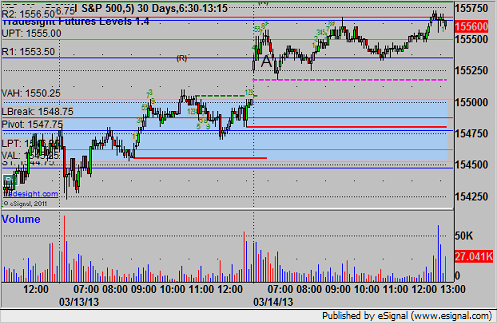

A trigger on the ES and a few on the NQ, one of which unfortunately stopped before it worked again. Overall, another narrow session, not even half of average daily range, and we really didn’t see an options unraveling move for triple expiration, which is unusual but par for the last two weeks. Volume was only 1.45 billion NASDAQ shares.

Net ticks: -6 ticks.

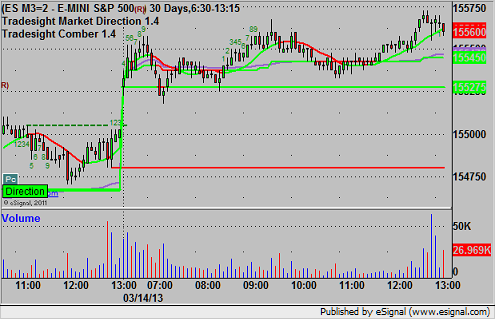

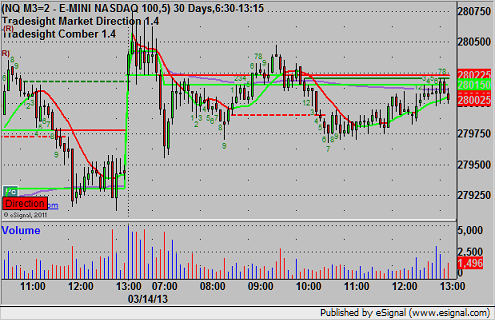

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Triggered short at A at 1553.00, missed the first target by a tick and stopped for 6 ticks:

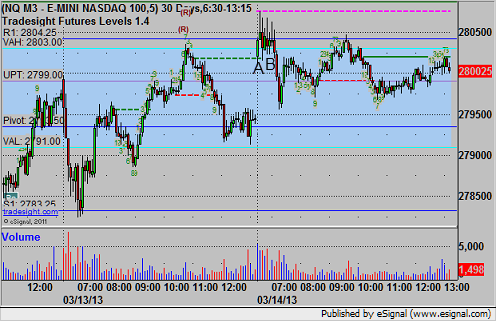

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark had a call and I had a call, which even confused me as I thought I had typo’d Mark’s call. So, since they were both their own calls, here we go.

Mark’s triggered short at 2801.50 at A and stopped. Triggered short again at B, hit first target for 6 ticks, and stopped the remaining at 2799.50. Mine was under the opening bar low and triggered short at C at 2800.50, hit first target for six ticks, and stopped the second half at 2799.50: