Well, we call that a “measuring day,” where the market does literally nothing and overtrading chops you apart. We had a nice setup on the NQ and one on the ES, but the markets barely moved an inch and volume slipped all session, closing at 1.6 billion NASDAQ shares. On to options unraveling, hopefully tomorrow.

Net ticks: -21 ticks.

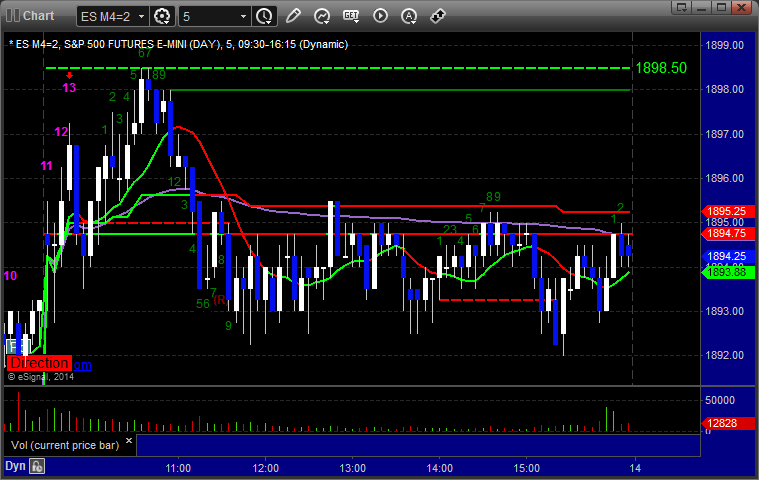

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Triggered long at A at 1897.50 and stopped. Did not re-enter, and it would have stopped again. We had a great Value Area setup, almost perfect, with the ES basing above the VAH all day, and against my better judgement due to lack of volume and action, I went ahead and posted it. It triggered at B and stopped:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3604.00 and stopped: