A nice day, although back to having a trade sweep once before working a second time. See ES, NQ, and YM sections below for all of the trades.

Net ticks: +22 ticks.

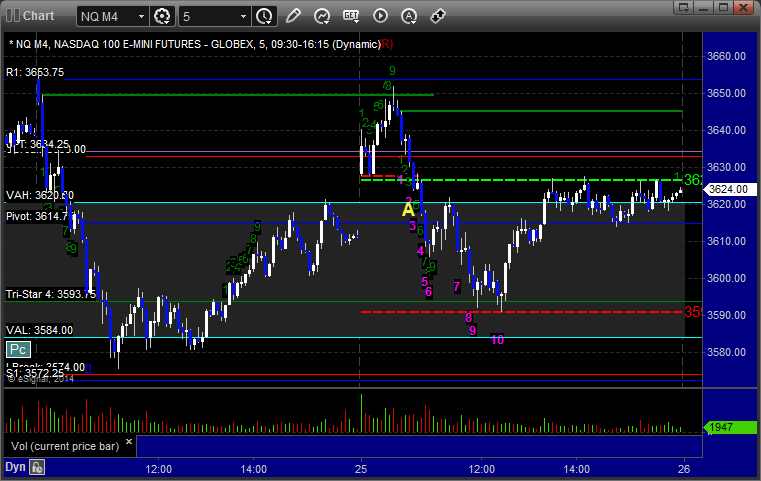

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

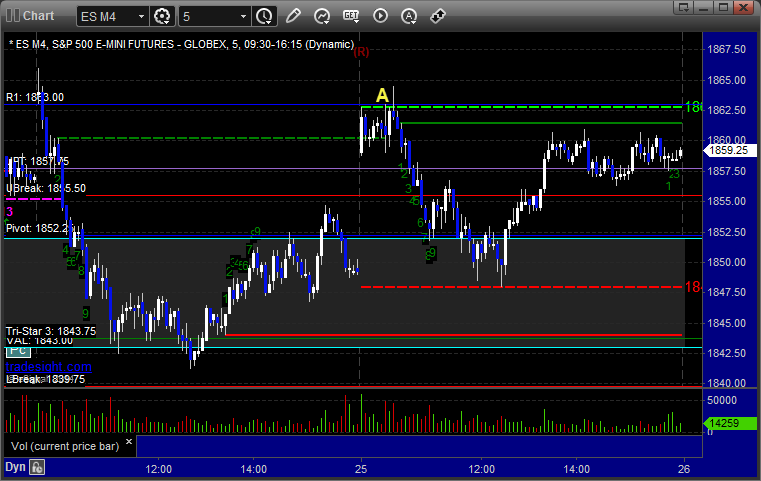

ES:

Long call triggered over R1 at 1863.25 at A after some excellent basing action and then stopped for 7 ticks. I put the trade back in but it never triggered again:

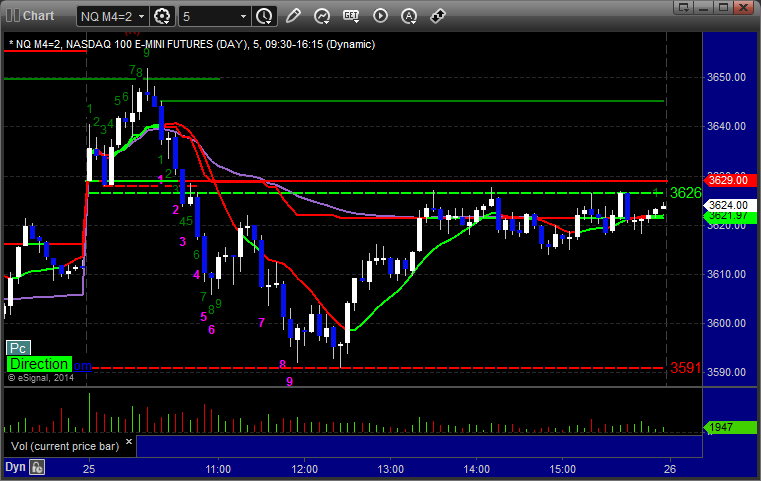

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark’s call triggered short at A at 3620.00, hit first target for 6 ticks, he lowered the stop several times and stopped the final piece at 3611.25:

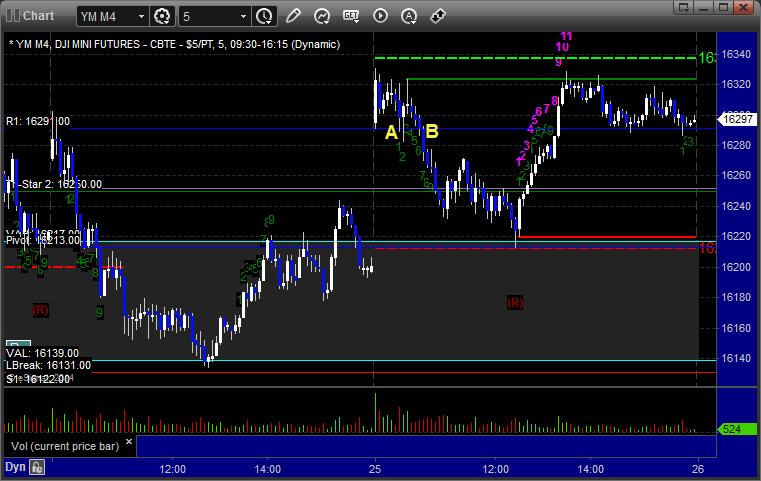

YM:

Short call triggered at A at 16290 and stopped for 10 ticks. Triggered again at B, hit first target for 10 ticks, lowered the stop a few times and closed final piece at 16251: