A nice day in the markets. We got a big gap down after the global markets sold off, and we started to head lower for about 4 minutes, then reversed sharply, with the NASDAQ side recovering over 30 points in ten minutes or so. Then we rolled again and made new lows and really broke down, which was where the fun began. We then drifted over lunch and rolled again to the downside for another sell off as we expected in the Lab. Final NASDAQ volume was a solid 2.5 billion shares.

Net ticks: +26 ticks.

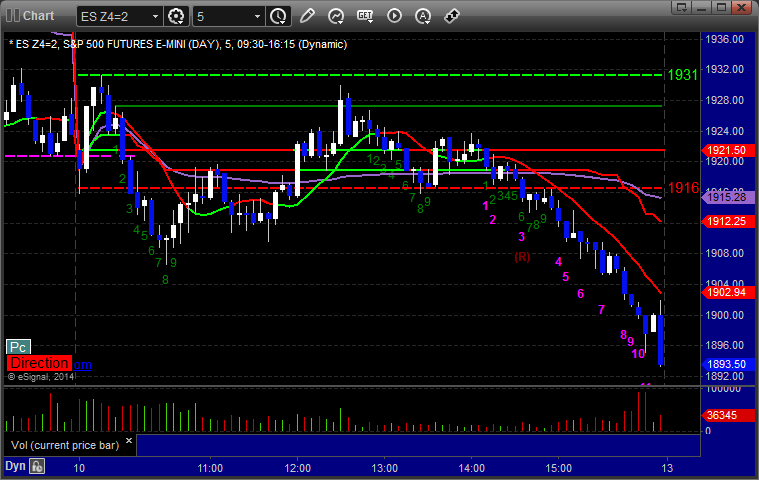

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3922.50, hit first target for 6 ticks and kept going. Lowered the stop several times and stopped final piece well in the money at 3989.50 for 46 ticks: