We got a big gap down in the markets and then pushed a bit lower for 30 minutes, then flattered out for three or more hours, then dipped one more time coming out of lunch. Although a lot of it was the gap, it’s interesting to see the markets move so far from the Wednesday/Thursday prices for options expiration. NASDAQ volume closed at 2 billion shares, which looks big compared to the last two weeks, but is really poor for expiration. No official calls, but the Opening Range plays worked great.

Net ticks: +0 ticks.

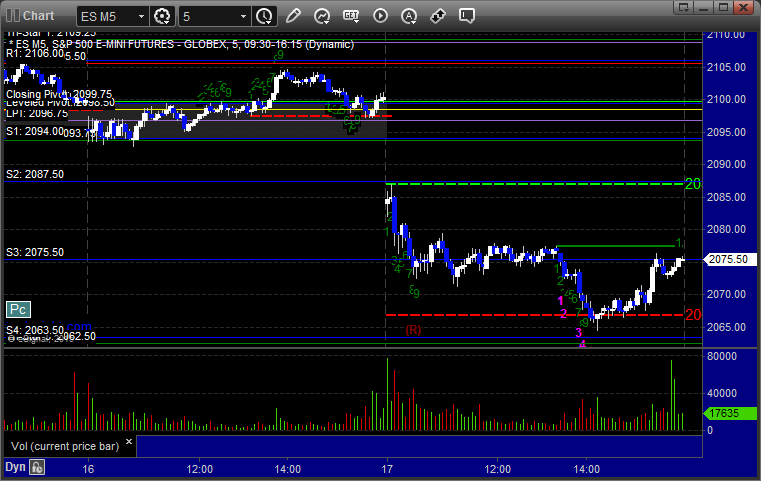

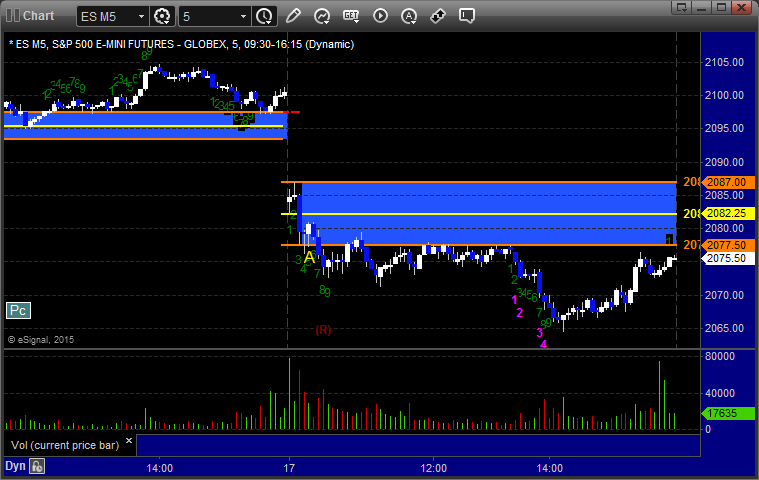

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked, triggered short at B a little later and worked:

NQ Opening Range Play triggered long at A and worked, triggered short at B a little later and worked:

ES Tradesight Institutional Range Play only triggered short at A, and worked:

NQ Tradesight Institutional Range Play only triggered short at A and worked:

ES: