Another session where the whole move occurred on a price spike. Very strange that we have seen several of these the last month or so and nothing prior. I think it is a function of the fact that not much trading is occurring, thus the poor ranges, so when the news hits, there isn’t much size in either direction and the market spikes. See EURUSD below for the recap.

Here’s a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Not much new as we aren’t going anywhere.

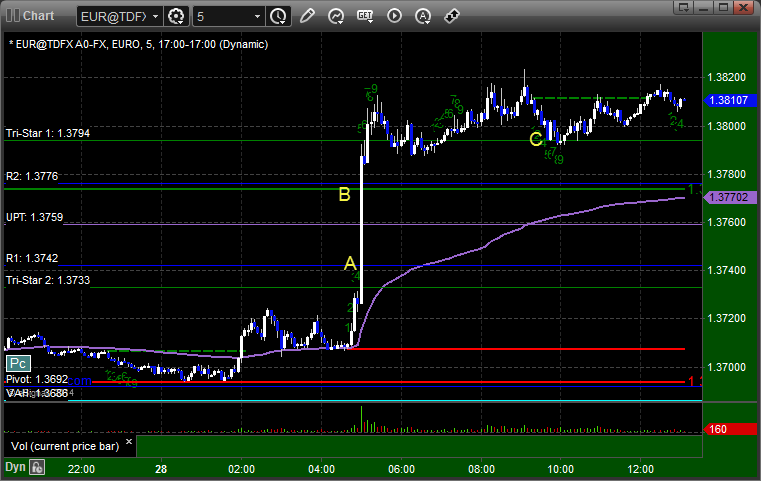

EURUSD:

Triggered long at A on a spike. If you got filled on any of your pieces, hit first target at B and stopped last piece at C, but fills are questionable in a move like that: