Forex Calls Recap for 10/9/19

A winner for the session. See GBPUSD section below.

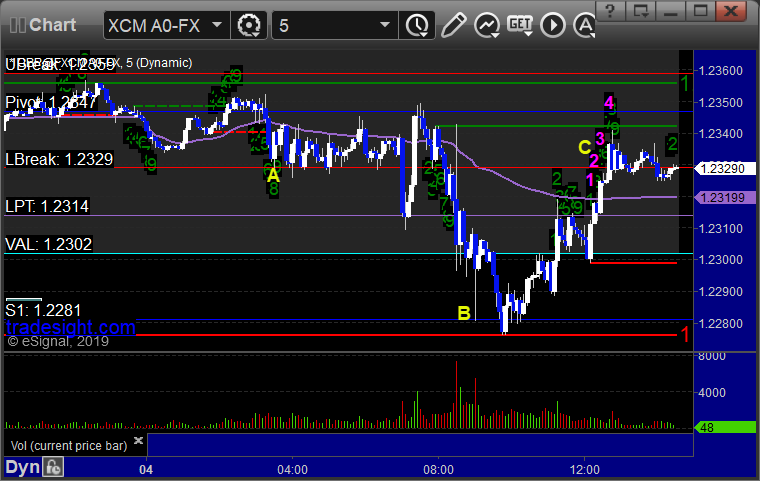

Here's a look at the US Dollar Index intraday with our market directional lines:

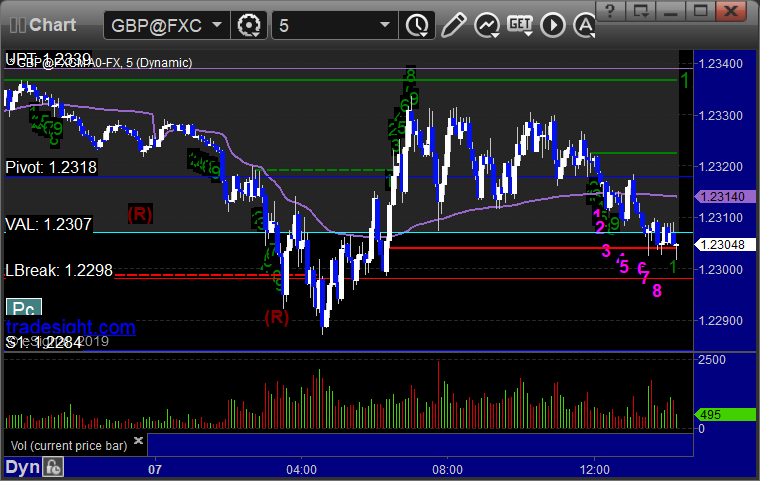

GBPUSD:

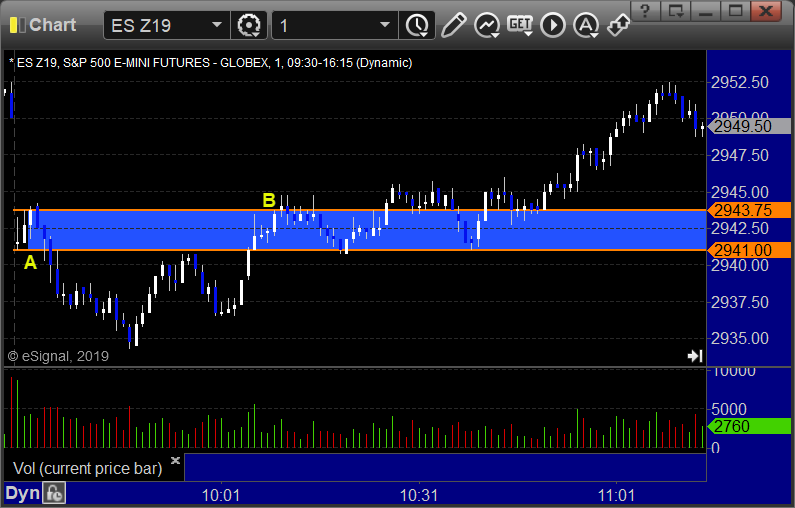

Triggered long at A, hit first target at B, stopped second half under entry:

Stock Picks Recap for 10/8/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, ATVI triggered short (with market support) and didn't work:

WYNN triggered short (with market support) and worked:

NKTR triggered short (with market support) and worked a little:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

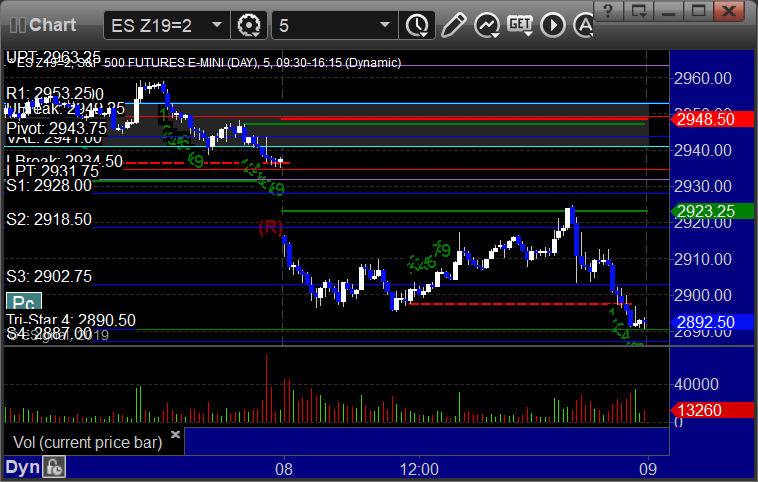

Futures Calls Recap for 10/8/19

The markets gapped down, headed lower, started to look interesting, and then that was the range of the day. We recovered to the highs and open but then sold off on news and closed at the lows on 1.9 billion NASDAQ shares.

Net ticks: +7 ticks.

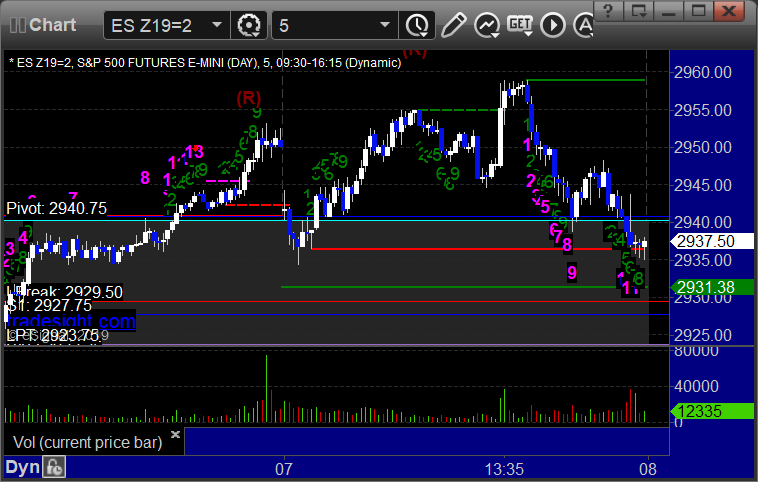

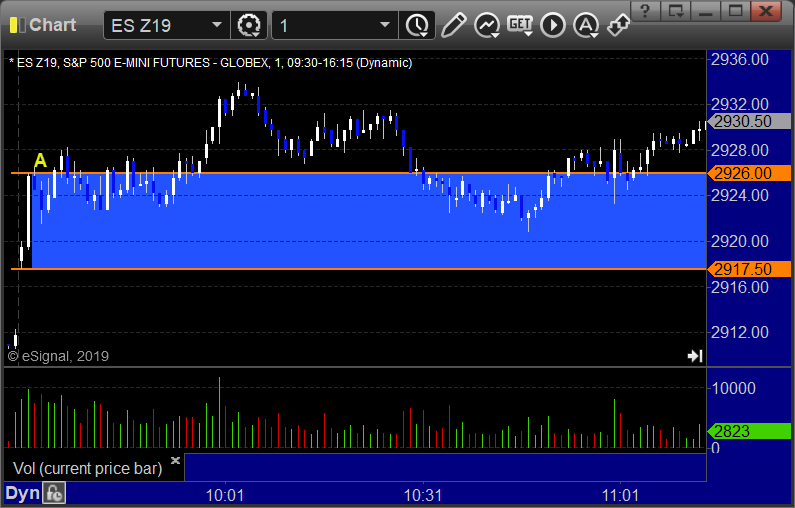

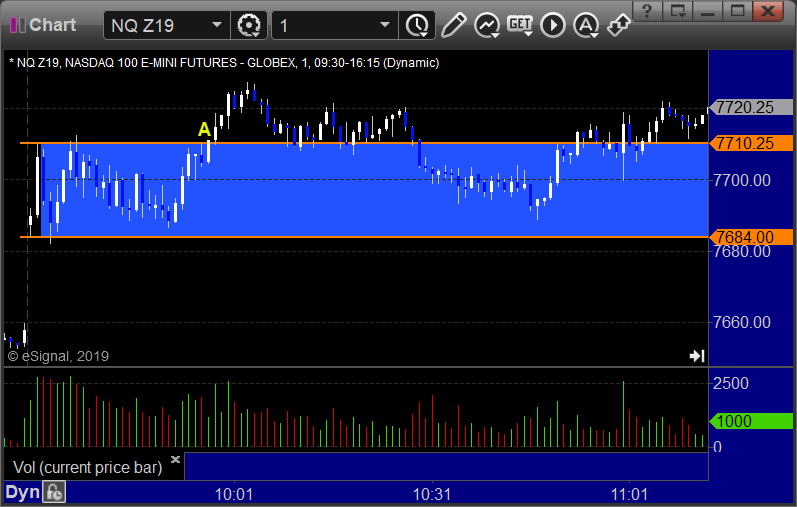

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

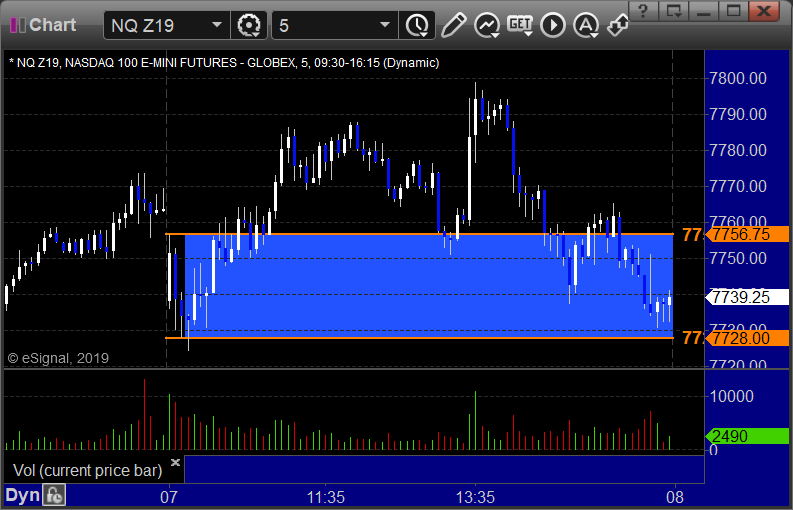

NQ Opening Range Play triggered long at A and worked but too far out of range to take, triggered short at B and worked but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/8/19

No calls for the session because the ranges from the prior day were so narrow, but the Levels spacing should be better tonight.

