A nice session for the set plays. I mentioned in the Lab that I wasn’t thrilled with the Opening Range plays on a Monday with a gap, but the Institutional Range plays were more interesting. In addition, the ES Value Area play set perfectly and worked exactly to the target. In terms of the separate calls, the ES stopped twice against the Pressure Threshold and I didn’t do it a third time (which would have worked. The markets ended up filling the gaps and that was it, but NASDAQ volume was only 1.6 billion NASDAQ shares and the markets ended up basically flat.

Net ticks: -14 ticks.

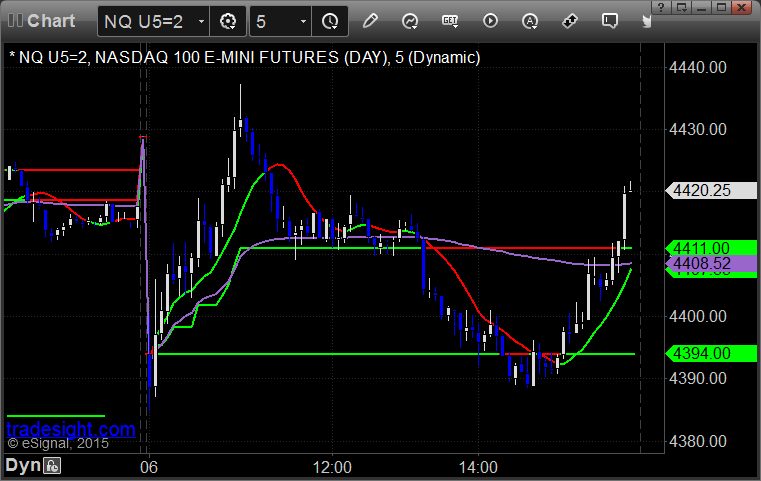

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn’t work and long at B and did:

NQ Opening Range Play triggered short at A and didn’t work and long at B and did:

ES Tradesight Institutional Range Play triggered long at A and worked:

NQ Tradesight Institutional Range Play triggered long at A and worked:

ES:

The setup against the Pressure Threshold triggered long at A at 2058.50 and stopped for 7 ticks. I put it back in and it stopped again. Third time would have worked. Then, the Value Area setup perfectly and triggered at B and crossed to the target exactly at C for 30 ticks: