With each stock’s recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EBAY triggered long (with market support) and worked:

NWBO triggered long (with market support) and worked:

VNDA triggered long (without market support) and didn’t work:

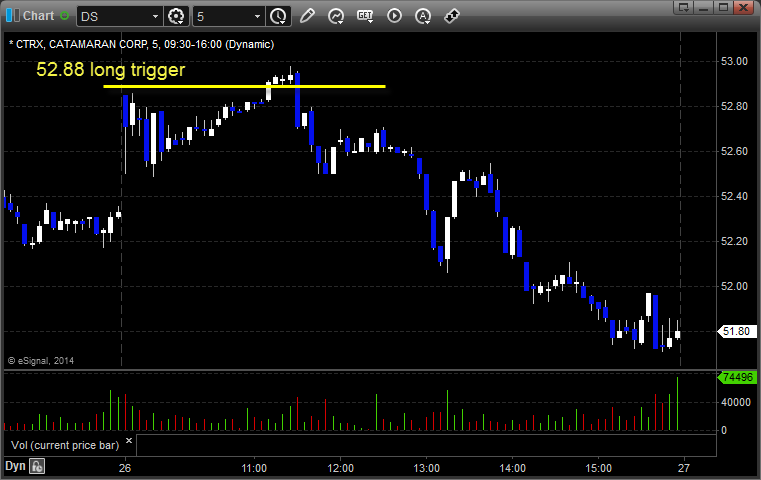

CTRX triggered long (with market support) and didn’t work:

CGEN gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich’s VXX triggered long (ETF, so no market support needed) and worked:

His NFLX triggered short (with market support) and worked enough for a partial:

His BIDU triggered short (with market support) and worked enough for a partial:

His MS triggered short (with market support) and didn’t work:

GOOG triggered short (with market support) and didn’t work on a sweep, it did work later:

Mark’s PANW triggered long (with market support) and worked:

Mark’s RGLD triggered long (without market support) and didn’t work:

Rich’s AAPL triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked:

His FB triggered short (with market support) and didn’t work:

In total, that’s 12 trades triggering with market support, 8 of them worked, 4 did not.