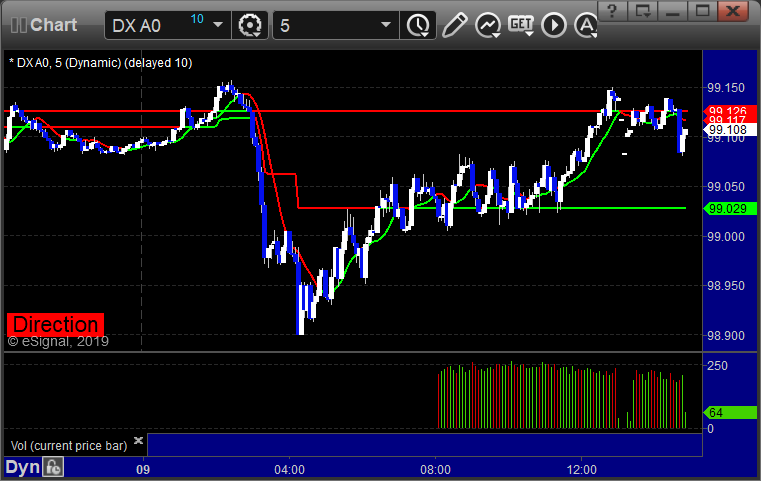

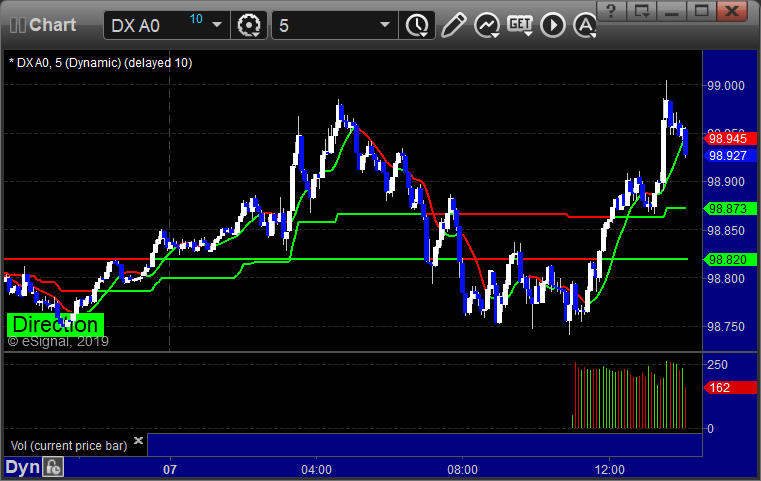

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 10/7/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's CELG triggered long (with market support) and was working fine until news dropped the market:

In total, that's 1 trade triggering with market support, and it didn't work.

Futures Calls Recap for 10/7/19

The markets gapped down, tried both ways, and ultimately close near the lows on a horrible 1.7 billion NASDAQ shares.

Net ticks: -1 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked, triggered long at B and stopped:

NQ Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/7/19

Neither call triggered in a dead session.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 10/4/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, nothing.

In total, that's a boring day.

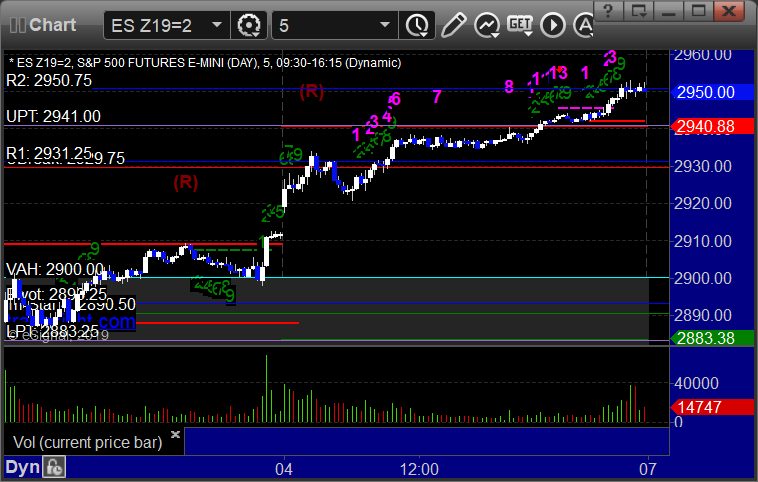

Futures Calls Recap for 10/4/19

The markets gapped up and did almost nothing, never filled the gap, and it was a waste of time on 1.7 billion NASDAQ shares.

Net ticks: +16.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

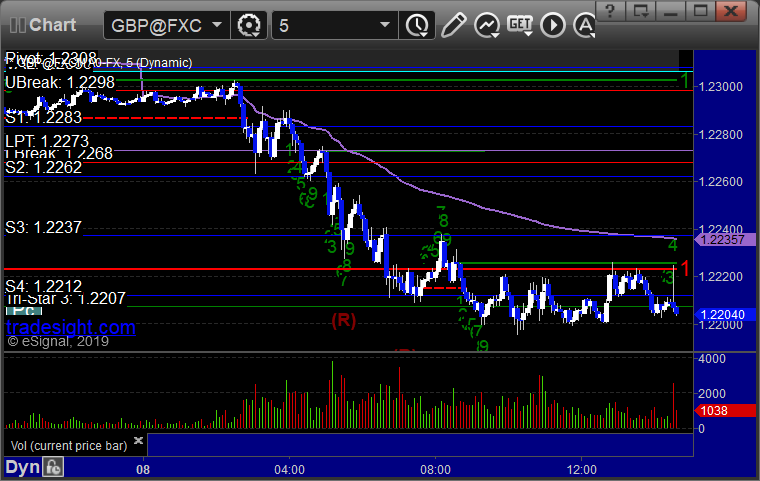

Forex Calls Recap for 10/04/19

A winner to close out a decent week. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A, hit first target at B, stopped second half over entry at C: