The markets gapped down and eventually filled over lunch. We had great volume at 1.8 billion shares, but it was a complete measuring day after the plunge on Wednesday. Not a lot happened. We ended up getting stopped out of the ES twice (before it went on to work) and we had winners and losers in the Opening Range plays.

Net ticks: -14 ticks.

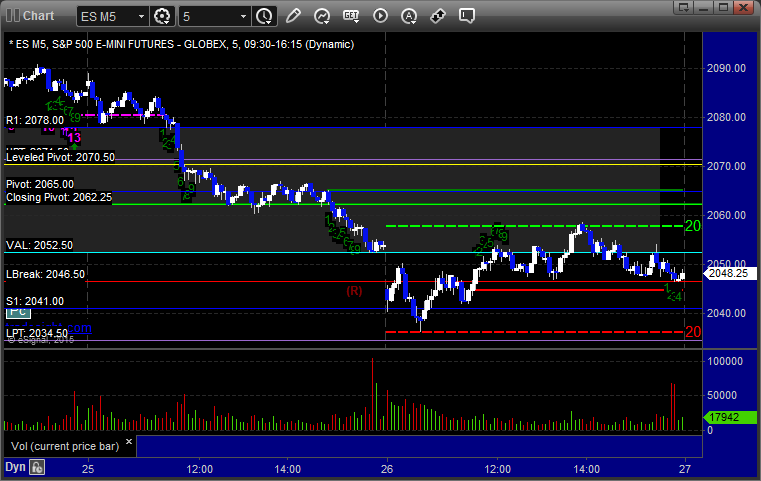

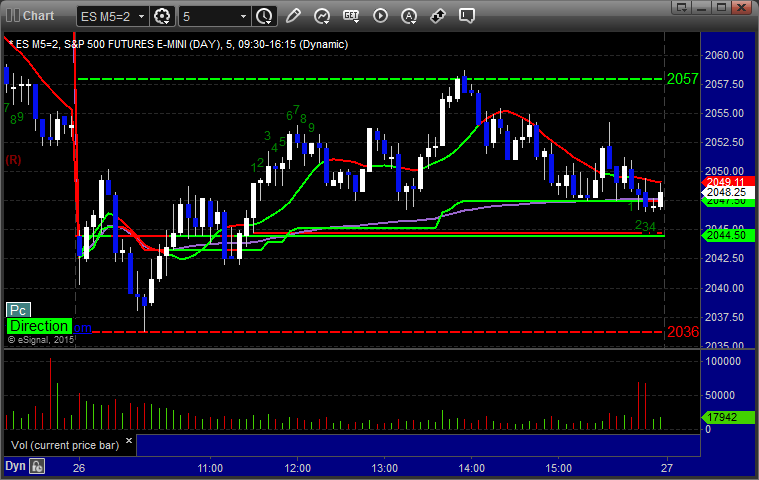

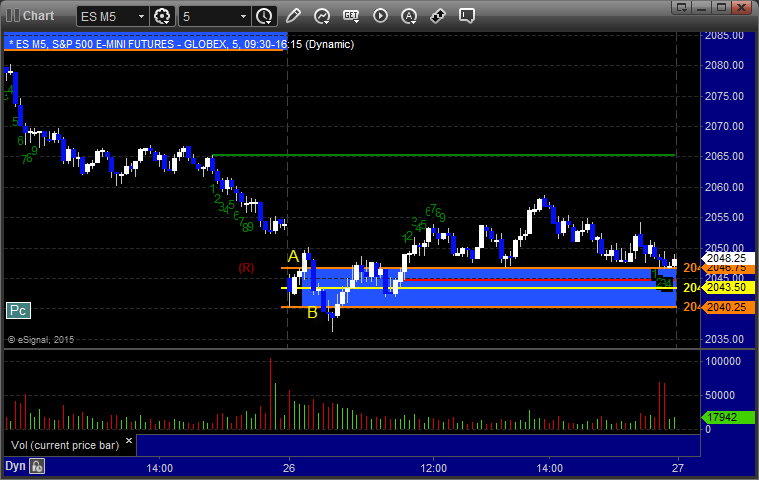

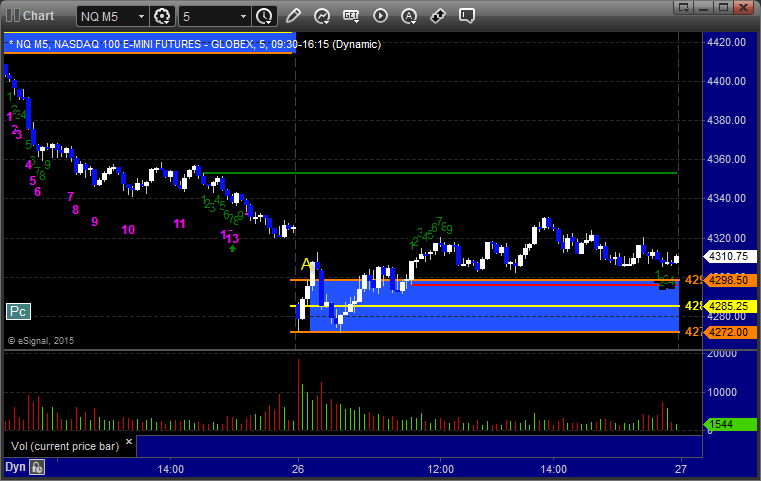

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

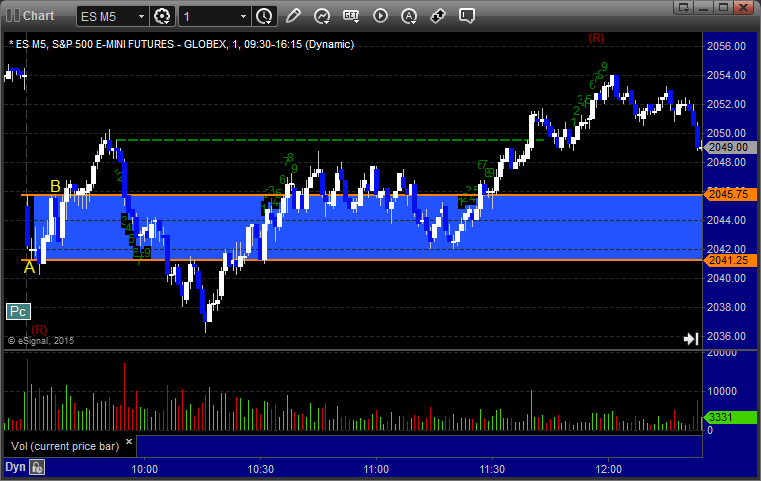

ES Opening Range Play triggered short at A and didn’t work, then triggered long at B and worked:

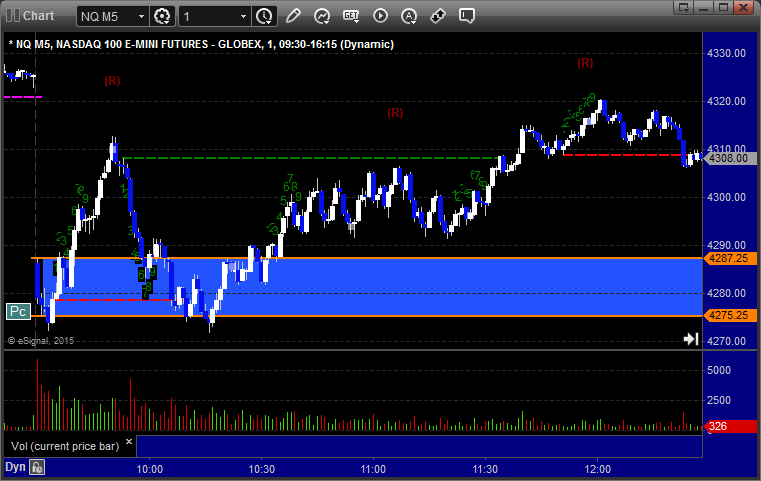

NQ Opening Range Play triggered short at A and didn’t work, then triggered long at B and worked great:

ES Tradesight Institutional Range Play triggered long at A and didn’t work, triggered short at B and worked:

NQ Tradesight Institutional Range Play triggered at A, but that should have been a little too far outside the range to take:

ES:

Triggered long at A at 2046.75 over the LBreak and stopped. Triggered again and stopped, so we posted not to retrigger, although the third time worked as it often does: