Forex Calls Recap for 1/13/20

Two losers to end the week. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

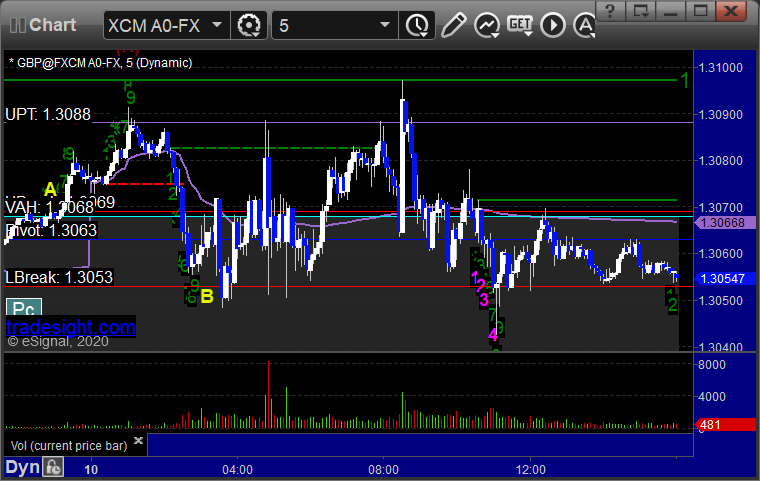

GBPUSD:

Triggered long at A, stopped. Triggered short at B, stopped:

Stock Picks Recap for 1/10/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, ADBE triggered long (with market support) and worked:

In total, that's x trades triggering with market support, y of them worked, z did not.

Futures Calls Recap for 1/10/20

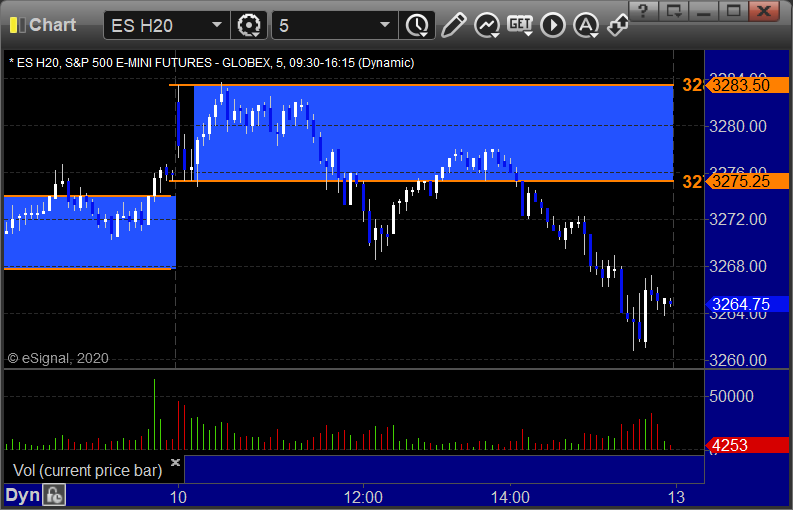

The market gapped up, filled, bounced, topped out on a Comber sell signal at the high of the day, then rolled for a perfect Value Area play, and sold off in the afternoon into negative territory on 2.3 billion NASDAQ shares.

Net ticks: +24.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/10/20

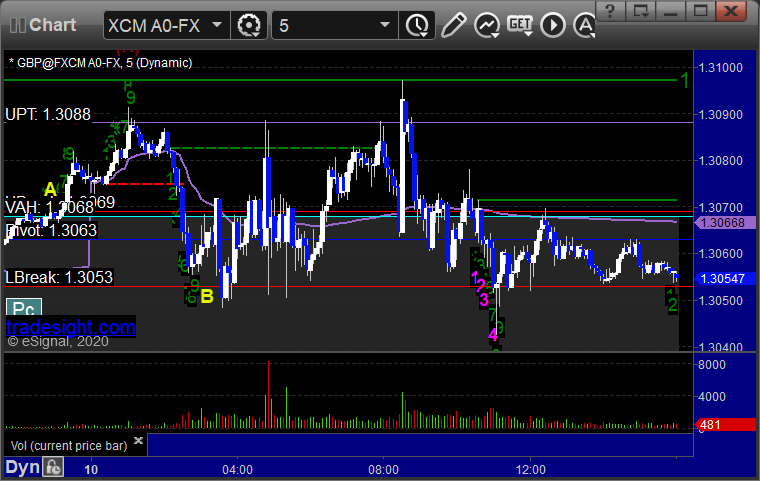

Two losers to end the week. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered long at A, stopped. Triggered short at B, stopped:

Stock Picks Recap for 1/9/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, XLRN triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOGL triggered short (with market support) and didn't work:

In total, that's 1 trade triggering with market support, and it didn't work.

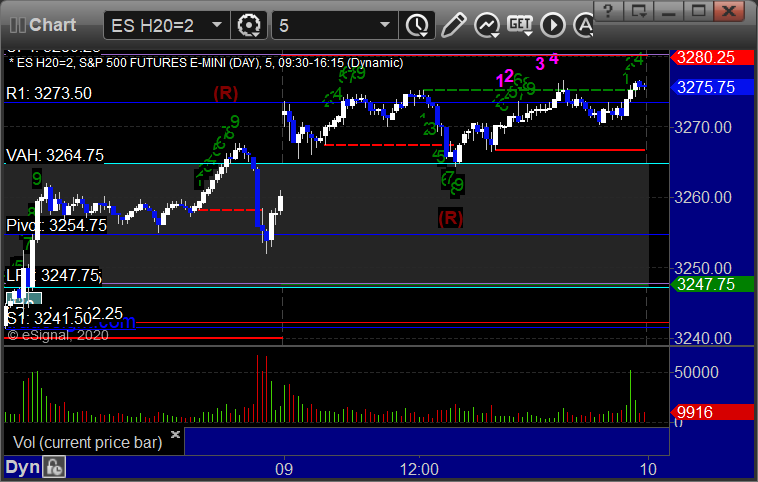

Futures Calls Recap for 1/9/20

The markets gapped up, pulled back and that was most of the range of the day back and forth for hours on 2.5 billion NASDAQ shares.

Net ticks: -39 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped:

NQ Opening Range Play triggered long at A and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/9/20

A small winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

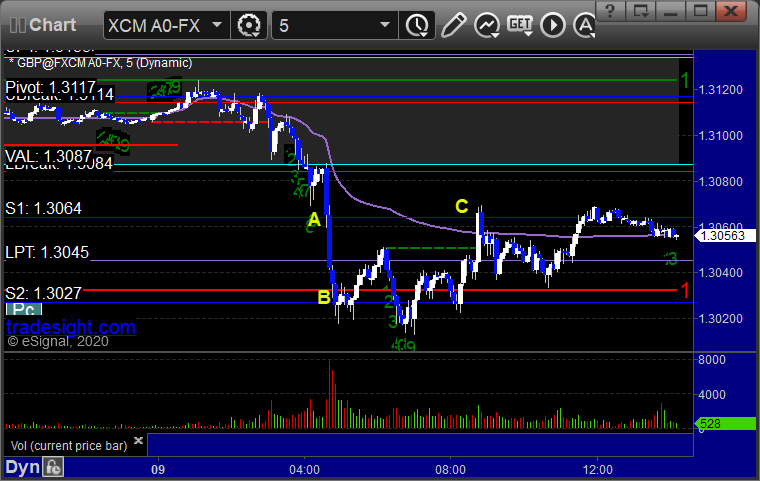

GBPUSD:

Triggered short at A, hit first target at B, stopped second half over entry at C:

Start of a New Decade Tech Update

Hello Traders-

Every year, at the end of the year, I use the slow weeks around the Holidays to look over both my hardware and software to see if anything needs to be updated or organized differently moving forward. Sometimes, I adjust my stock, options, futures, or forex layouts. Sometimes, I buy a new computer. This year, I bought new monitors.

I went with 32" CURVED Samsung 4k monitors. The refresh rate is high, so the monitors don't seem quite as bright. Everything just changes and moves without effort, and I can see everything better.

To give you an update on hardware that I currently recommend for active traders, here's my rig:

Intel i7-8700k CPU at 3.70 GHz

16 GB high speed RAM

Windows 10 Pro

1 TB solid state hard drive

NVIDIA GeForce GTX 1070 Ti video card

Gigabit Cox home internet (1 GB speeds up and down)

Google Wifi 2 routers in the house, but the computer is hard wired

Logitech keyboard and the new MX Master 3 mouse

3 Samsung 4k curved monitors, 32"

Remember, it's important to have your speed handled from start to finish, meaning, it's useless to have a good chip and lots of RAM if your internet speeds are slow. I can tell you right now that with these monitors, everything seems instantaneous in a way I don't remember seeing before.

We recently reported our results for 2019, and it was another stellar year in all asset classes. The short version (although you can view every trade if you dig down into the pages) is:

Forex, 60.35% win rate and 1095 pips made, view the results here.

Futures, 69.8% win rate and 1282 ticks made, view the results here.

Stocks, 70.5% win rate and plenty of money made, view the results here.

This is all despite the fact that the markets behaved very differently in 2019 than the last few years. Forex and Stocks in particular were less exciting. It's a testament to the fact that the Tradesight systems that we have taught for nearly two decades work that we were able to push out those results in a different environment.

I'm very much looking forward to the live 2-day options course coming up in the weekend's ahead. Details of the course are here. I haven't done a live event in a while, and I always enjoy doing them. I look forward to making many of you options experts so you can apply that knowledge to your stock trading and improve your results. Have a great 2020, and a great decade.

Tradesight 2019 Stock Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. We publish our daily results both privately and publicly for anyone to review.

Click here for the daily Stock daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2019.

Total number of Stock trades that triggered in 2019: 438 (down almost 200 from 2018, which will be discussed below)

Big Losers: None

Small Losers: 129 (29.5%)

Small Winners: 138 (31.5%)

Big Winners: 171 (39%)

Winning percentage: 70.5%, which is outstanding and just above our target range of 60-70%, although down slightly from the prior year which hit 75.3%.

So why was this year so different in terms of the number of trades that triggered. First of all, the Holiday layouts for Fourth of July, Christmas, and New Year's were about the worst you can get, with all of them being in the middle of the week. That doesn't just mean that the markets are closed for a day, which always happens, but it means that people took most of the week off for each with only a day or two bracketed between the Holiday and the weekend. In addition, as we have discussed, this was one of the slowest years of trading I have seen since 2003 in the build-up to the second Iraq War. The VIX spent too much of the year extremely low and there were too many days where the markets established a range in 15-30 minutes and spent the rest of the day stuck to the VWAP/midpoint area. There were probably less than 30 days of the whole year where the afternoons were exciting after the traders usually come back from lunch at 2 pm EST. In short, despite the fact that the markets were up, ranges were narrow and volatility was very low. Our system is designed to prevent traders from over-trading dead markets and instead wait for proper technical setups with clear market direction. So the system did exactly what it should do in environment that we saw...less trades but still around the same win ratio of 70% overall. No complaints, other than we'd like to see some volatility return in 2020.

Tradesight 2019 Futures Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. All of our results are archived both publicly and privately for review and validation.

Click here for the daily Futures daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2019.

Total number of Futures trade calls that triggered in 2019: 550 (about 140 less than 2018)

Winners: 390 (about 50 less than 2018)

Losers: 163 (about 40 less than 2018)

Winning percentage: 69.8%, which is right in our target range of 65% for futures and literally 1 percent higher than 2018. We had two losing months (January and February with very small losses) and the rest of the year was just solid with five months that I consider stellar.

Net tick gains or losses for the year: +1282.5 ticks which is 300 more than 2018. It also brings our 4 year total to over 4000 ticks.

Keep in mind that this doesn’t count Value Area Plays, Seeker/Comber plays, and other trade types that we teach in our program which also work more than they don't. This is just the basic calls that we make plus the Opening Range plays. The system is consistent and just works.