The markets gapped up, didn’t do much, and eventually made their way back to fill the gap and close around even on a weak 1.8 billion NASDAQ shares, which means we haven’t seen an options unraveling move for triple expiration.

Net ticks: +12 ticks.

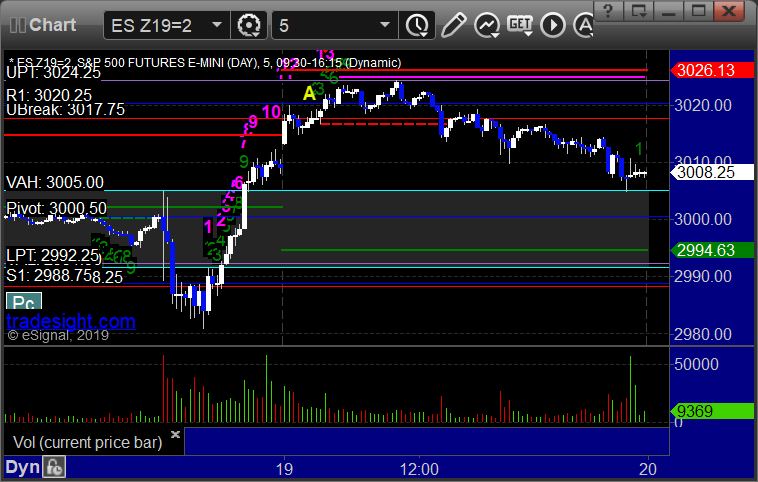

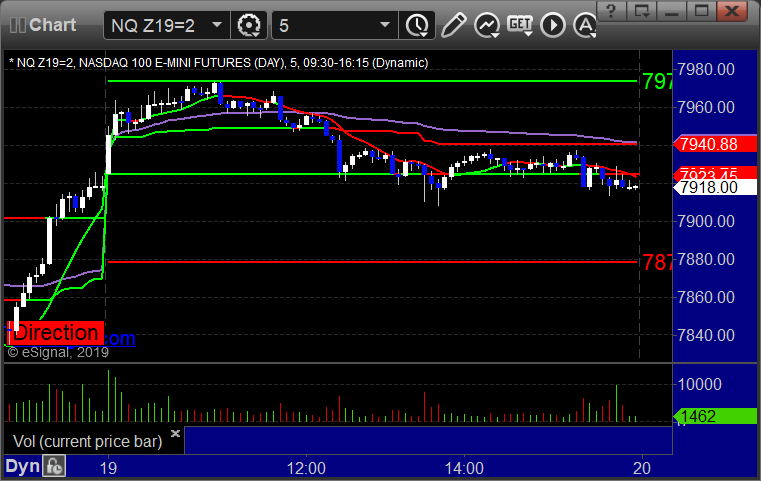

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play triggered long at A but too far out of range to take:

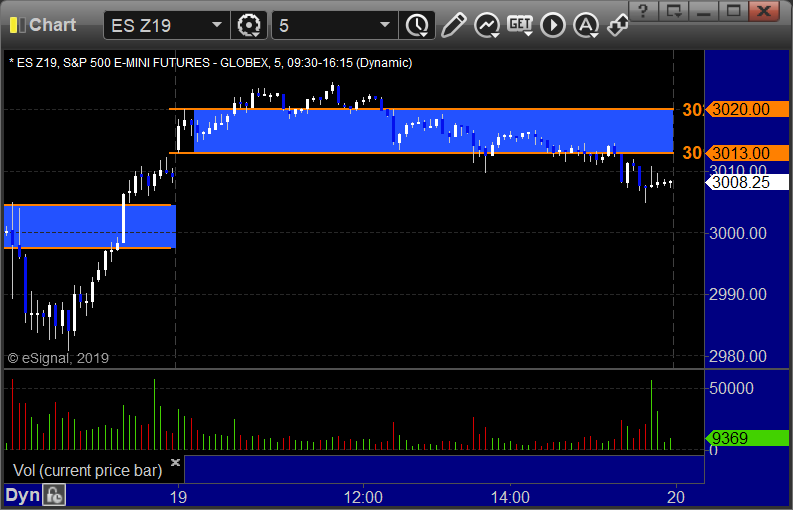

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A at 3020.50, hit first target for 6 ticks, and closed second half 10 ticks in the money after the 13 Comber signal brought us near that risk level: