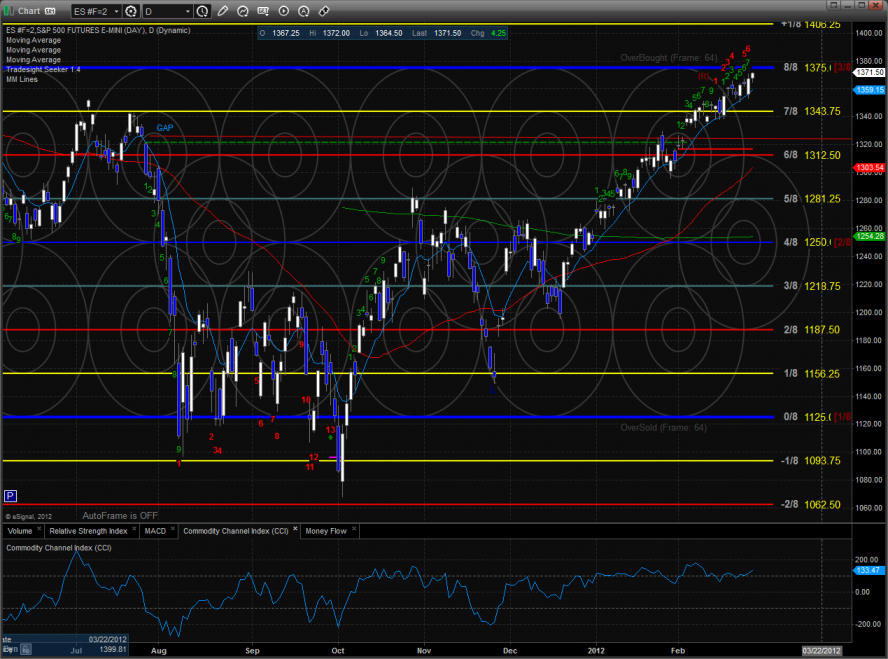

The ES is marching closer and closer to the key 1375 level. Up 4 handles on the day in a very grinding advance the futures are about to interact with the very powerful 8/8 level. Tuesday was a new high on the move.

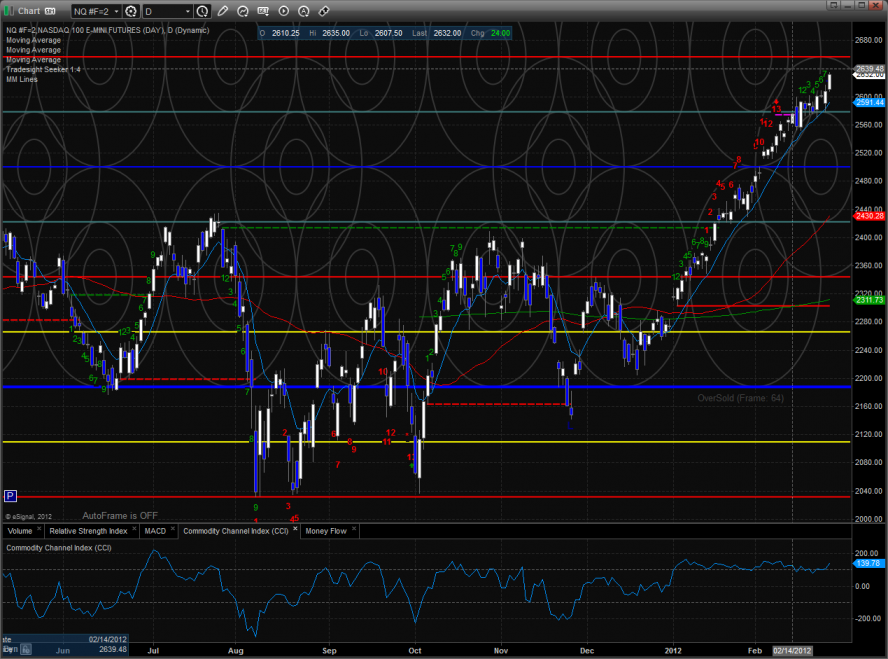

The NQ futures were relatively strong vs. the ES posting triple the percentage advance. This is good relative strength but it is mostly coming from over weighted index gorilla AAPL. If at some point AAPL breaks, the NDX will get the stuffing pulled out of it. Money will flow out of the NQ faster than an Italian captain can abandon ship.

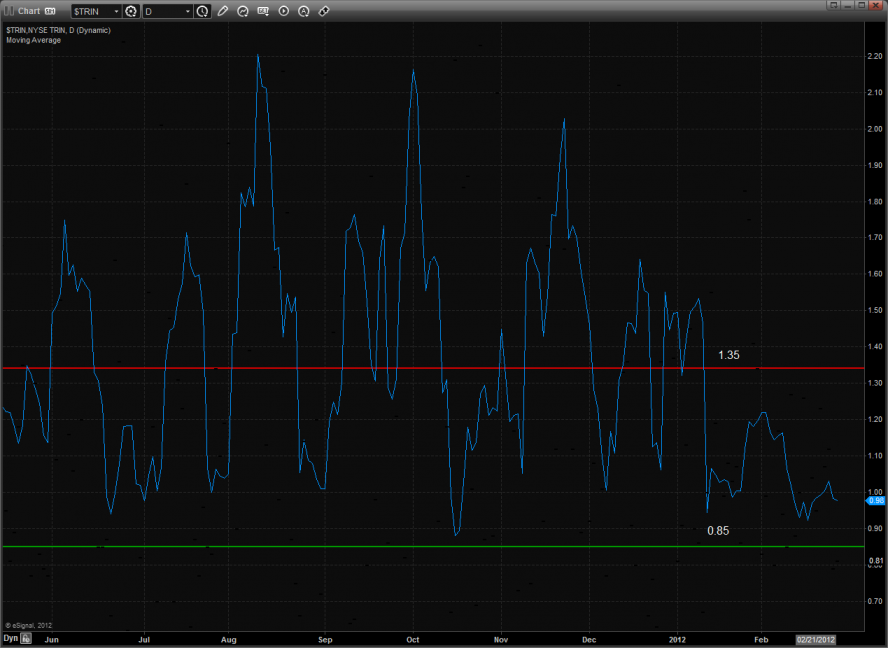

The 10-day NYSE Trin remains neutral:

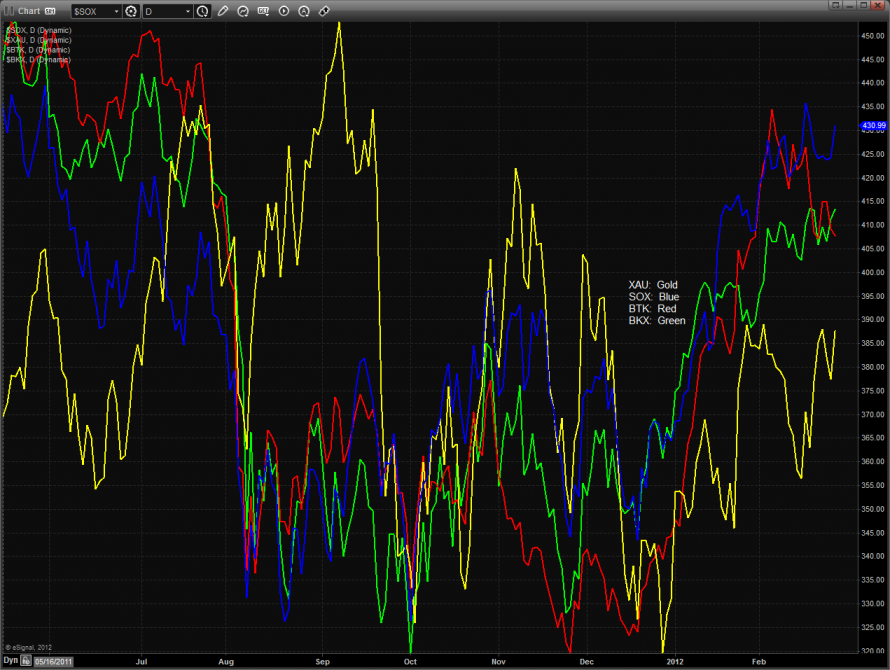

Multi sector daily chart shows that the SOX is trying to make a move–more on this below.

The SPX/NDX cross bullishly made a new high on the move.

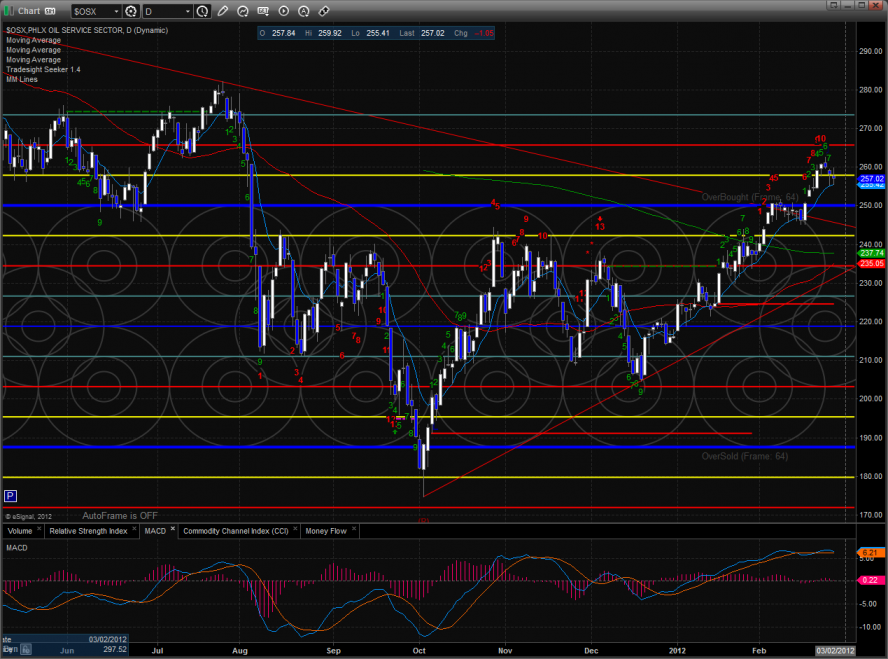

The OSX continues to bearishly lag crude futures. If this persists it will hold crude back and eventually reverse the futures.

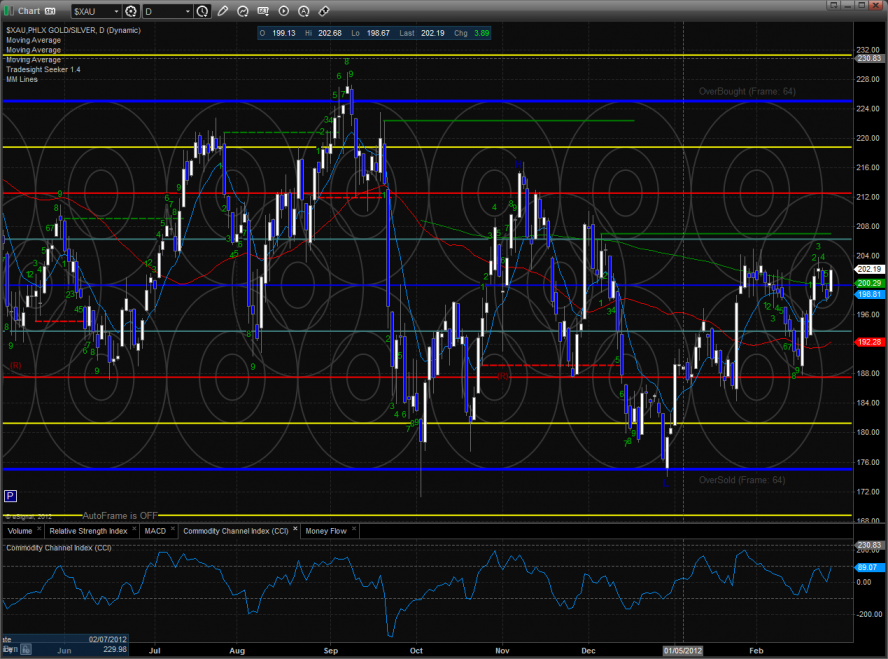

The defensive XAU was the top gun on the day. It remains rangebound but is but now above all of the major moving averages. If the XAU reclaims its relative strength vs. the broad market then the overall equity bull trend is getting close to done.

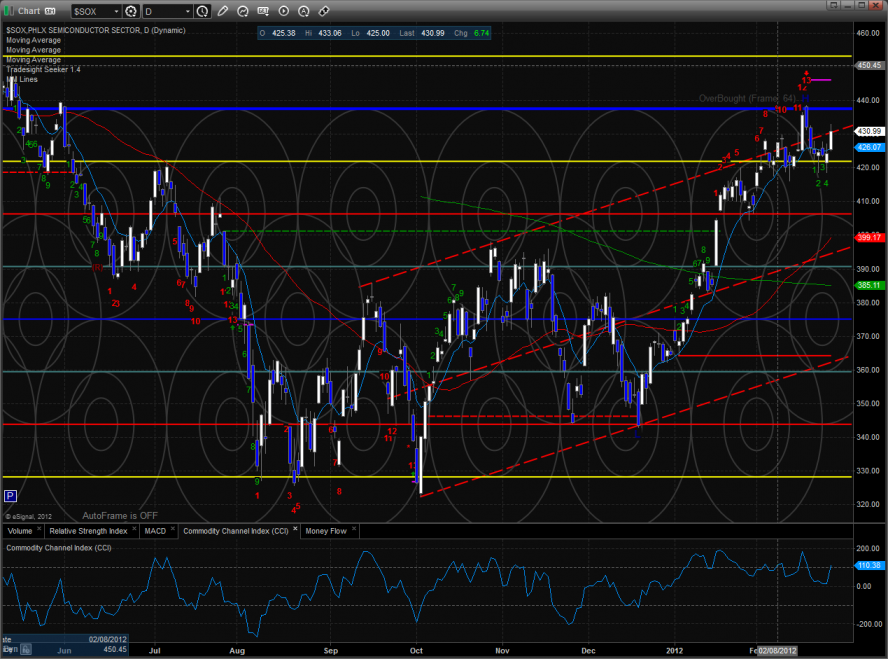

The SOX was higher on the day and outperformed the NDX but it didn’t record a new high.

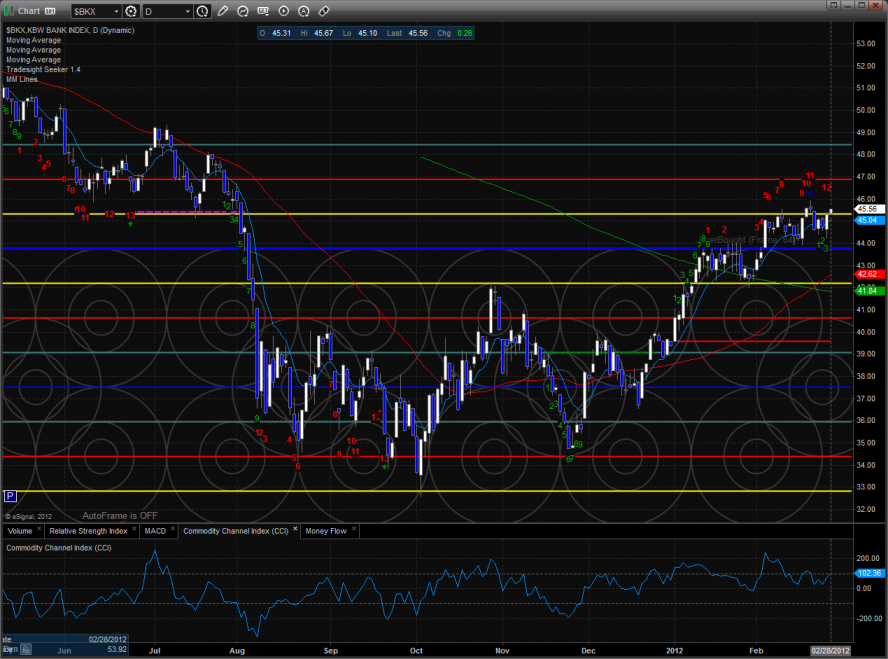

The BKX was higher on the day but in so doing will record a 13 Seeker exhaustion signal.

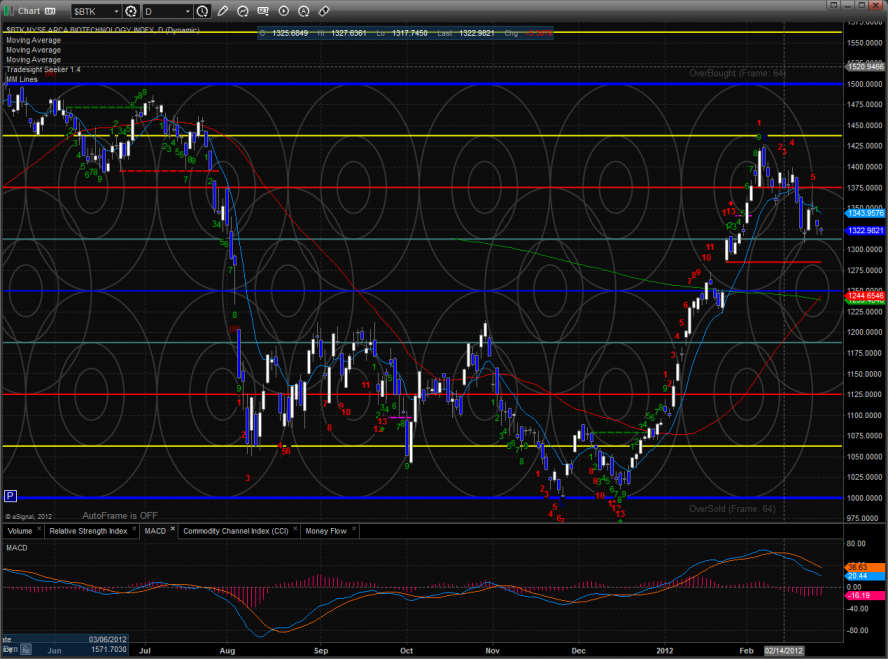

The BTK traded inside yesterday’s range and showed relative weakness. Be sure to have an alarm set for a break under last week’s low. Note how the MACD is rolling over.

The OSX also posted an inside day and underperformed the overall market. Price remains overbought and a close under the 10ma could get momentum rolling to the downside.

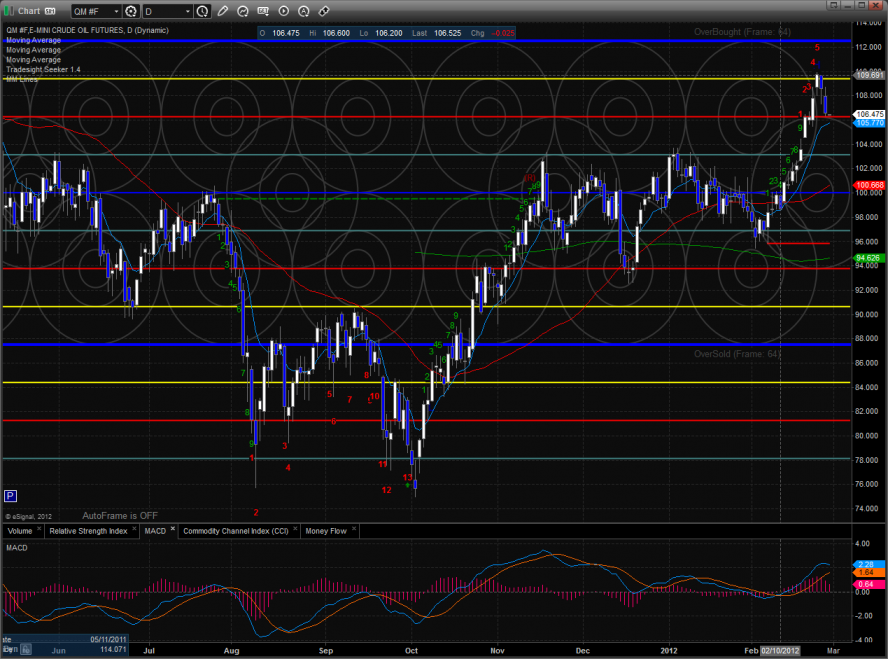

Oil futures are retreating and falling back to the breakout level.

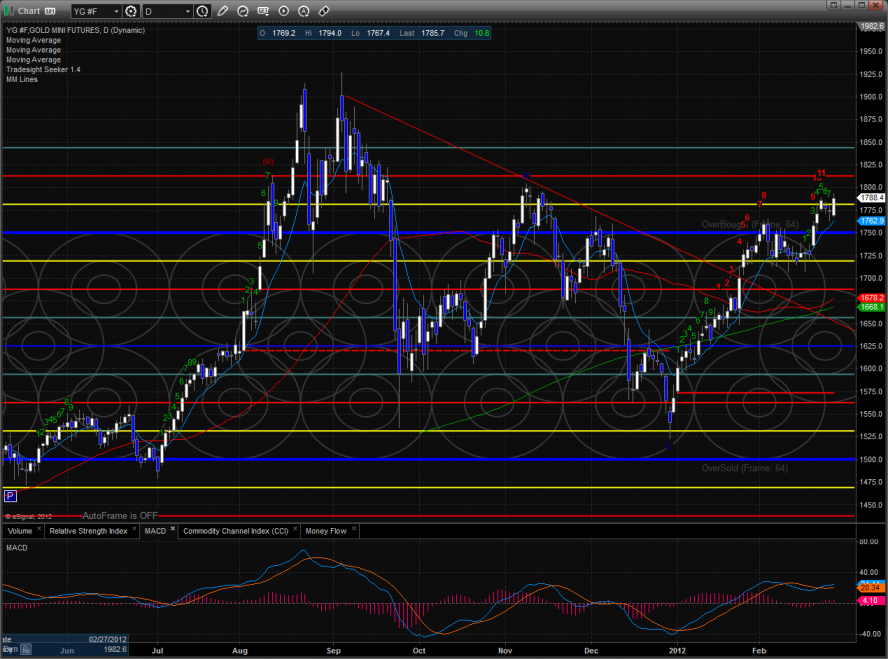

Gold made a new high on the move and is getting very close to the Nov. highs. The Seeker pattern is now 12 days up but is at risk of recycling.

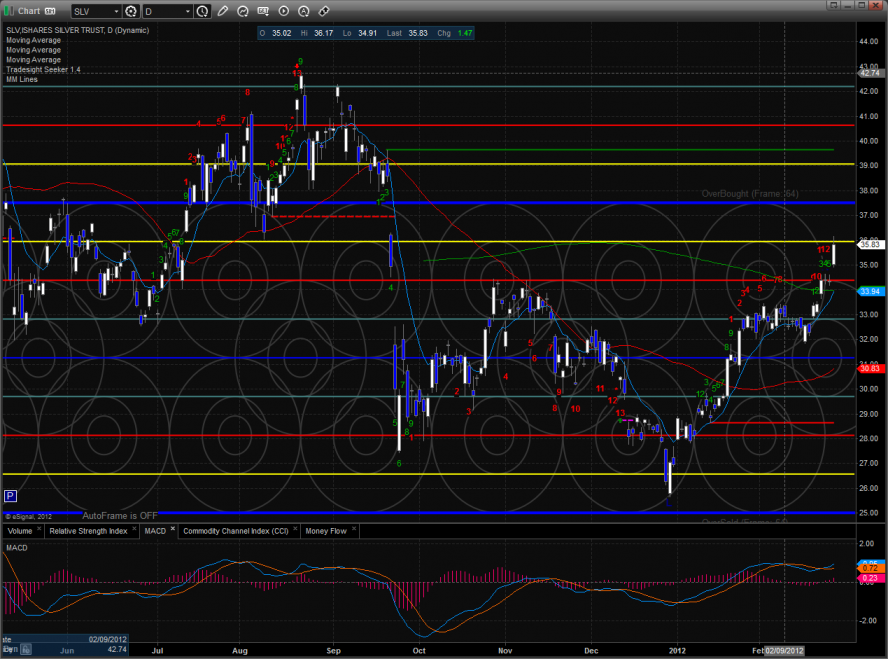

Silver has now recorded 13 days up in the daily Seeker count.