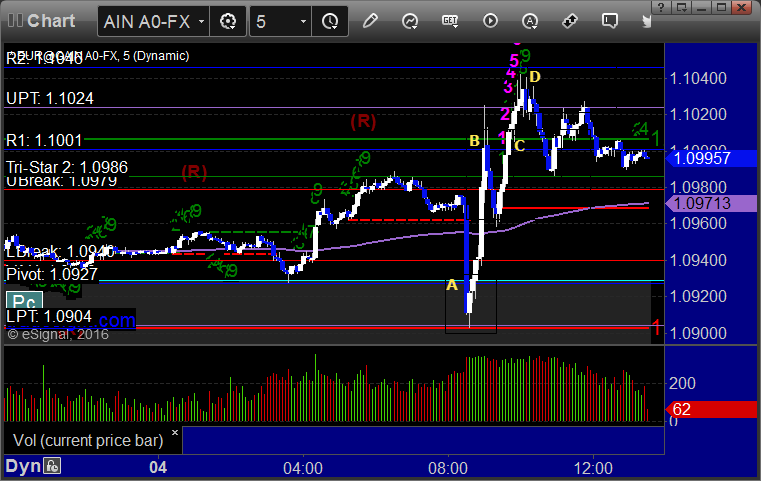

There’s a great example of why we lower size ahead of the three big economic numbers that come out each month. See EURUSD section below.

Here’s a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

So we were half size ahead of the key data (NFP and Trade Balance, two of our Big Three each month coming out at the same time), and this is a good example of why. Triggered short at A on the news and stopped, then triggered long at B and stopped. After that, we can put the trades back in for full size. Triggered at C, hit first target at D, closed second half at E for end of week: