The ES reversed lower losing 12 on the day. Key support is the March highs which coincides with the 10ema. Note that he CCI is in a very short-term overbought condition.

The NQ futures lost 39 on the day and like the ES posted a very negative day but did not register a key reversal. Volume was lower than the previous day and a new high was not traded. The 10ema is key support.

The 10-day Trin is still neutral.

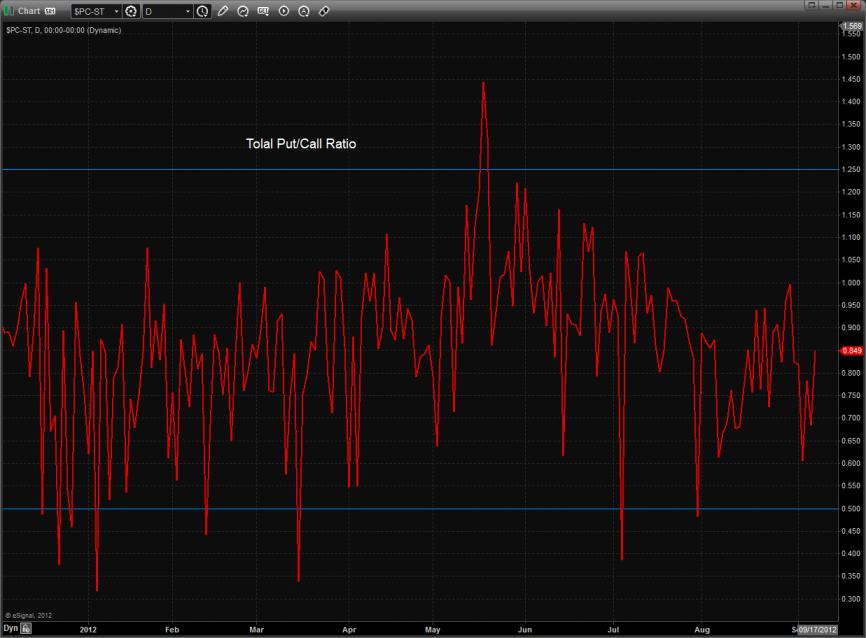

Nothing new in the total put/call ratio which is neither over bought nor oversold.

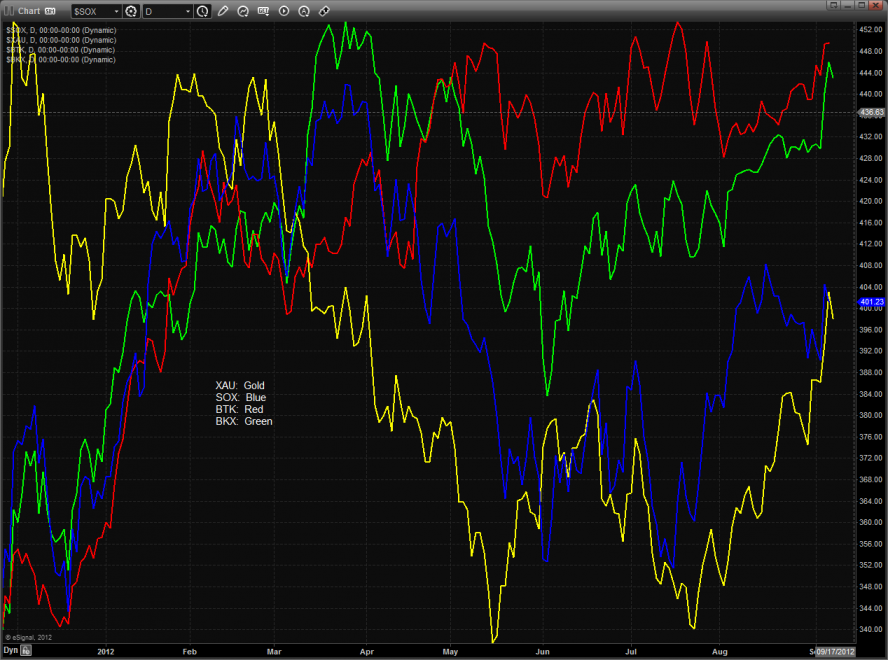

Multi sector daily chart:

The double tops in the SPX ns NDX have been broken and need to follow through to qualify.

While the double tops have been broken the SPX/TLT still needs to record a new high to confirm the strength in equities over the perceived safety of bonds.

The BTK was the strongest major sector on the day. A new high has yet to be recorded and the pattern is in no meaningful way overbought.

The OSX posted an inside day:

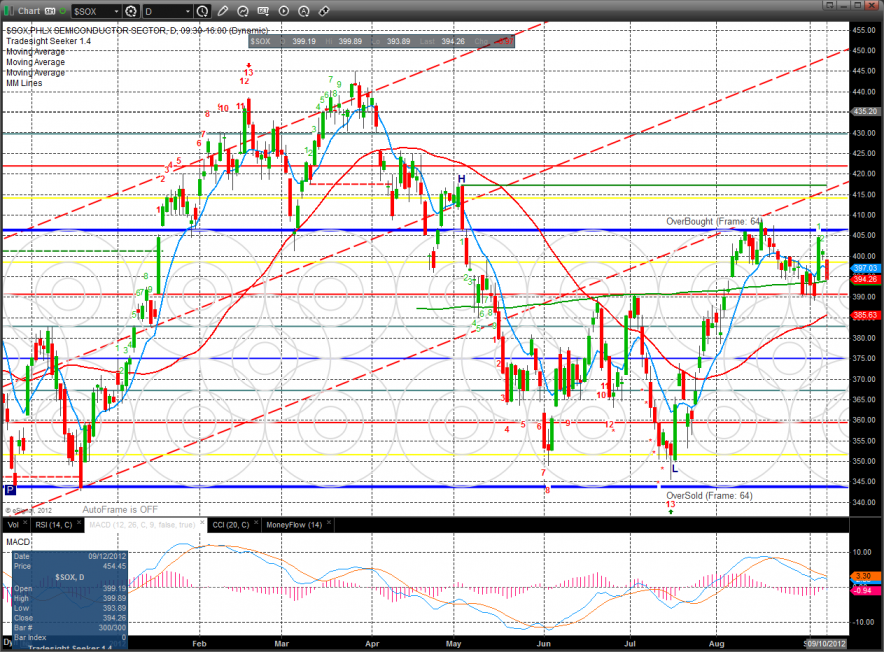

The SOX was the last laggard on the day by a wide margin, settling at the 50dma. Note that price has now settled below the 10ema.

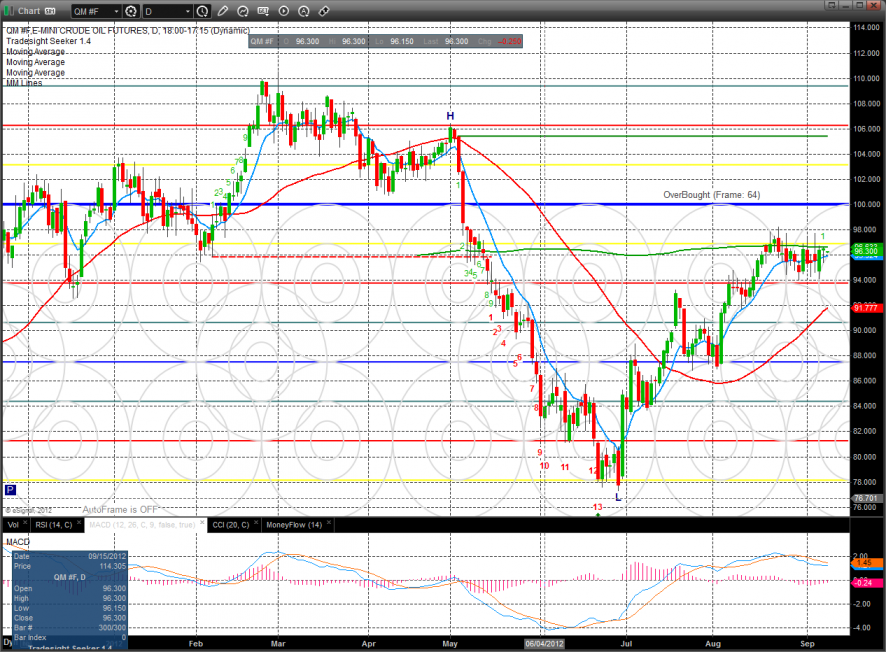

Oil:

Gold:

Silver: