fib extension for the next upside target.

The BKX treaded water, be sure to set an alarm for a break under 52.30 which was both Friday and Monday’s low. Note that there is a Seeker setup phase that just completed last week.

The trend leading SOX was bearishly weaker than both the SP and the Naz. Price is now below both the 10 and 50dmas. Note the DTL that has been added to the chart.

The OSX is making good on the Seeker exhaustion signal and breaking lower. The next major test will be interaction with the rising 50dma.

The XAU was the last laggard and for now, has failed the test of the 2010 high.

In the cross pair chart below note how gold recorded a new high on the move but it was not confirmed by gold stocks. This is a classic bearish divergence and makes these elevated prices in gold futures suspect until it is confirmed by a new high in the XAU gold mining index.

Oil recorded a bearish range-high outside day down. Sell rallies for the next few sessions.

Forex Calls Recap for 4/11/11

I can count on my two hands the number of days in 7 years of making Forex calls that I haven't been able to find setups that I liked, and this was one of them. Not surprisingly, the market didn't do anything, so when the market doesn't give you setups you like, don't expect much, which is why I used half size on the calls I did eventually make.

Here's the Dollar index intraday with market directional lines, not much movement:

See GBPUSD below. New calls and Chat tonight.

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 4/8/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, MRVL gapped over, no play.

In the Messenger, Rich's AAPL triggered short (without market support due to opening 5 minutes, but it was a designed gap fill play) and worked great:

His AMZN triggered (with market support) and didn't work:

GS triggered short (with market support) and worked:

RIMM triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Forex Calls Recap for 4/8/11

Another winner to close out the week and we're back to flat, which is probably the place to be.

Here's the US Dollar Index intraday from Friday with the market directional tool...obviously red most of the session:

Winner was in the GBPUSD. As usual, for the Sunday report, we'll take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week (nothing to see) and then look at the US Dollar daily chart.

EURUSD with our Levels:

GBPUSD with our Levels:

Triggered long at A, hit first target at B, stopped in the morning under the entry at C:

The rest of the report with our recaps on ten pairs, preview of the daily charts of those pairs, and discussion of the US Dollar Index is available for subscribers and trial members only.

Stock Picks Recap for 4/7/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, PLCE triggered long (without market support due to opening 5 minutes) and worked:

CDNS triggered long (with market support) and went enough for a partial but that was it:

From the Messenger, AMZN triggered long (with market support) and worked great:

Rich's AAPL triggered short (with market support) and worked:

BIDU triggered long (without market support) and didn't go anywhere:

KLAC triggered short (with market support) and worked:

There were several other calls but they didn't trigger.

In total, that's 5 trades triggering with market support, all 5 of them worked, plus PLCE worked and it was the top pick, just triggered in the opening 5.

Stock Picks Recap for 4/6/11

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

From the report, DNDN triggered long (without market support due to opening five minutes) and worked enough for a partial if you did manage to grab any:

VRSN gapped over the trigger, no play.

PPDI triggered long (with market support) and worked:

NXPI gapped over the trigger, no play.

In the Messenger, Rich's CREE triggered long (with market support) and worked:

RIMM triggered short (without market support) and didn't work:

Rich's CF triggered short (without market support, although mixed in the second 5-minute bar); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES and worked:

NFLX triggered short (with market support) and worked great:

COST triggered short (with market support) and didn't work:

Rich's FCX triggered too late in the session to have time to move.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.