One of the flattest opening 30 minutes I can recall in the markets. We opened with a small gap down and did absolutely nothing. Then the Consumer Confidence number came out and the market started to head lower, but we had worse volume than even Monday. There were some nice setups on the ES and NQ, see that section below. Opening Ranges didn’t work out given the flatness. NASDAQ volume closed at 1.5 billion shares, horrible.

Net ticks: -9 ticks.

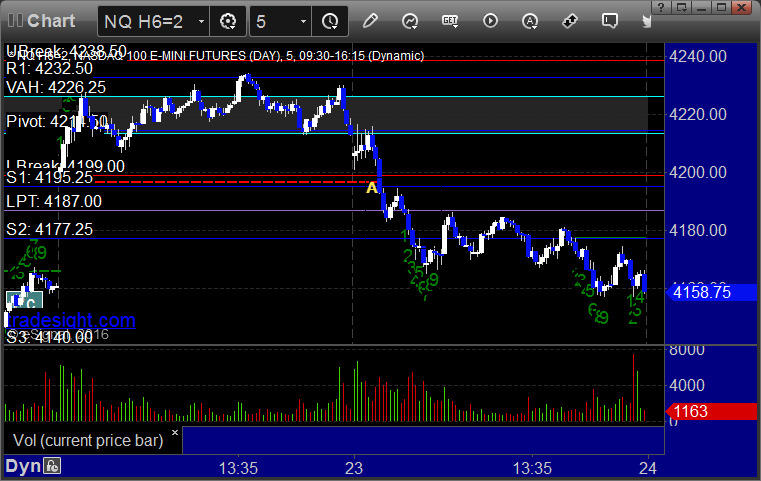

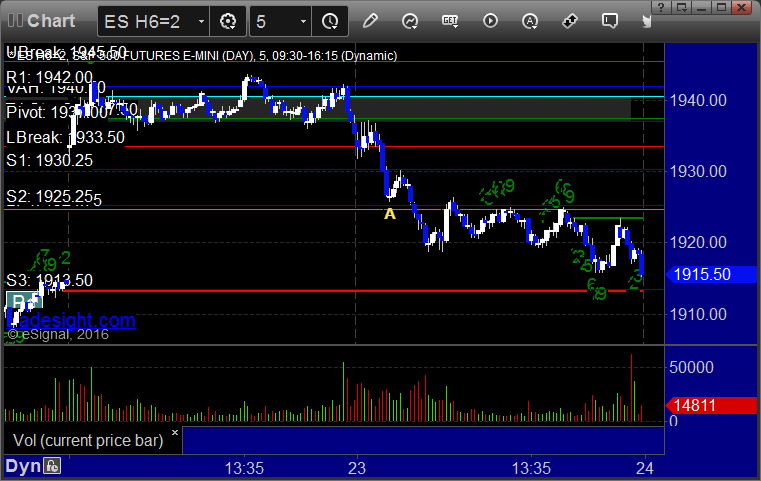

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn’t work:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Nice setup short under LPT after setting the level at A:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Nice setup short under S1 at A, breaking under the base and into the gap from Monday: