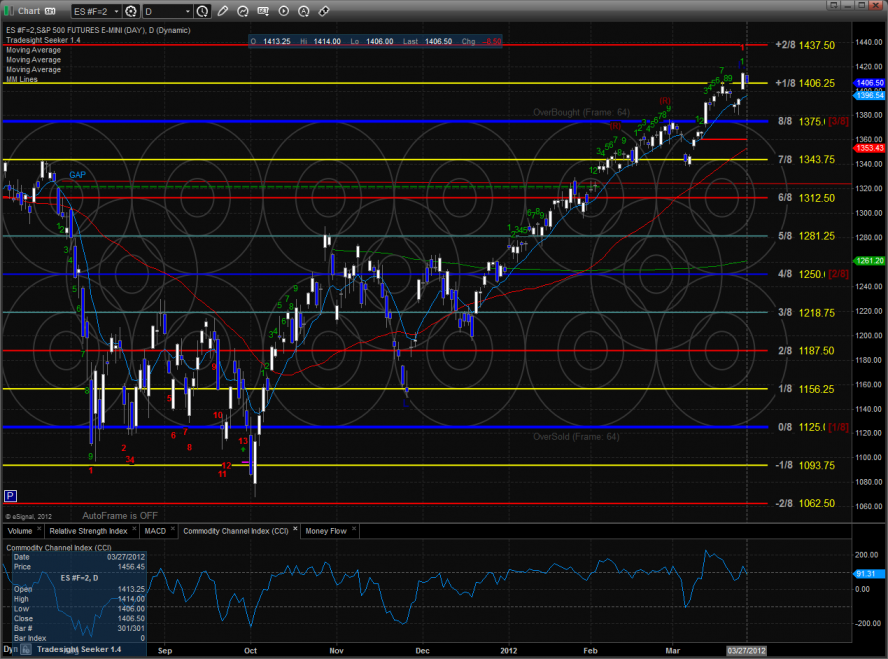

The ES was lower on the day by 8 handles and was totally controlled by yesterday’s range. This leaves an inside day on the chart which works off a tiny bit of the overbought energy in the pattern.

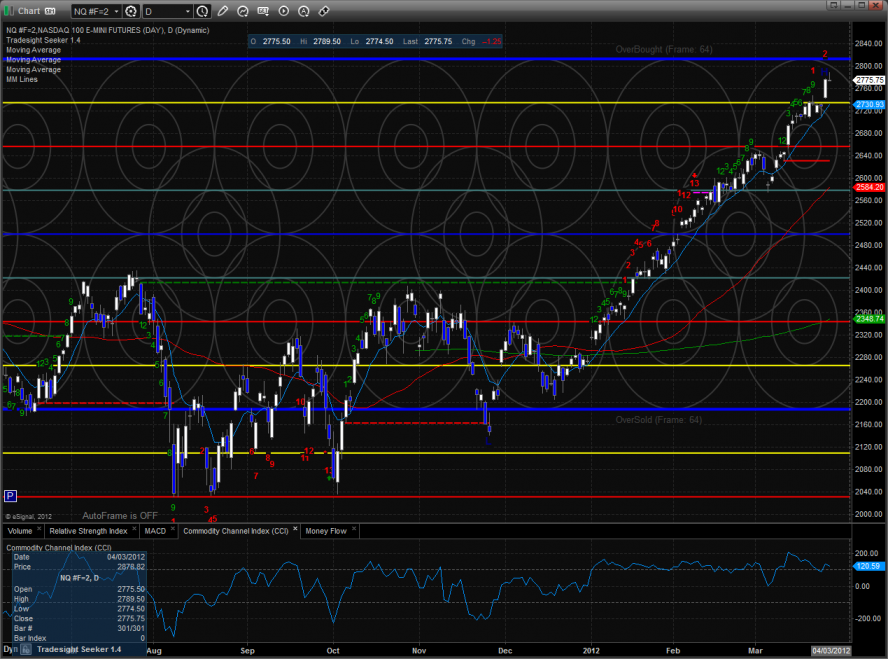

The NQ futures were again relatively strong vs. the SP side. The Naz futures were lower by only 1 point on the day. Price did make a new intraday high on the move so there is no question that this was a range high distribution day. The end of month chicanery is about to start so be prepared for some more volatility.

10-day Trin:

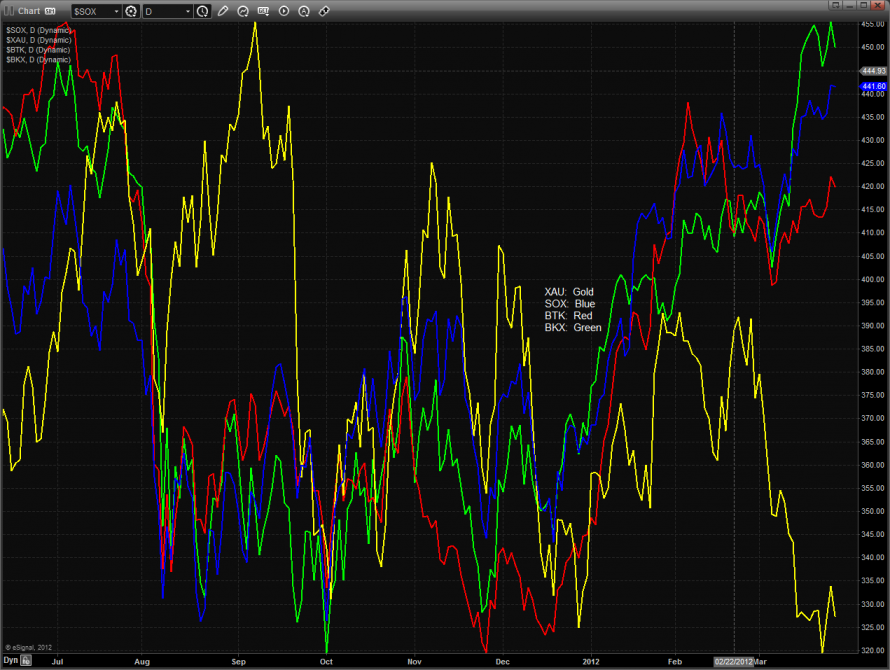

Multi sector daily chart:

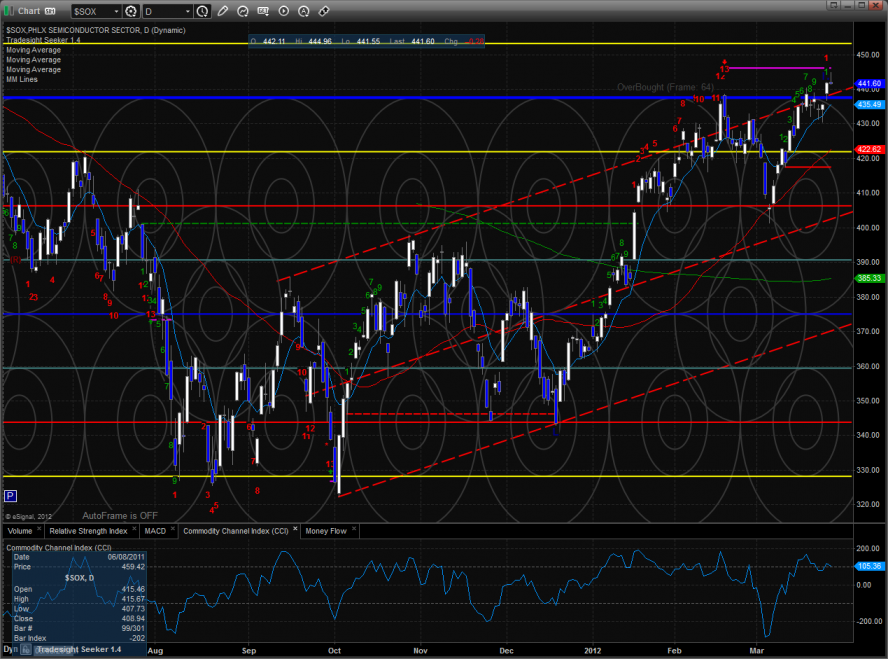

The SOX continues to struggle vs. the overall NDX:

The NDX still has good relative strength vs. the SPX:

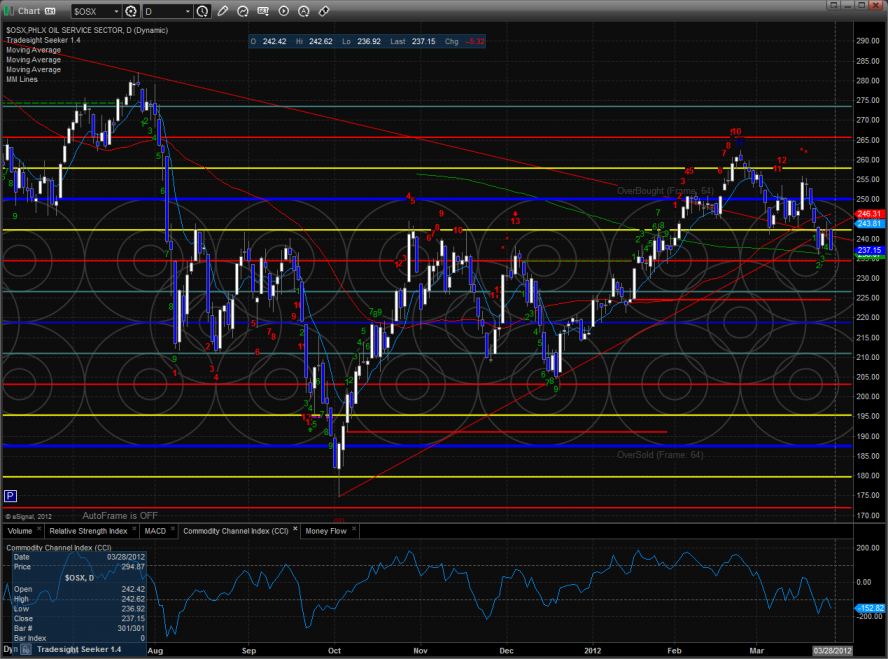

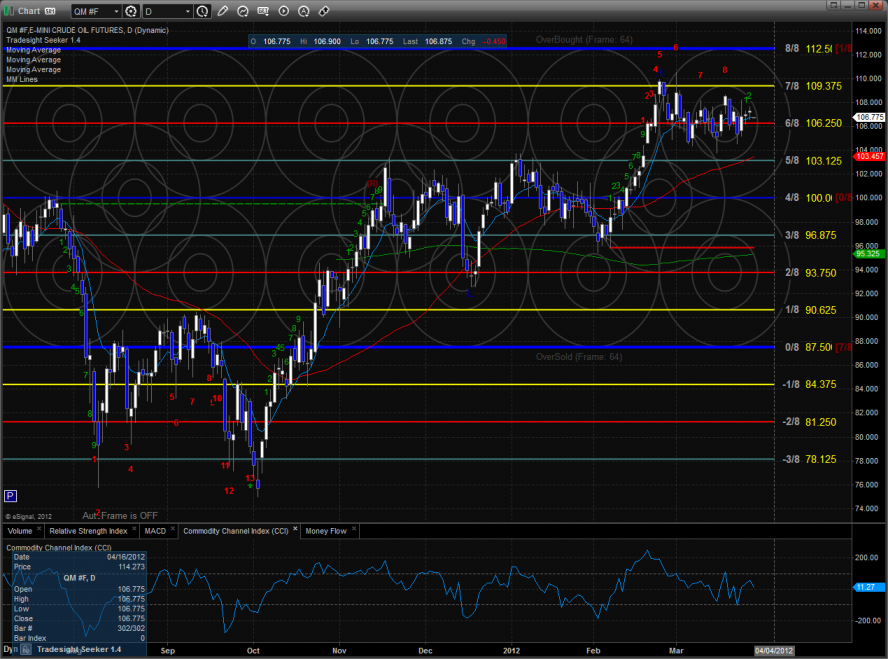

The most notable intermarket divergence continues to be the OSX which bearishly lags crude futures.

The SOX was unchanged on the day almost touching the risk level from the Seeker sell signal.

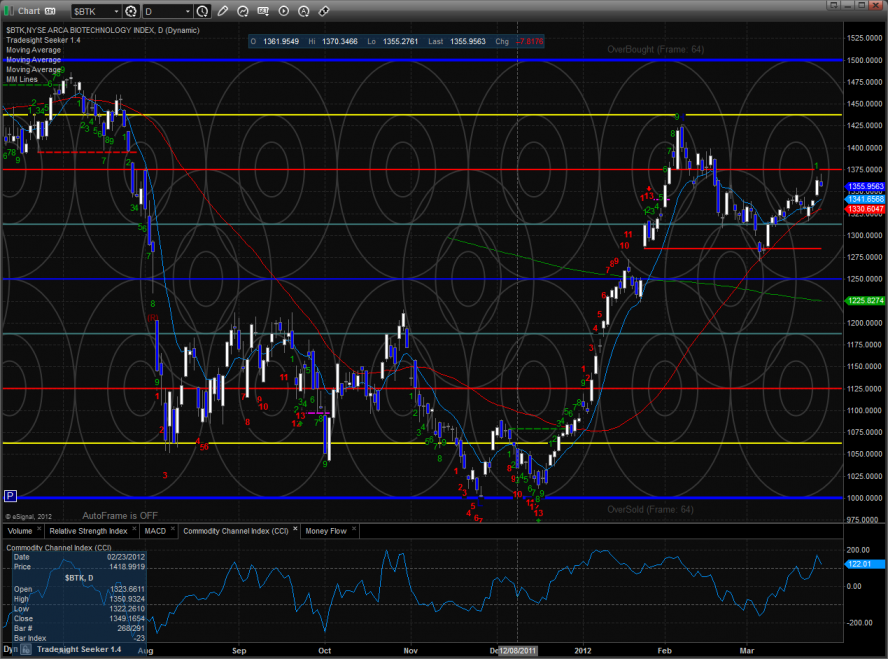

The BTK traded inside yesterday’s range.

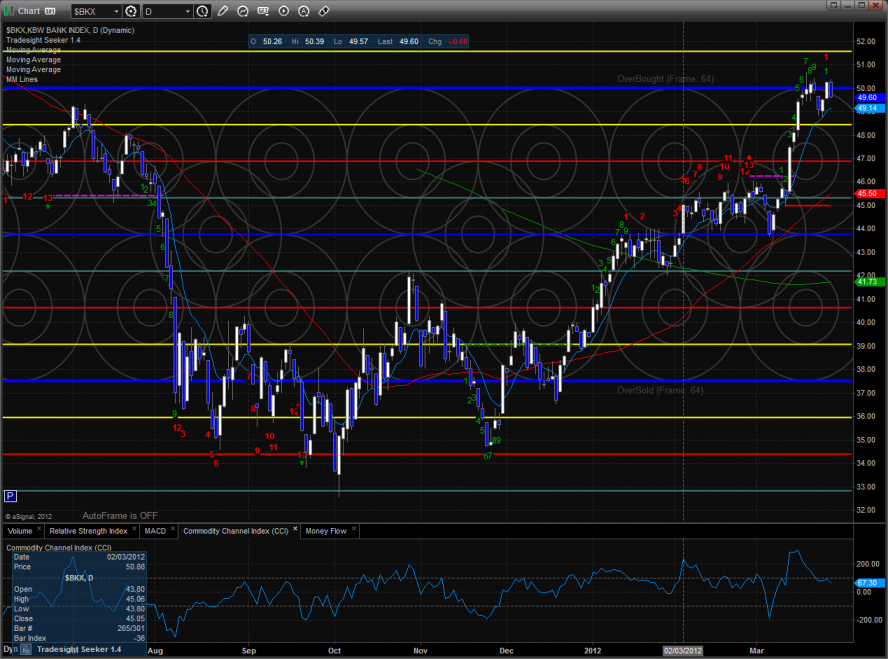

The BKX was lower on the day and weaker than the broad market. Possible signs of fatigue but be sure to allow for end of quarter nonsense in the sectors that have been attracting money.

The OSX was again the last laggard and is just above the very key support area of the 200dma.

Oil:

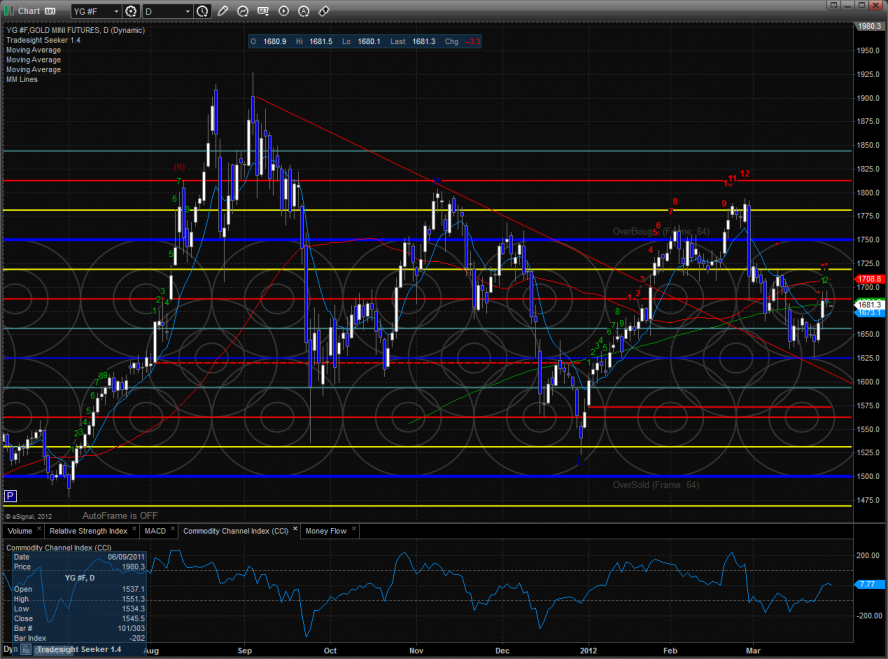

Gold:

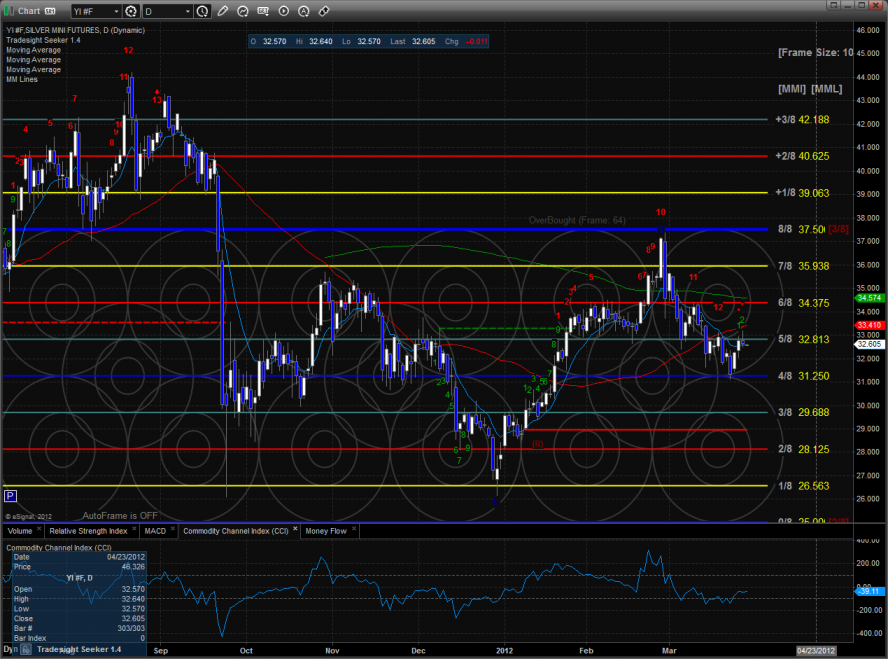

Silver: