The ES made a new low on the move losing 6 on the day. Next support is the 2/8 Gann level.

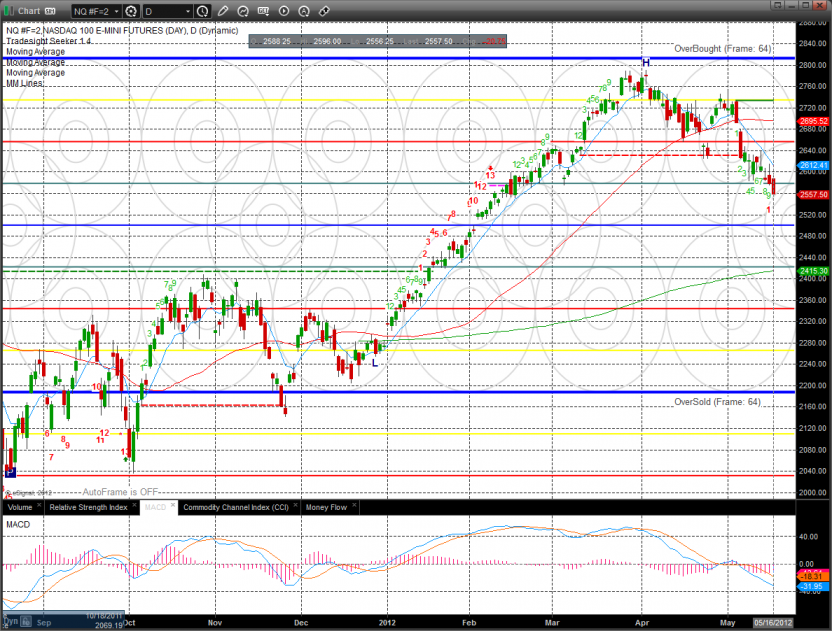

The NQ futures broke to new lows losing 21 on the day. Both the ES and NQ have down side CPS candles from today’s session.

10-day Trin:

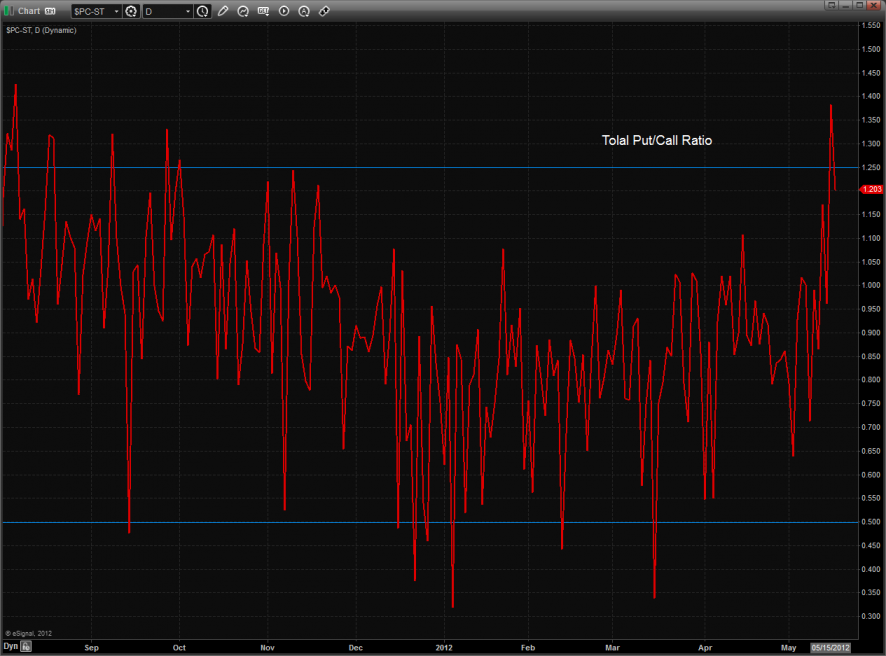

The total put/call ratio now has a climatic spike in place:

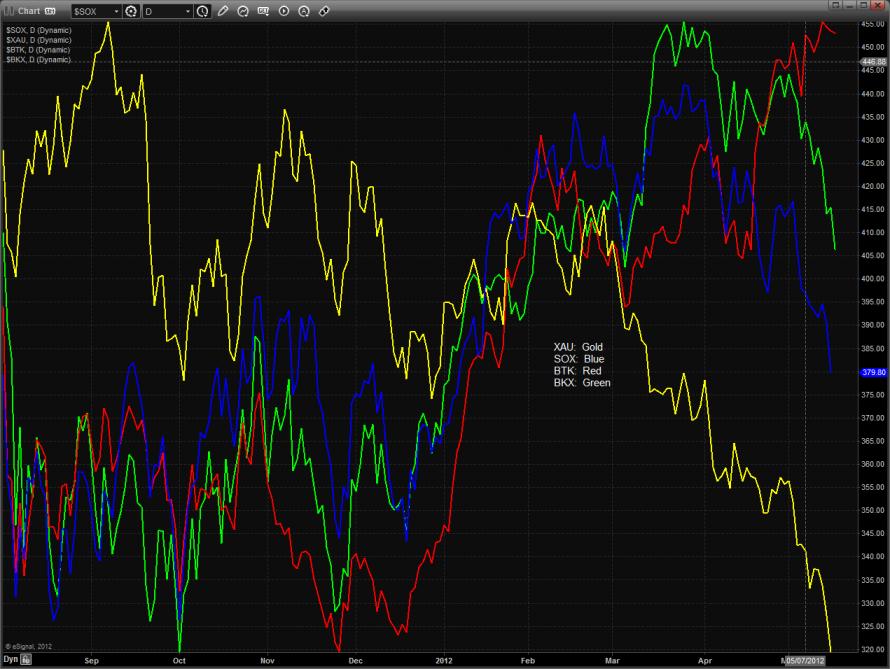

Multi sector daily chart:

The XAU was the top gun on the day and the only major sector up on the day. The eSignal below is wrong as they often are.

The BTK was relatively strong and is still glued to the 8/8 level.

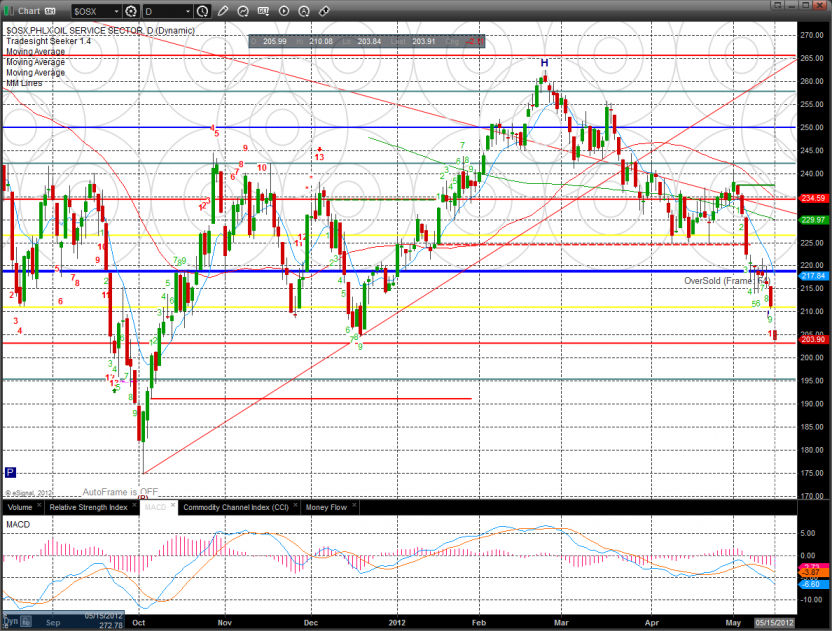

The OSX made a new low and is hovering just above the critical -2/8 level. Keep in mind that a frame shift would be very bearish.

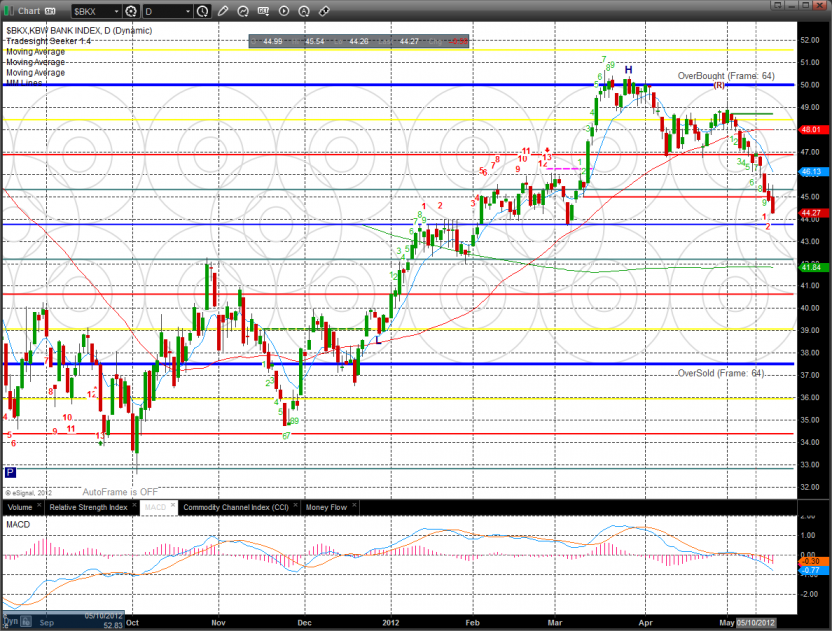

The BKX continues to retreat and should find important support at the 4/8 level just below 44.

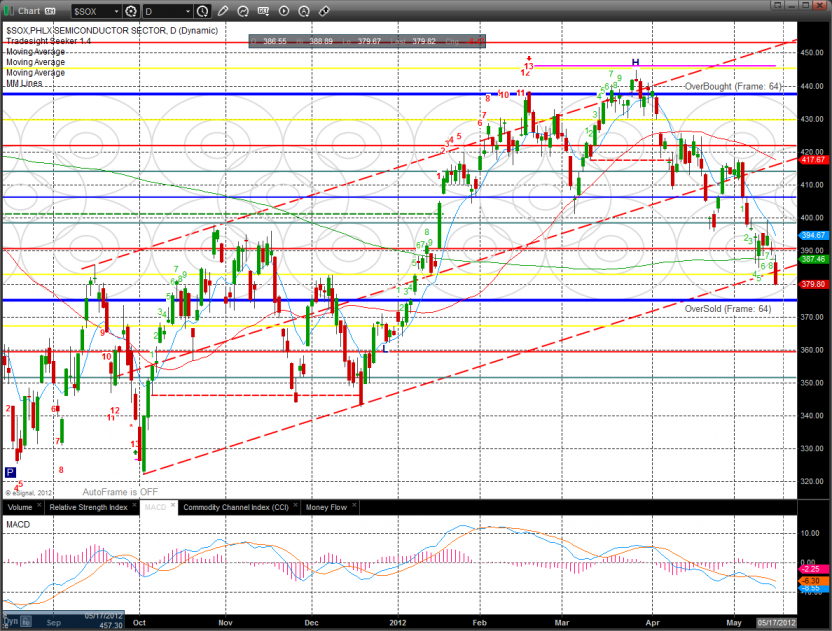

The SOX settled below the 200dma and also the lower channel boundary. The pattern is just now 9 days down so there could be some lateral or retracement activity soon.

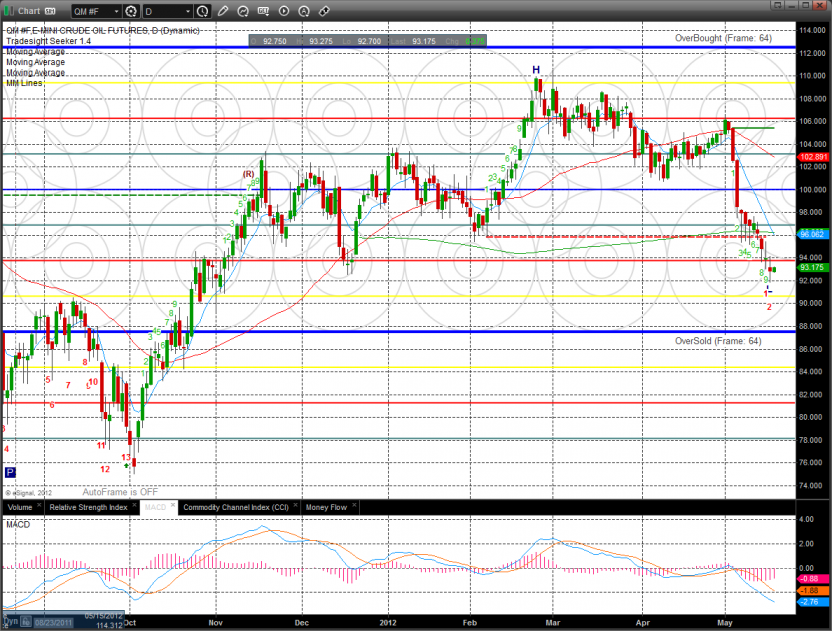

Oil:

Gold:

Silver