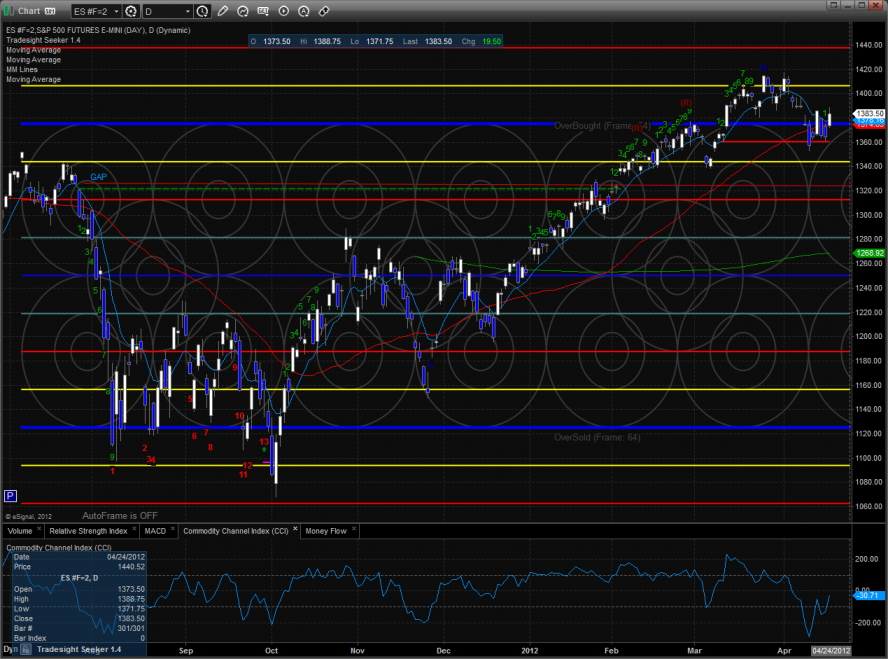

The ES was higher by 19 on the day, possibly beginning the “B” wave bounce. This is a key pivot off 9 bars down on the Seeker but does not necessarily mean that the all clear signal has been sounded.

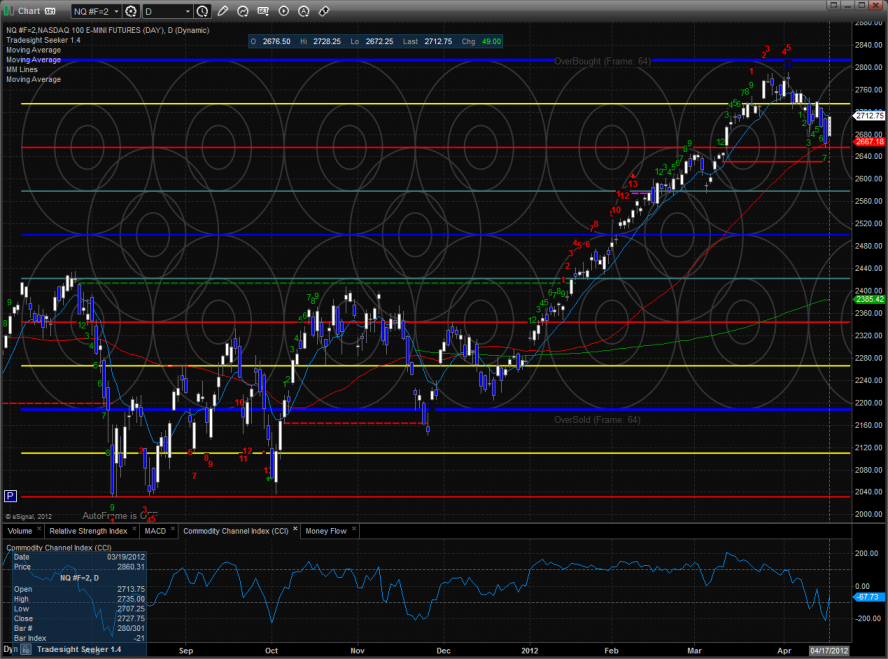

The NQ futures were higher by 49 handles settling just below the 10ema. The 50dma is still providing support.

10-day Trin:

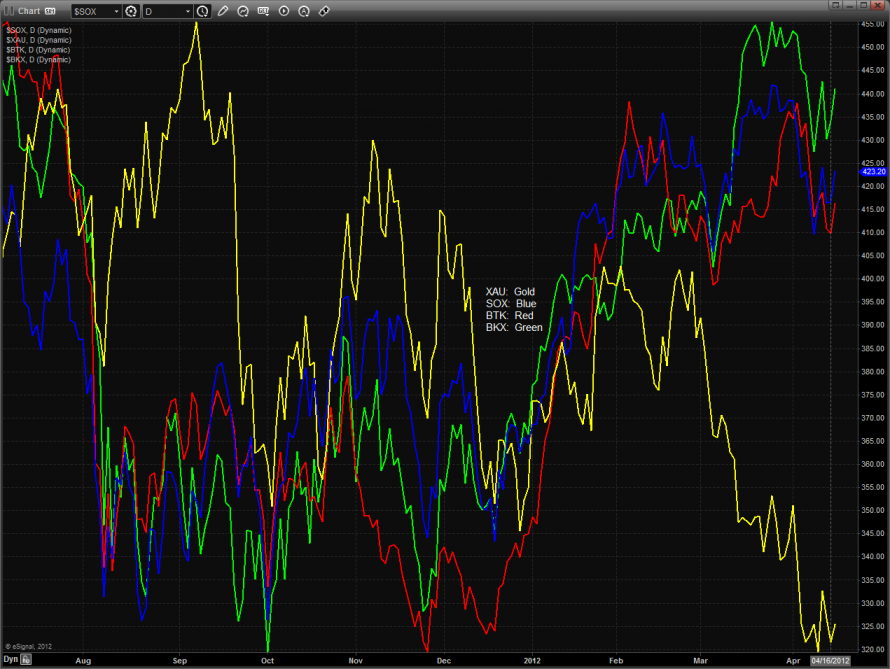

Multi sector daily chart:

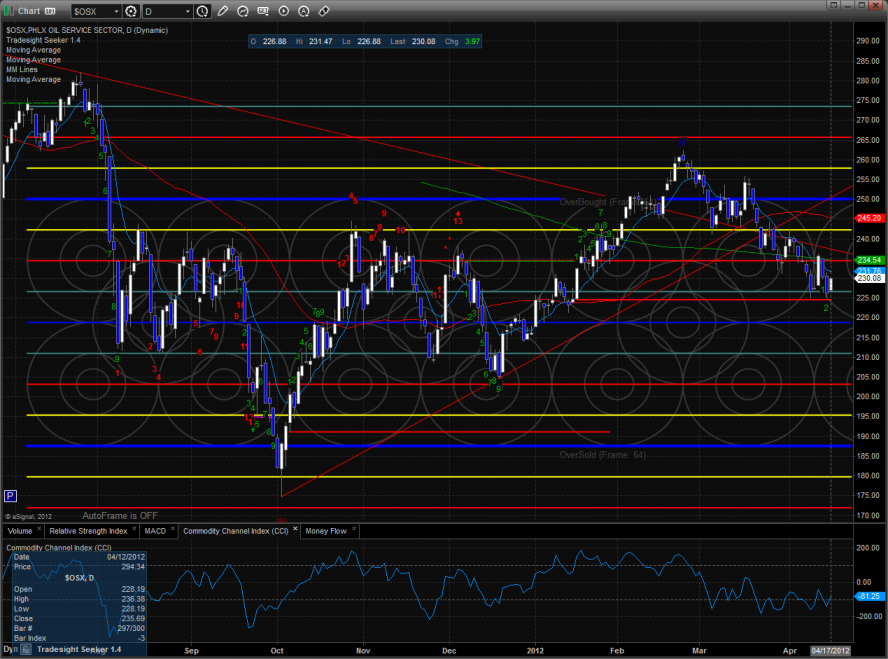

The OSX was top gun using the static trend line for support:

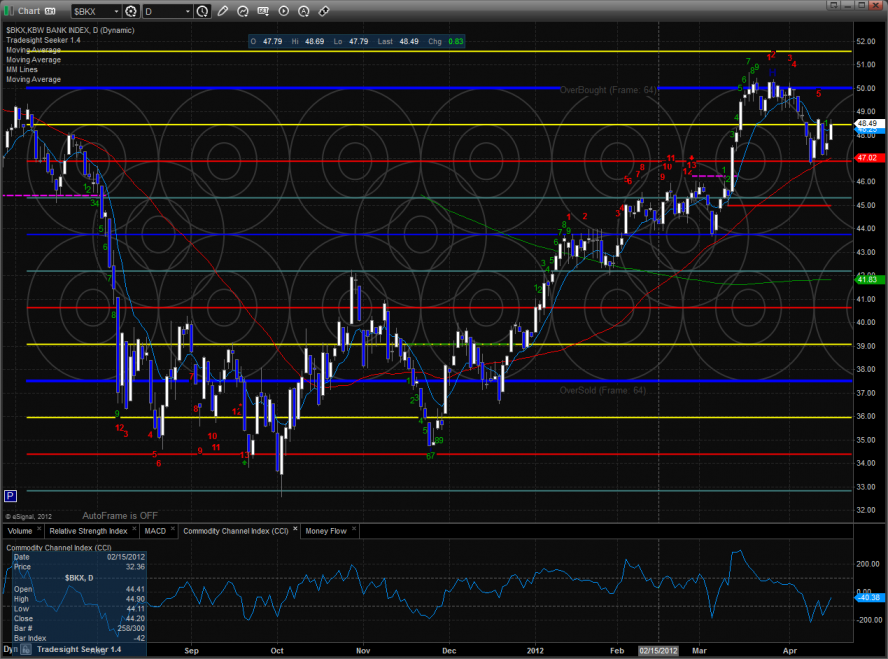

The BKX was stronger than the broad market but remains trapped in the recent range. Note how what were the weakest stocks were the strongest on the day. This is very typical of the first day up in a reflex rally.

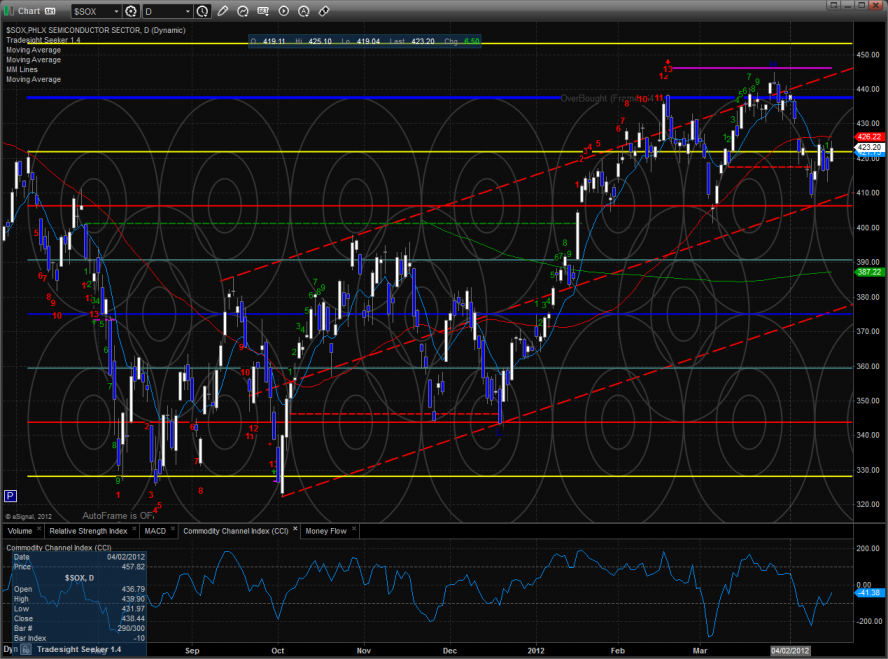

The SOX was nicely higher on the day but for the time remains below the key 50dma. Keep a close eye on the gap window overhead which will be stiff resistance.

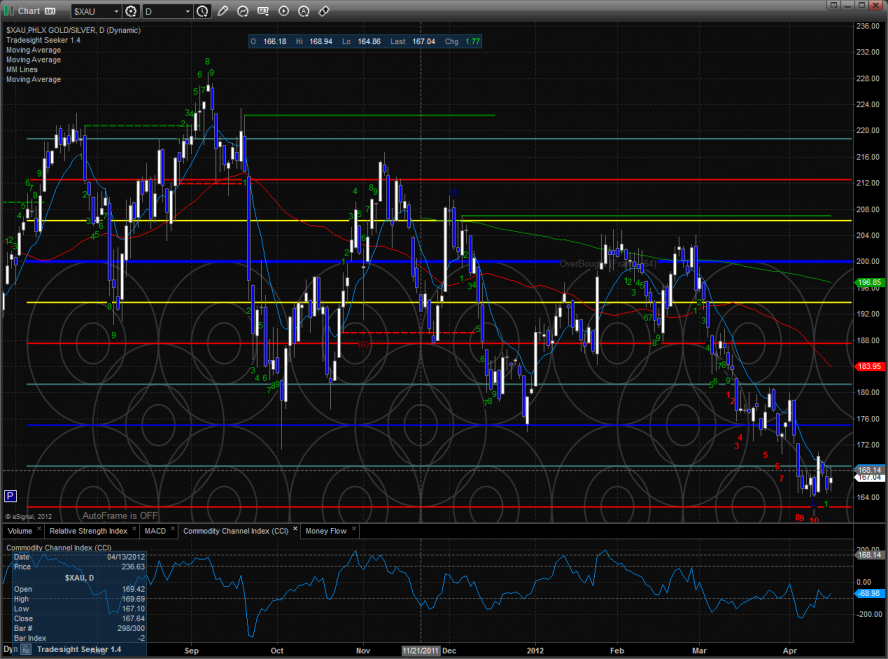

The XAU traded inside yesterday’s candle. The Seeker count is has yet to record the exhaustion signal.

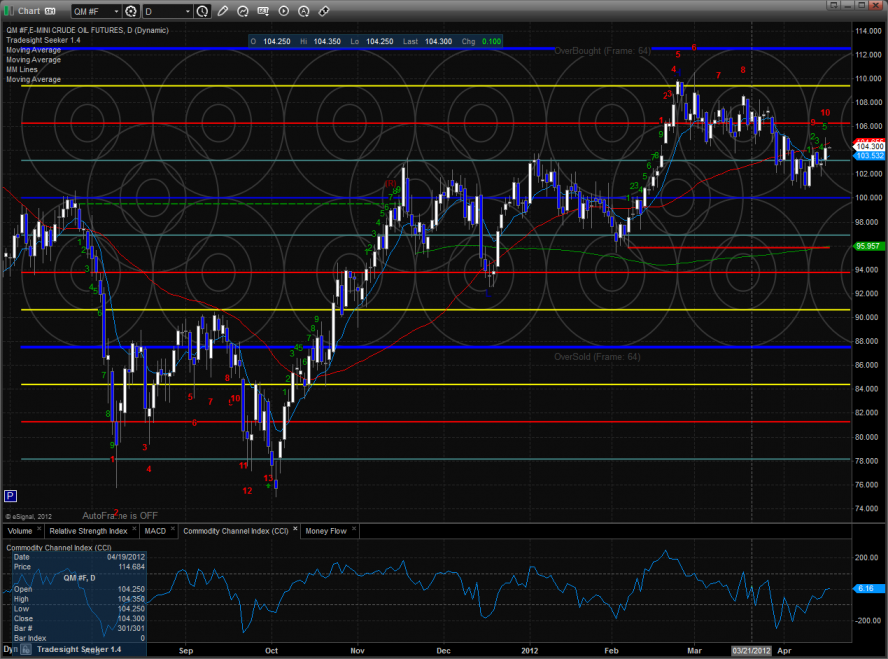

Oil:

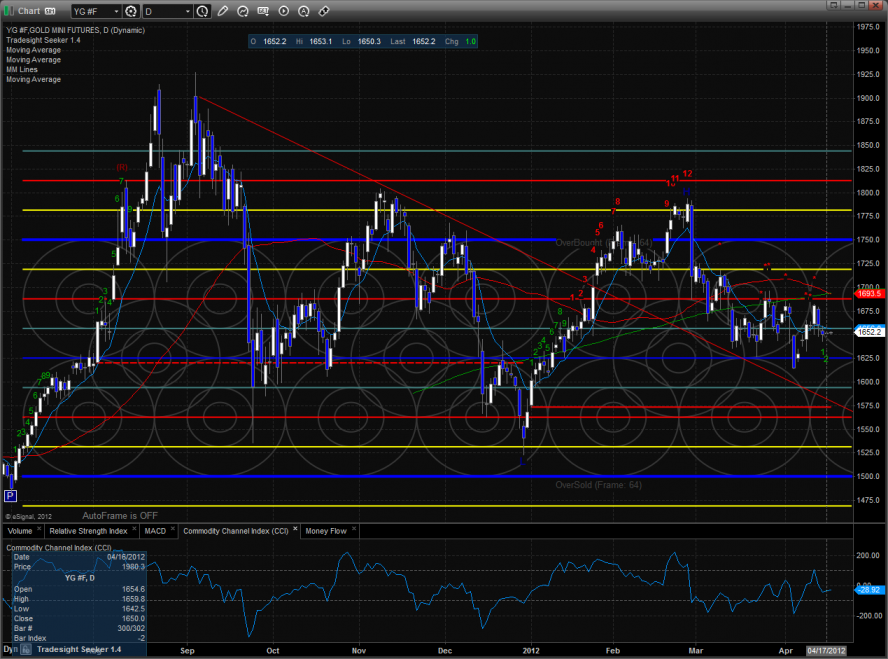

Gold:

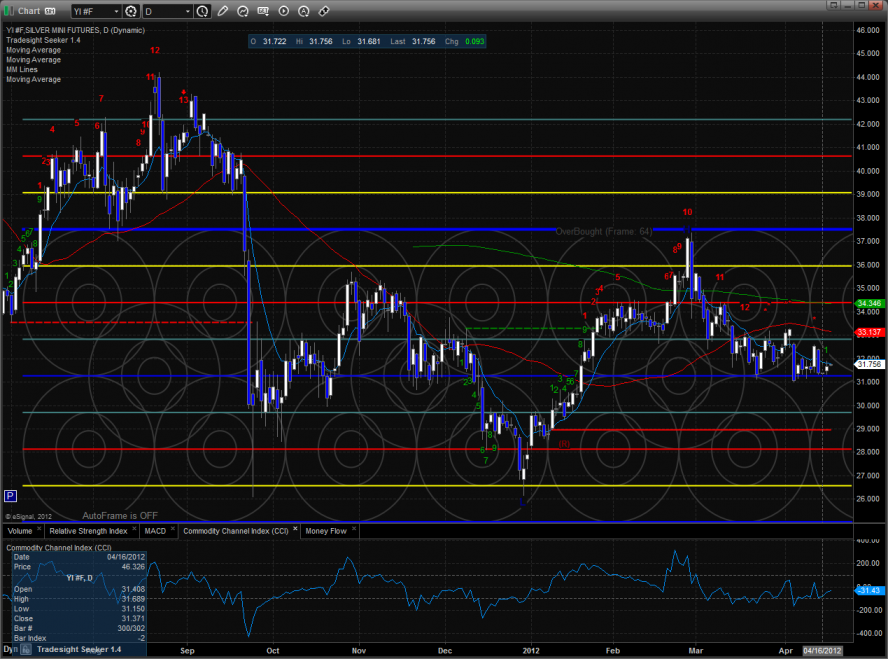

Silver: