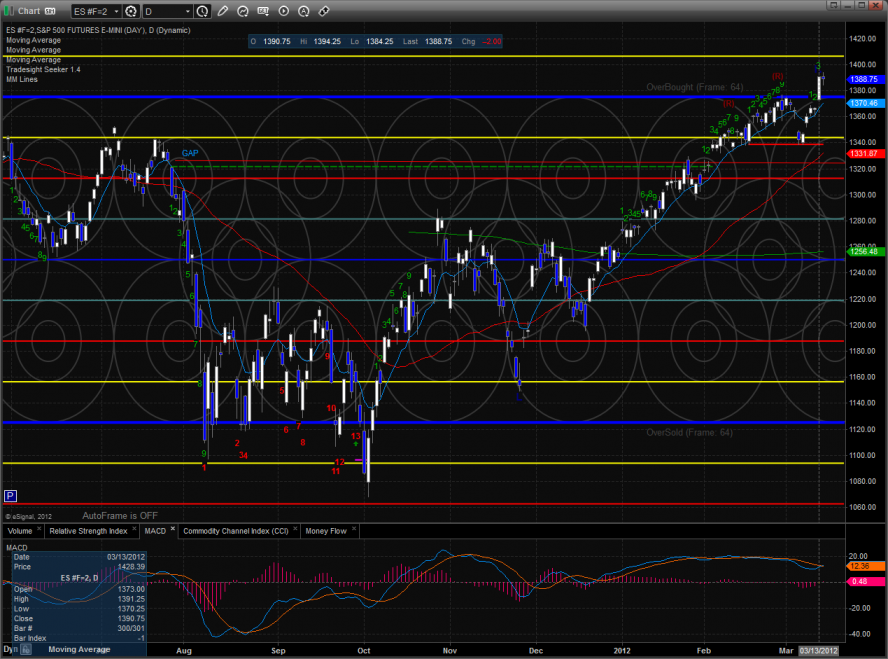

The ES posted a measuring day with a net decline of 2 handles. The market moved sideways in a choppy fashion. A new high was recorded but not a new high close which makes this a distribution dayl.

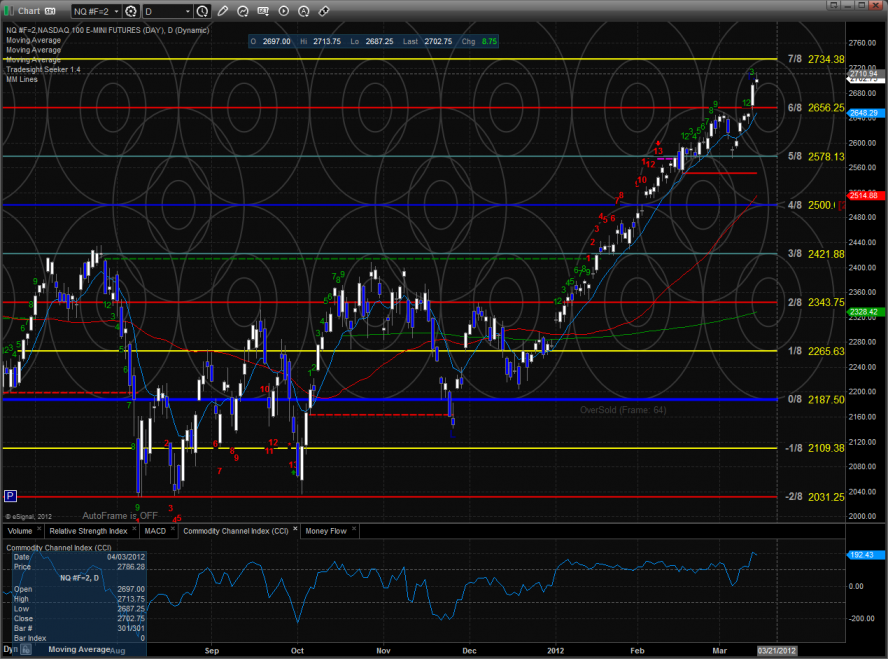

The NQ futures were higher by 9 on the day making a new high close. Note that the MACD is getting extended.

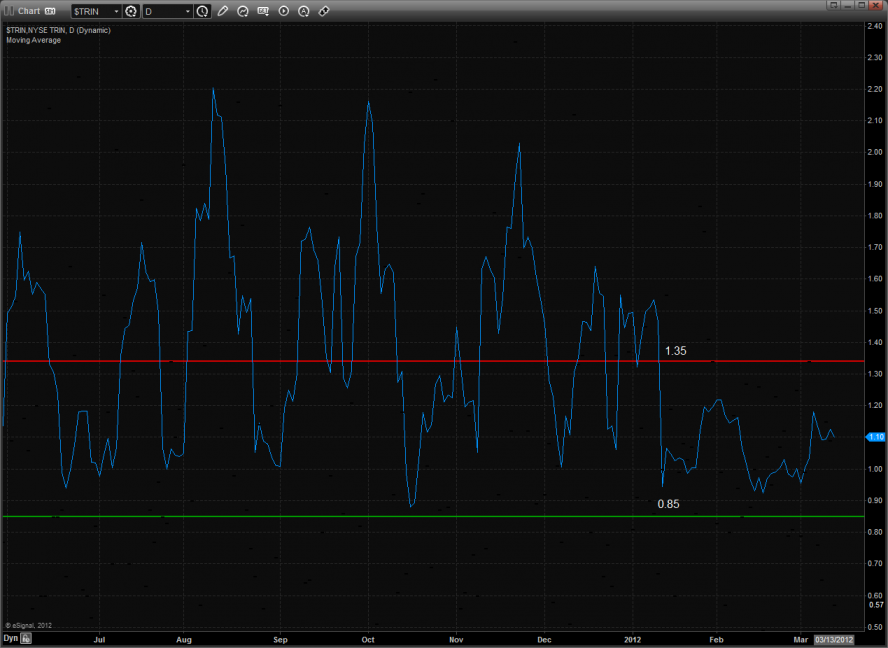

The 10-day Trin is still being very stingy with giving us an overbought or oversold reading.

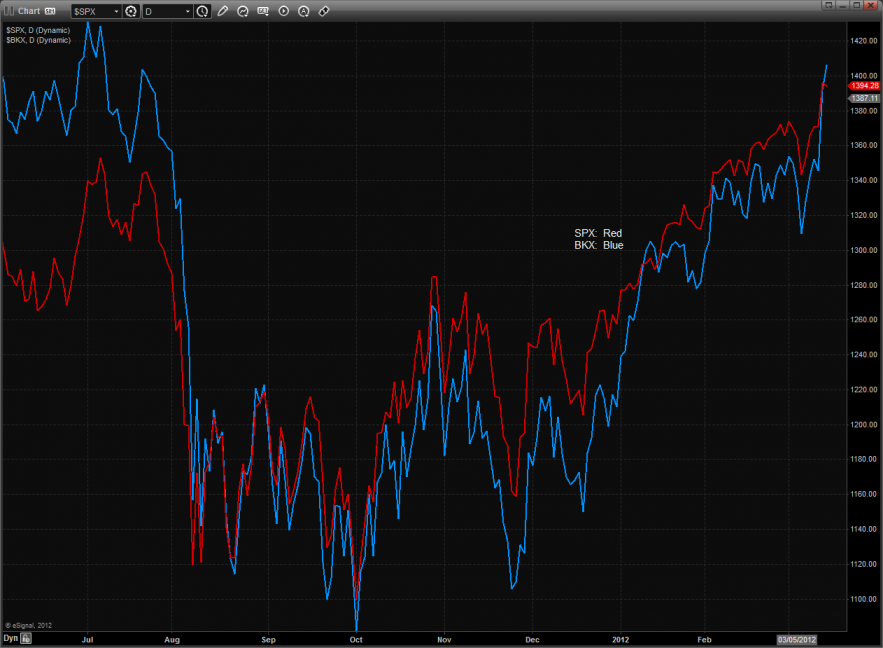

The strength of the banks and the weakness in the mining stocks is eye popping on our comparison chart. Can you say, “Rotation”?

The much welcomed strength in the BKX is good to see on the comparison chart.

The NDX/SPX cross is getting close to a new high. A breakout would be very bullish.

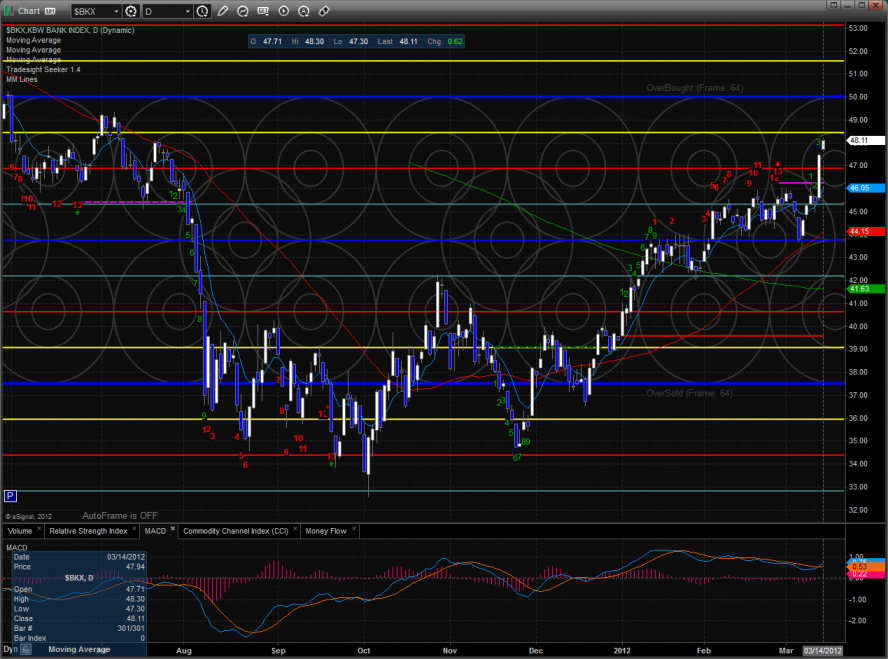

The BKX was the only sector up on the day and with it taking out yesterday’s high will disqualify the Seeker sell signal.

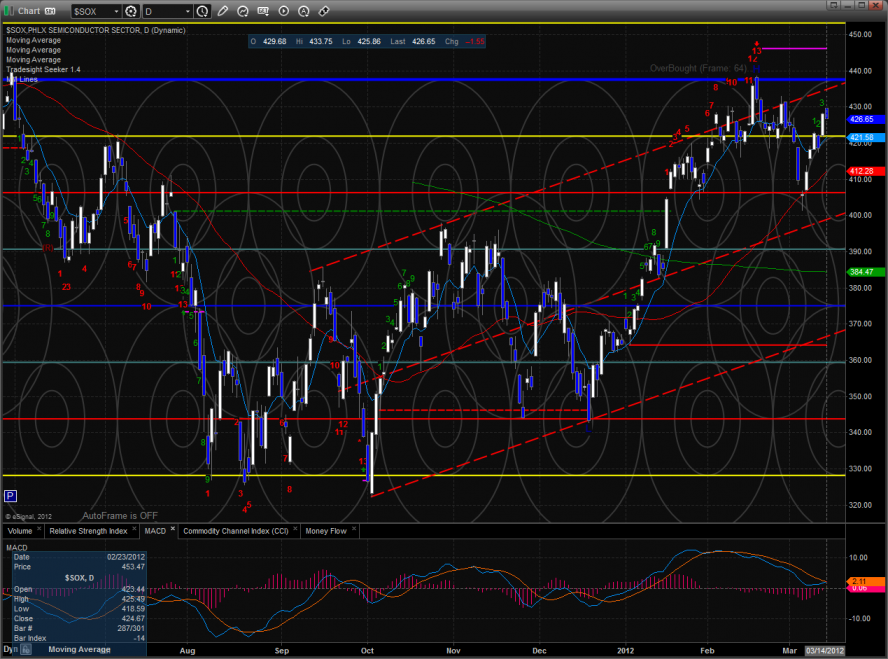

The SOX was the top NSDAQ sector but was lower on the day. The price action in the next couple of days is going to be very key because it will determine if the current up move is a retest of a high or more. The Seeker is still in a sell condition.

The XAU got thumped and is just above the YTD low. The 9 bar Seeker setup did not support price which implies that a full countdown phase is in the cards. Take it one bar at a time but this could be trouble if the 0/8 level is lost.

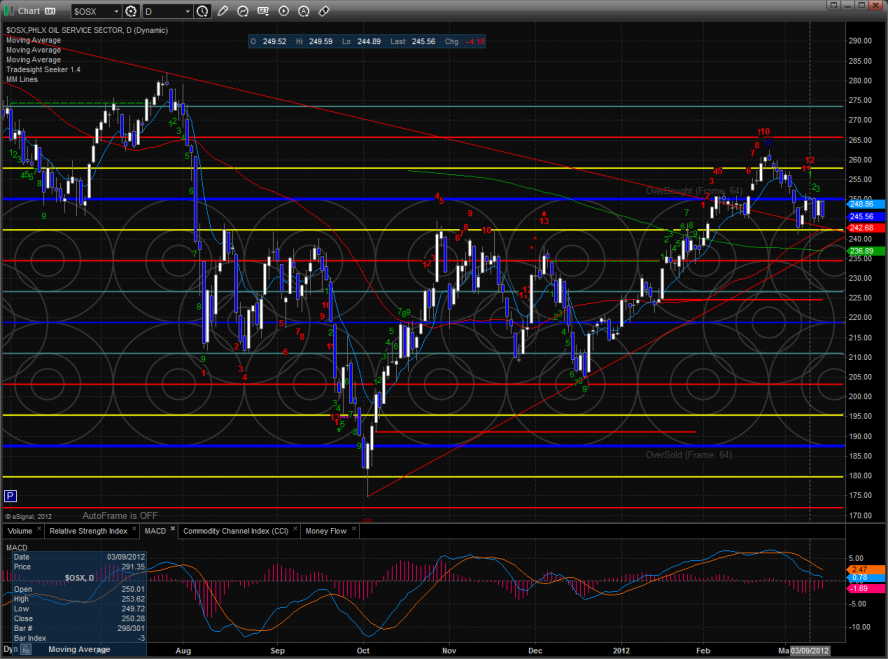

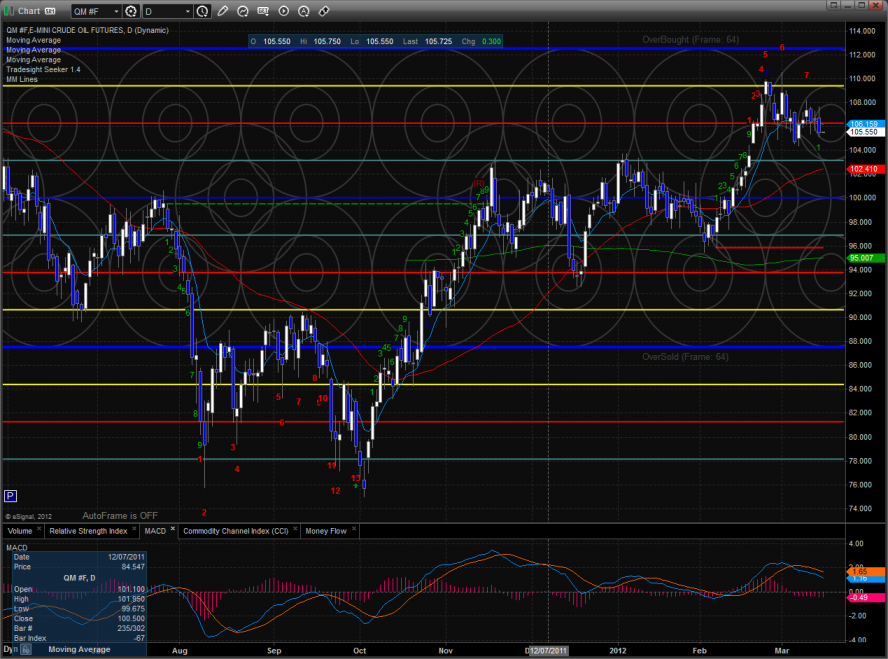

Oil:

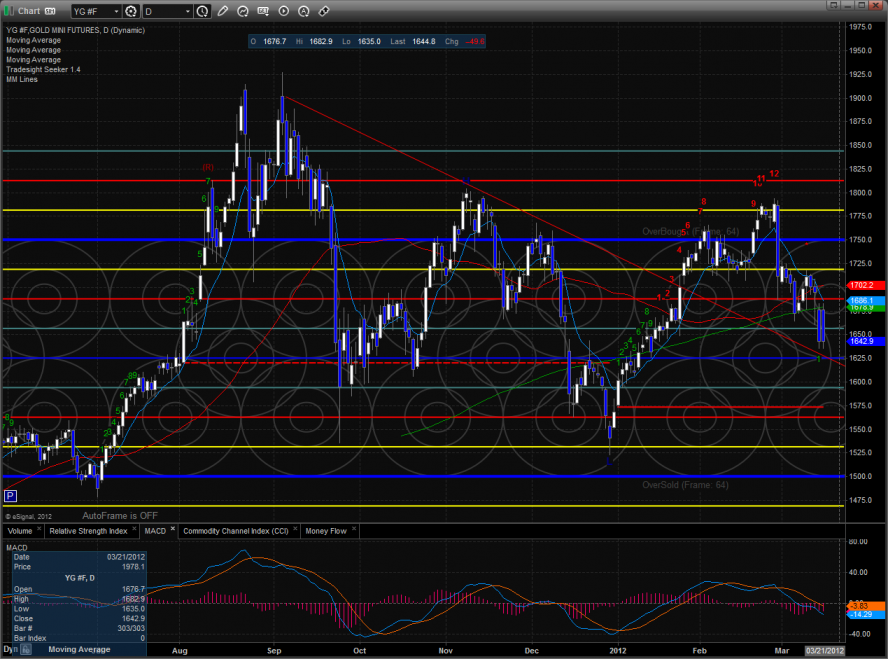

Gold:

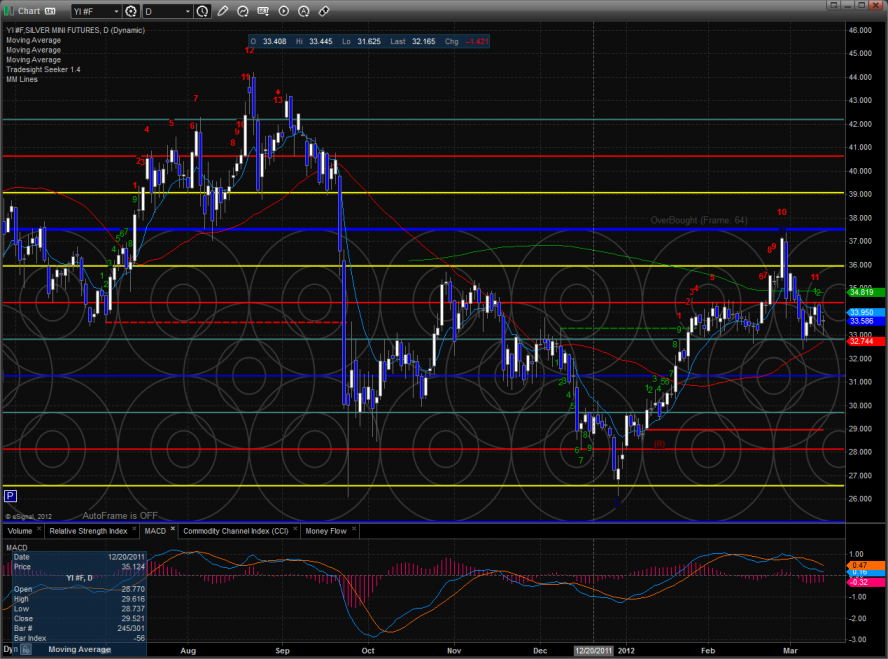

Silver: