The SP lost 11 on the day, settling below the most recent swing in April. This is the lowest level that the SP has so far traded in Q2. There is a very obvious area of important support where the 200dma aligns with the 0/8 Gann level. Note that the MACD has matched the low reading in March and that the CCI is -222 slightly above the climatic threshold of -250. The takeaway is that the market is oversold but any market can get more oversold.

Naz was lower by 13 after showing relative strength until the lunch time doldrums. Monday’s candle broke under the active static trend line and is now 2 days into a Seeker buy setup. There is a key area below where the April low is exactly the current 4/8 level.

The put/call ratio has been spiking higher and is sustaining elevated levels. This condition rarely persists and is usually reckoned by a sharp bounce.

The 10-day Trin is very oversold at 1.75. This important reading can always go further but there is plenty of gas in the tank for an oversold bounce.

The weekly cumulative advance/decline line is rolling over but not leading price which implies that when the market turns back up, the current highs will be challenged. This is very different than when the A/D line rolls over ahead of the equity indexes and then all rallies are shorts.

Multi sector daily chart:

The SOX down on the day but also the best performing sector. Price is getting close to very important support at the 405 area where there is convergence with the 200dma and 0/8 level.

The BTK remains above key support at 1440.

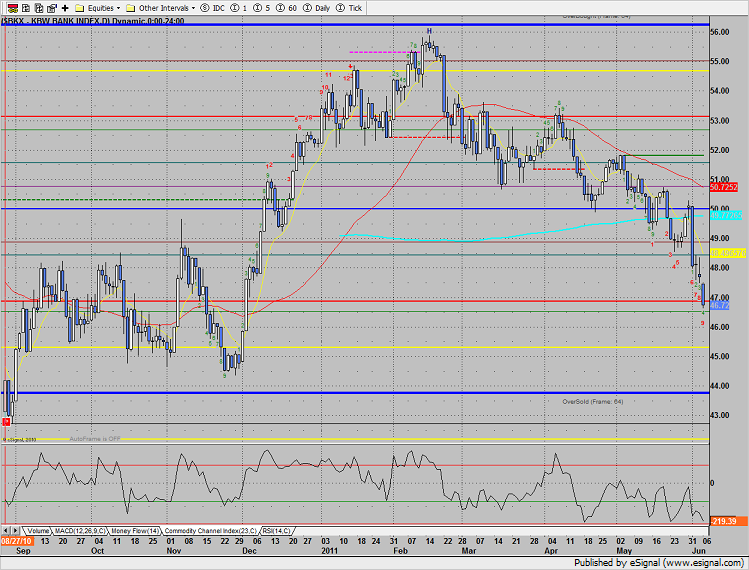

The BKX continues to hemorrhage losing twice as much as the broad market on the day. The Seeker buy countdown is now 9 candles.

The XAU was a source of funds even though gold was higher on the day. This continues to be negative for gold prices.

The OSX was the last laggard on the day which should be very concerning to the stock market bulls. At this point in the recovery, weakness in the financials is typical because rates are usually on the rise and the market discounts a less accommodative central bank. This is typically associated by the energy stocks performing very well as the economic activity begins to accelerate and demand for energy improves. More airline tickets sold, families driving far away from home to a “non-staycation” destination. The OSX has retreated to the low of the recent range which means that is at support. Is this alarming? No, the broad market is making lower lows but energy stocks are not. If this support level at 256 is violated on a closing basis, look out below. And, if the market takes a turn for the better, this is a sector that is worth overweighting.