The ES gapped higher and added onto the gains to close up 23 handles. Price is now above the 10ema which changes the short-term trend to positive. The advance today also cleared the 4/8 Murrey math level which is also bullish. Since the NYSE Trin closed around 0.50 a measuring day rather than more range expansion is likely.

The NQ futures were higher by 56 on the day. Though the levels are different the technical setup is very similar to the ES. As it should, the chart pattern found initial support at the 0/8 level. If the chart follows through either Tuesday or Wednesday then the 4/8 level that is coincident with eh 200dma will be in play.

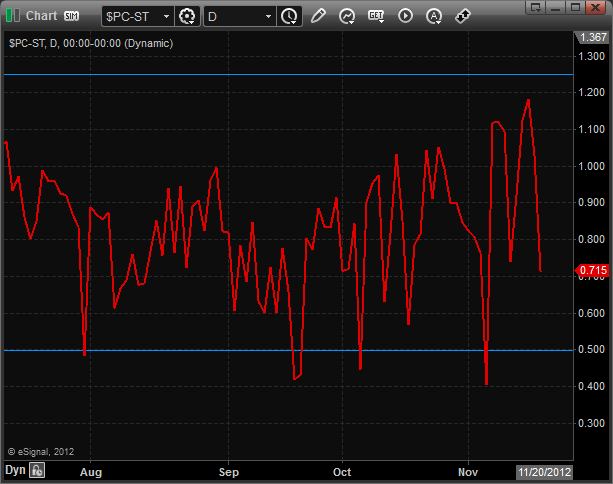

The total put/call ratio has moved back to the neutral area but is well away from overbought.

The 10-day Trin still has plenty of room before it recorded a reversal signal.

Multi sector daily chart:

On the strength of AAPL the NDX/SPX cross has blasted back into the comfort zone of the trading zone.

The BKX had a very strong session showing good relative strength vs. the overall broad market SPX. If the relative strength can persist it will be very bullish for the overall market.

The OSX was the top sector on the day, nicely closing above the 10 ema.

The US$ was weak on the day and the XAU took a healthy reflexive bounce. Price remains below all of the major moving averages.

The BKX banking index was stronger than the broad market and NAZ. Keep in mind that this has been one of the stronger sectors on the day and in the larger time frames still bullishly has the 200dma below.

The SOX traded in line with the Naz.

The BTK was the last laggard on the day and is back into the heart of the recent range.

Oil:

Gold: