A loser on the NQ and a small winner on the ES. See both sections below.

This Friday, I will have a longer post to make about the current state of futures and how to handle what we’re seeing in this market with volume low. Today’s NASDAQ volume was only 1.4 billion shares, and the ES range was only 6 points.

Based on the results of the survey from the weekend (and thanks to those that filled it in), I’m going to get a little more detailed about the futures trading environment.

Net ticks: -5 ticks.

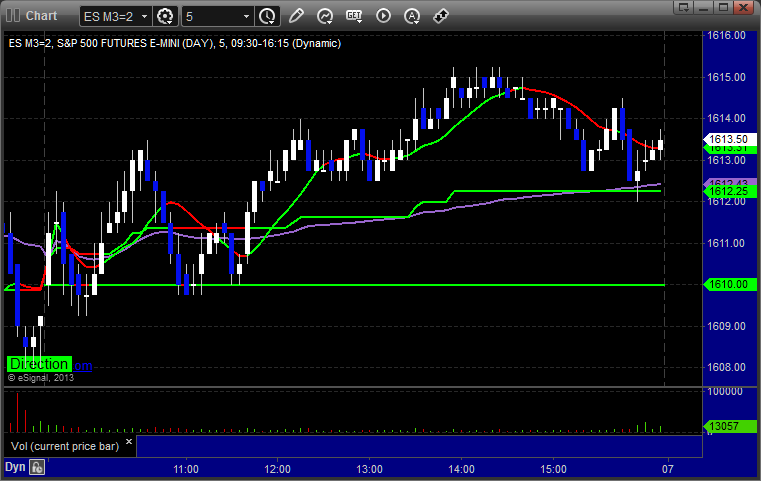

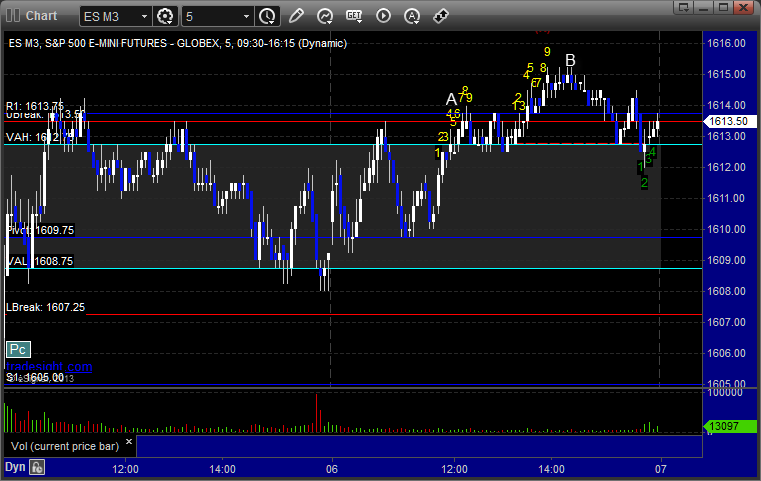

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

My call triggered long at A, never stopped over lunch, finally headed up. It technically never traded at the first target, but I posted at B when I took the partial and stopped the second half under the entry:

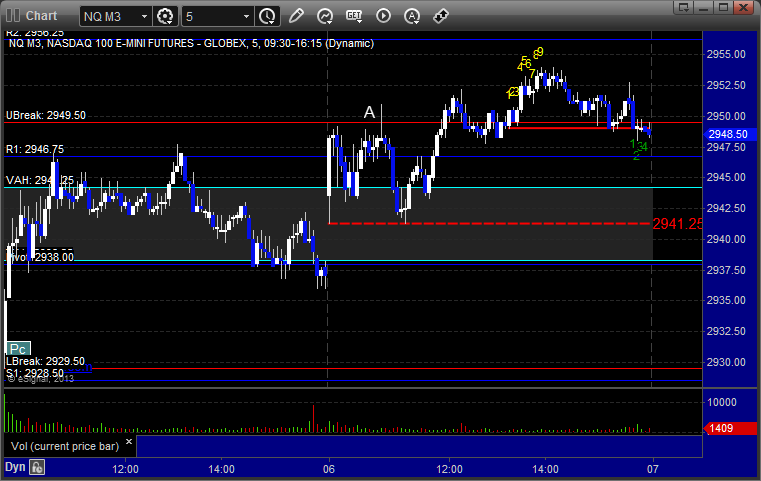

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Nice setup that set the Break level early, Mark’s call triggered long at A but triggered on no volume and didn’t work. Technically, it worked on the retrigger, but because of the volume issues early, Mark called off taking it again: