A loser, and then a sweep that retriggered and worked. The markets gapped up and meandered around for the last day of the quarter, which isn’t anything new. NASDAQ volume closed at 2 billion shares. Once again, the Opening Range Plays worked great.

Net ticks: -7 ticks.

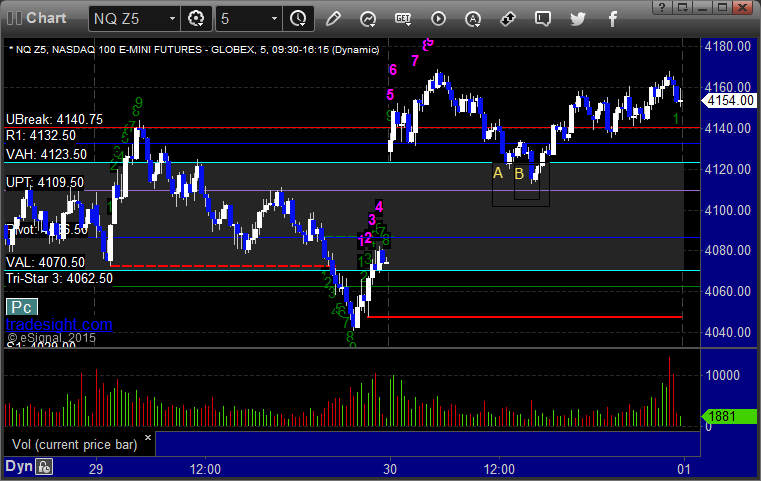

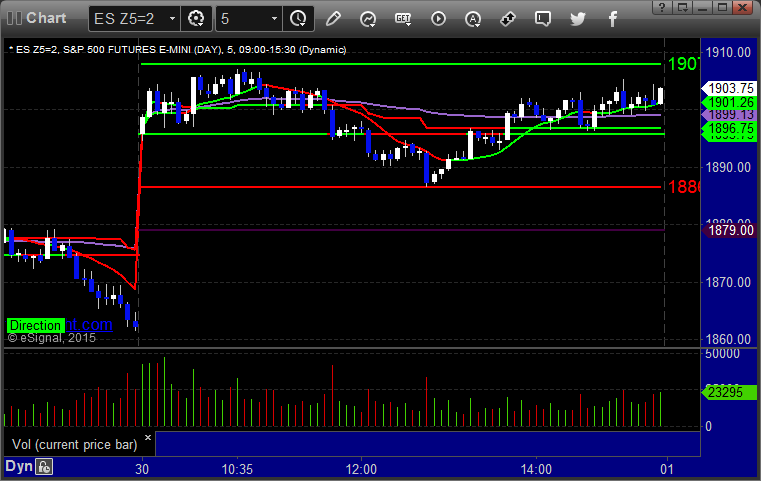

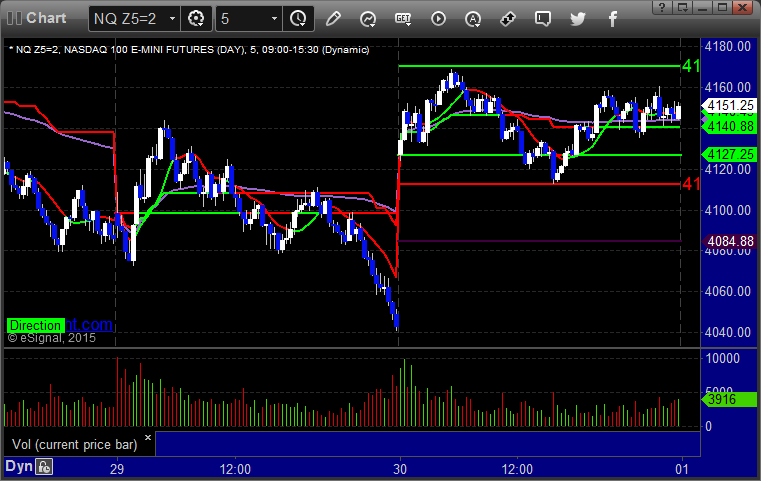

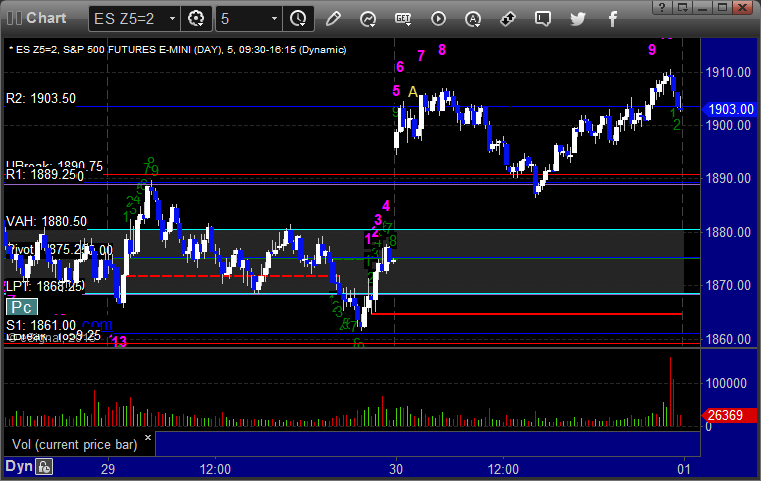

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

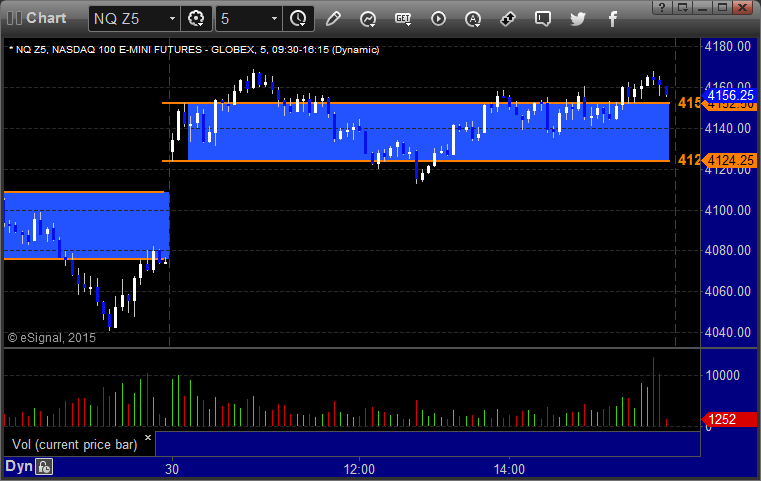

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 1904.75 and didn’t work, I did not re-enter:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A and stopped on a sweep, then triggered again, hit first target, lowered stop twice and stopped in the money: