Mixed results on the Opening Range plays with a winner and a loser. Another nice setup for the gap fill triggered and stopped on the ES, and since it was options expiration Friday, I didn’t put it back in like I usually would, and it ended up working. The markets closed dead flat (S&P literally down 0.05) on 1.7 billion shares, which is horrible for options expiration.

Net ticks: -9 ticks.

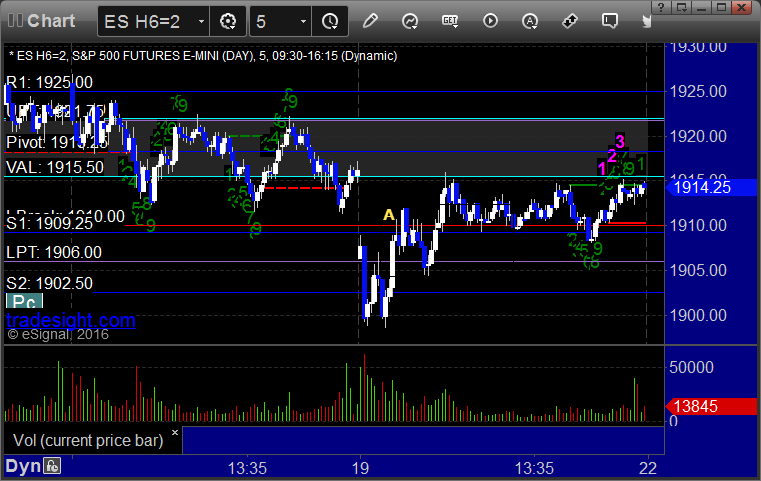

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered long at A, used the 50% for the stop since the OR was over 10 points and stopped. The entry at B would have been too far below the lower boundary to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 1911.00 and stopped: