Exactly what we expected from options expiration Friday. The broad market opened flat (NASDAQ gapped up because of GOOG) and we stuck in basically a 5 point range for the session. NASDAQ volume was only 1.68 billion shares, which isn’t much considering GOOG traded 80 million more than usual and we had all of the options expiration volume. No calls, but the Opening Range Plays worked.

Net ticks: +0 ticks.

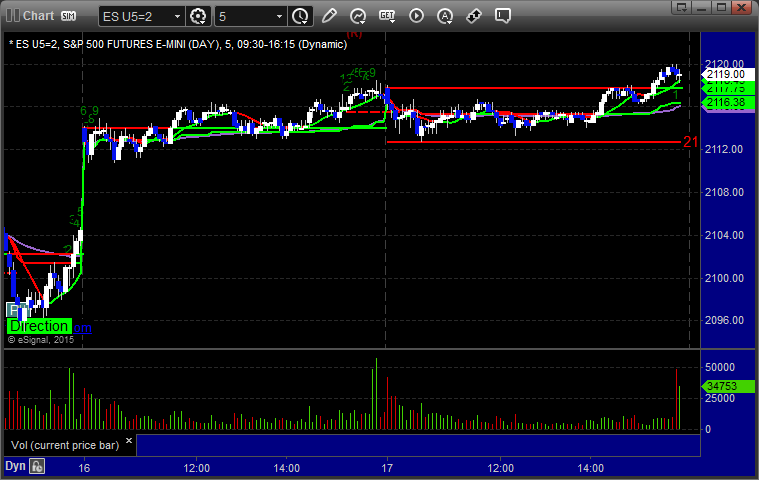

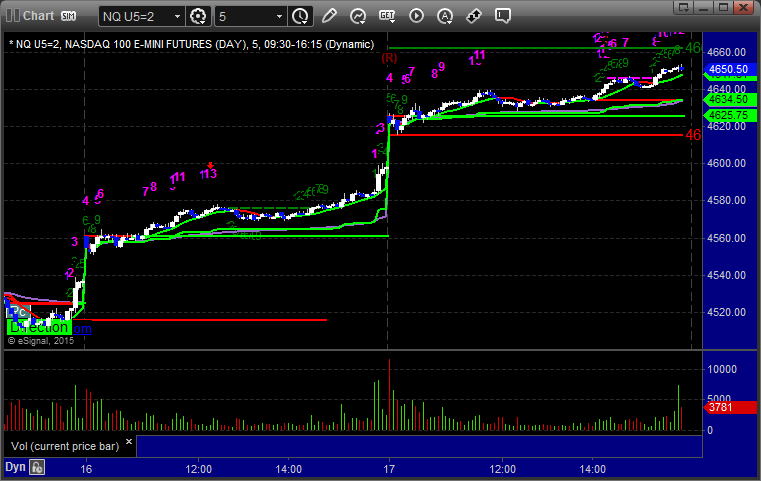

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

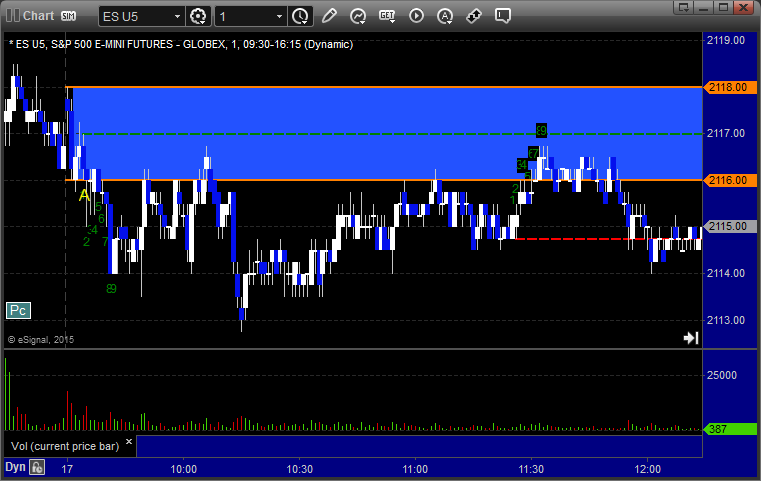

ES Opening Range Play triggered short at A and worked enough:

NQ Opening Range Play triggered short at A and worked enough:

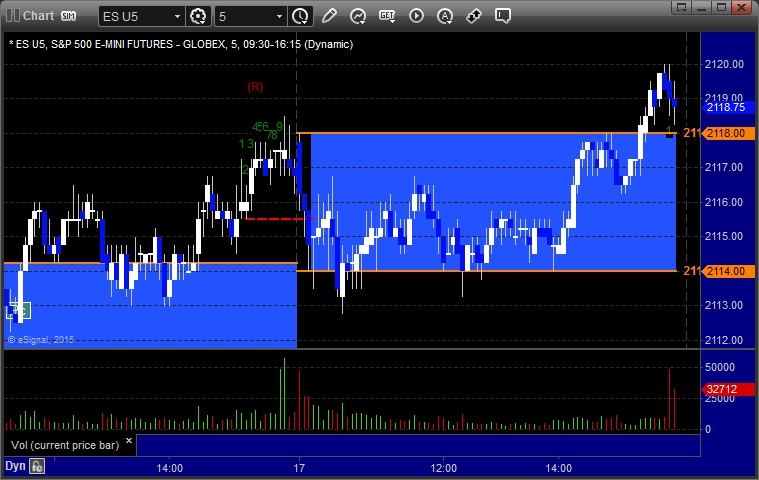

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: