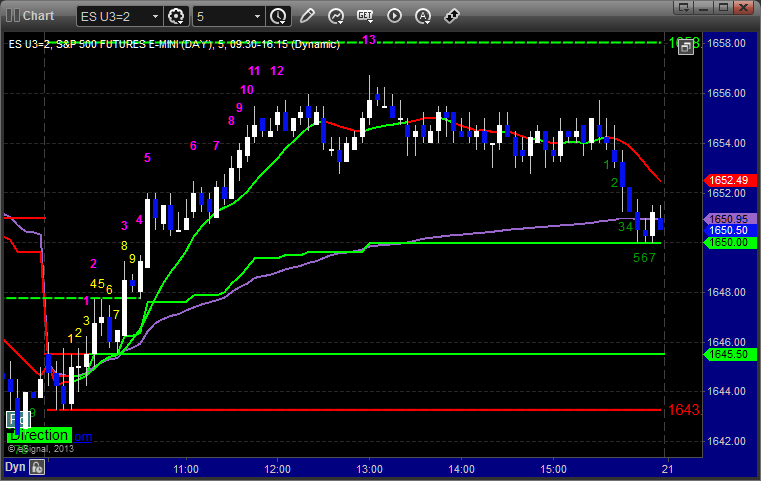

A trigger and a stop out on the NQ for the lightest volume day of the year. We didn’t even clear 300 million NASDAQ shares after 60 minutes, and volume at the close was 1.2 billion. Note that the Comber 13 sell signals on both the ES and NQ gave the high of the session.

Net ticks: -7 ticks.

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

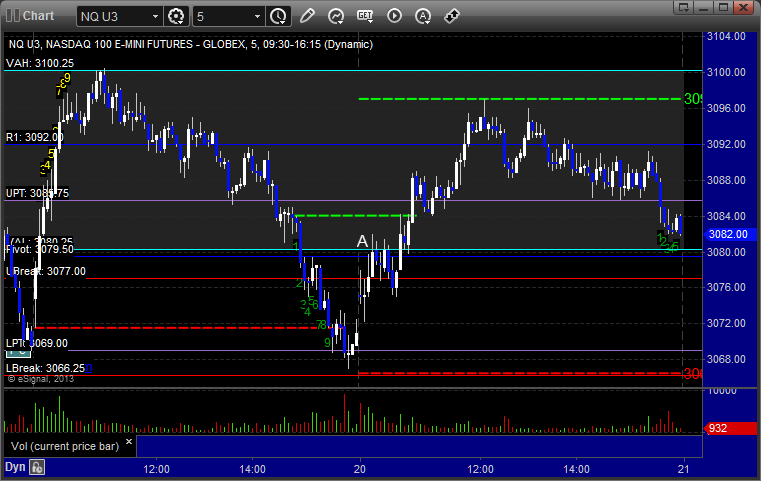

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3080.50 and stopped. It eventually would have worked but would have taken three tries and I didn’t put it back in the second time due to volume: