The Opening Range plays worked again (we will actually take a look at them in the next section for once) on the ES and NQ, so that was enough in another light volume day ahead of the Holiday. Done for the week, although there will be Futures Levels for Wednesday’s half day and then Levels Friday based on Wednesday’s half day session.

Net ticks: +0 ticks.

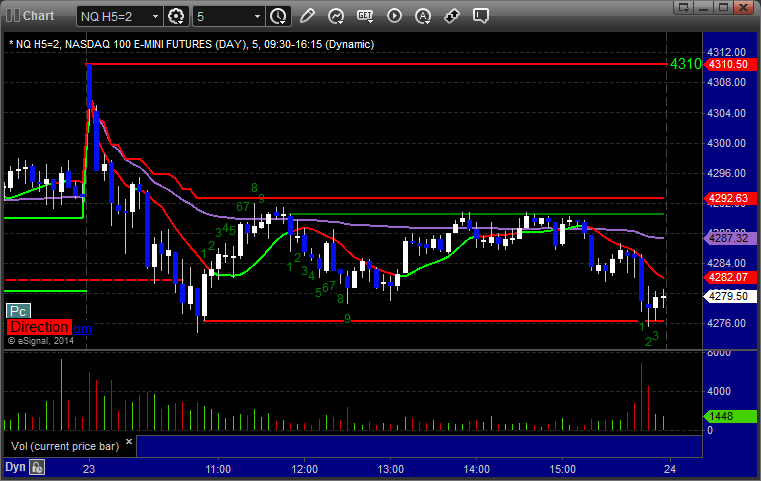

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

Opening Range Plays:

Since we aren’t really making other calls, let’s look at the Opening Range plays on the ES and NQ for Tuesday. Again, the idea is to let the contract establish the opening 2 minutes of play, then go long if a 1-minute candle closes above that range or go short if a 1-minute candle closes below that range. You use the other side of the opening range as the stop and take a partial (half) off around 6-10 ticks. Once you have a partial, the stop goes over the closer side of the Opening Range.

So, on the ES, triggered short at A, took a partial at B, and closed second half at C breaking back into the Opening Range:

On the NQ, triggered short at A, took a partial at B, never really gave you another place to need to exit until either the first real bounce at C (20 ticks) or the Seeker Startup 9-bar count at D (around 44 ticks):