The ES was lower by 10 on the day settling right near key support at the September low. Also note that the 50dma is just below and is the nest area of key support or breakdown.

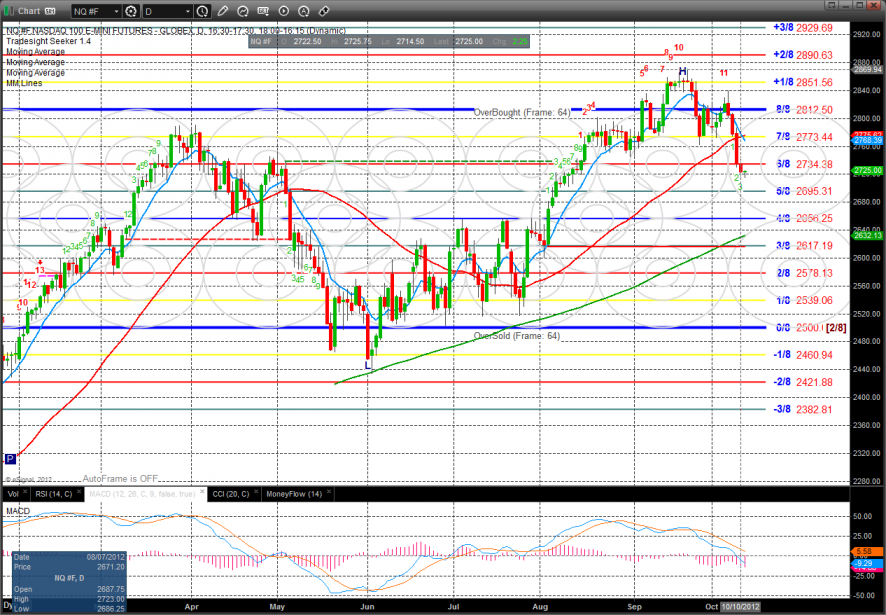

The NQ futures remain much weaker than the broad market tracking SP. Price is below the September lows and 50dma. Next support is the 5/8 Murrey math level. Technically the MACD is negative since is has crossed below the zero line.

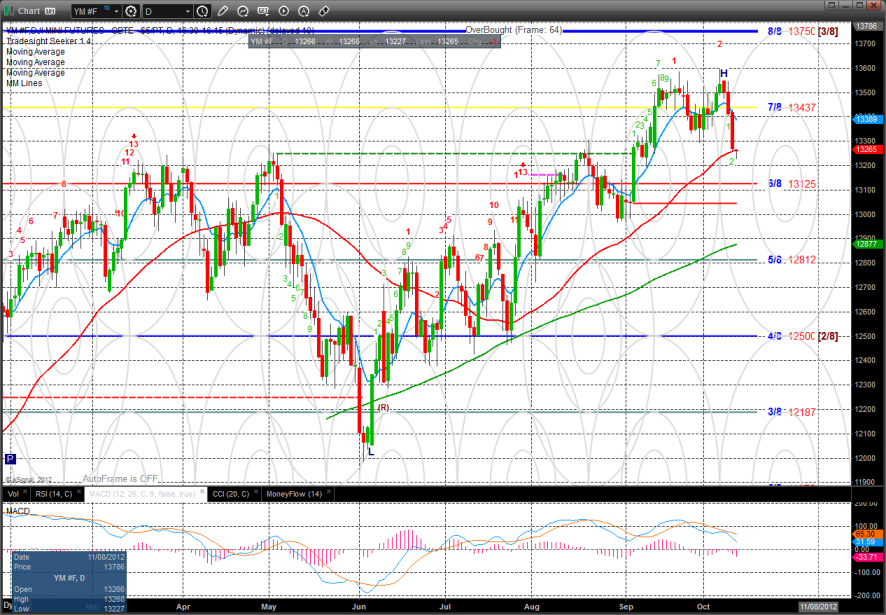

The YM futures are at a key level, closing right at the 50dma. The overall equity market is a 3 legged stool consisting of the SP, NQ and YM futures. If two of the stool’s legs close below the 50dma, than the overall pattern can be considered intermediate-term negative which makes the next few candles in the YM very important.

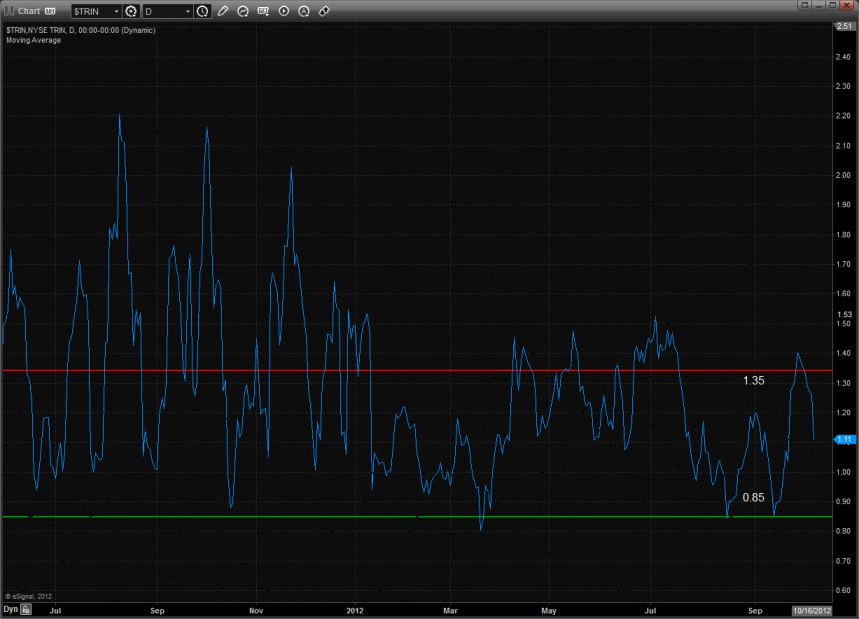

10-day Trin:

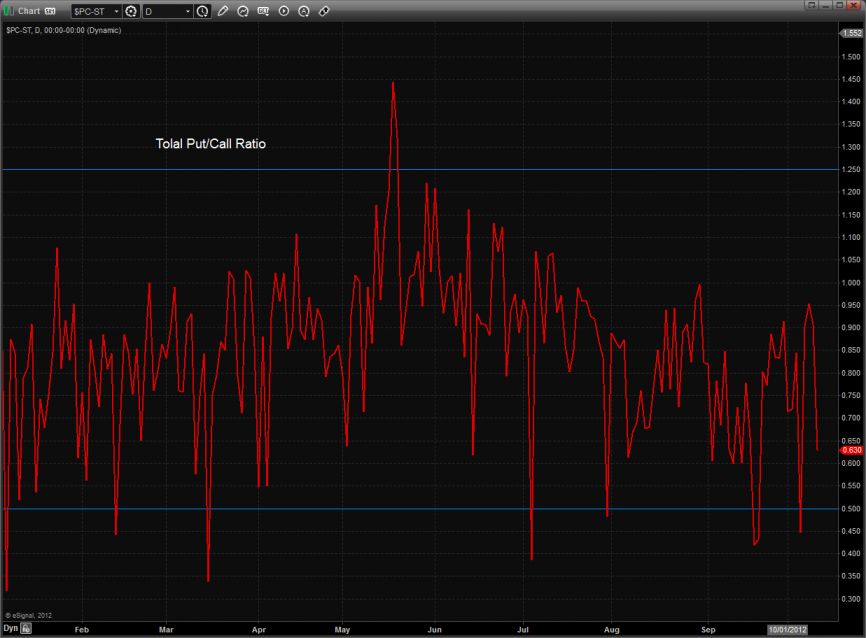

Total put/call ratio:

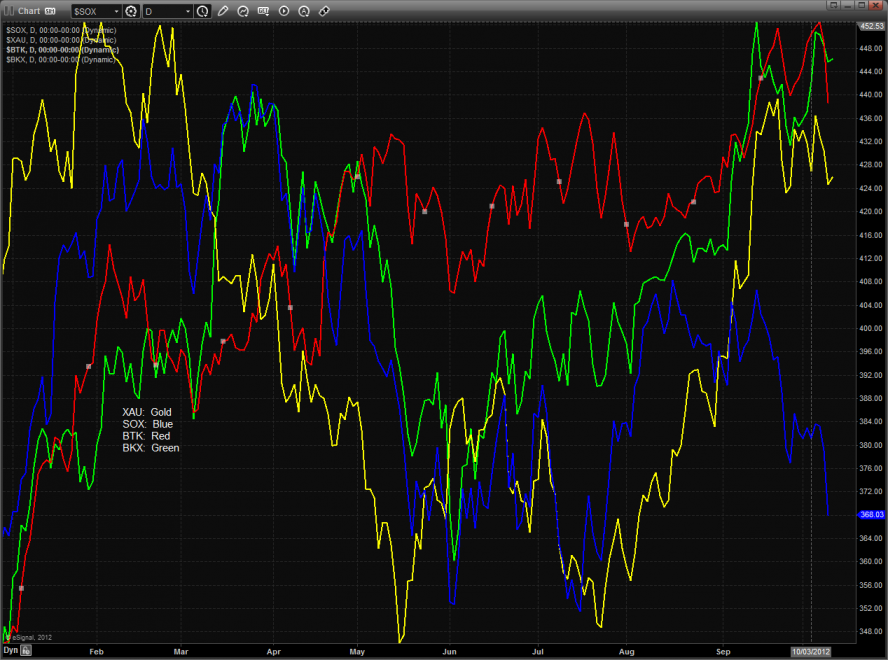

Multi sector daily chart:

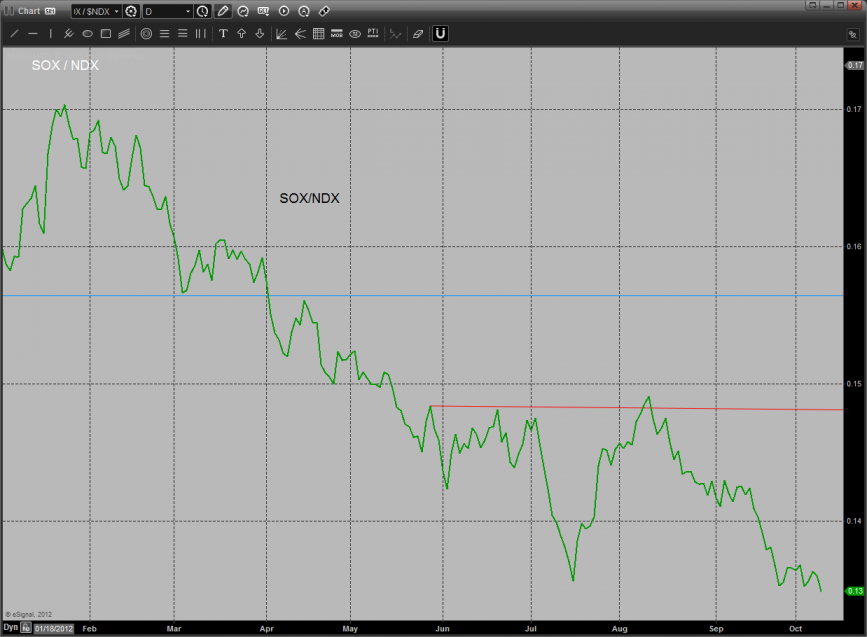

The SOX/NDX cross is leaking to new lows which indicates relative weakness in the SOX.

The NDX/SPX cross chart has declined to an area of key support. A break below the summer lows would be very bearish for the overall market.

The defensive XAU was the top gun on the day

The BKX outperformed the NAZ and is still above the short-term trend defining 10ema.

The SOX broke to a new decisive low. The pattern is now below the 4/8 level and will have layered support at the next Murrey math level.

The OSX remains boxed up and could really get ugly if it loses the support in the 217 area. If this happens than the seeker countdown will become very important.

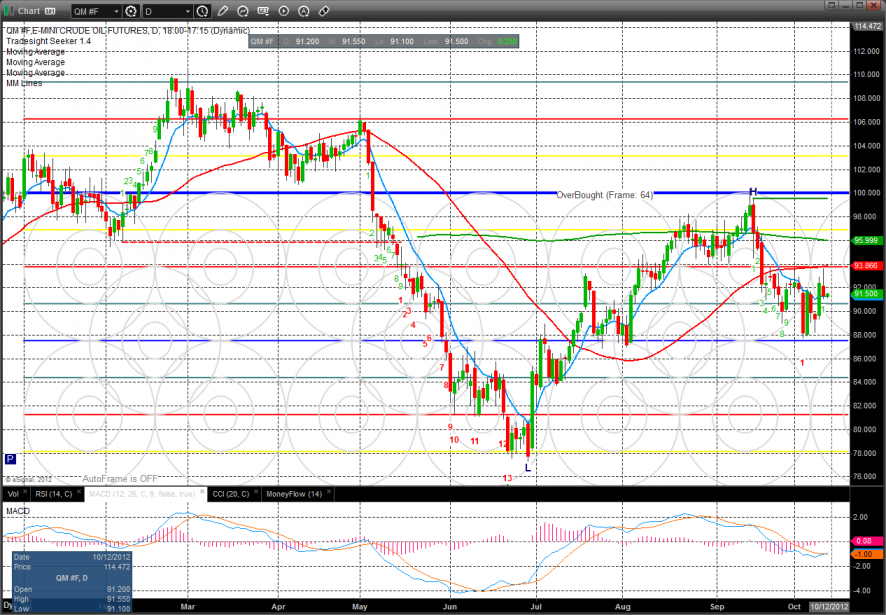

Oil:

Gold:

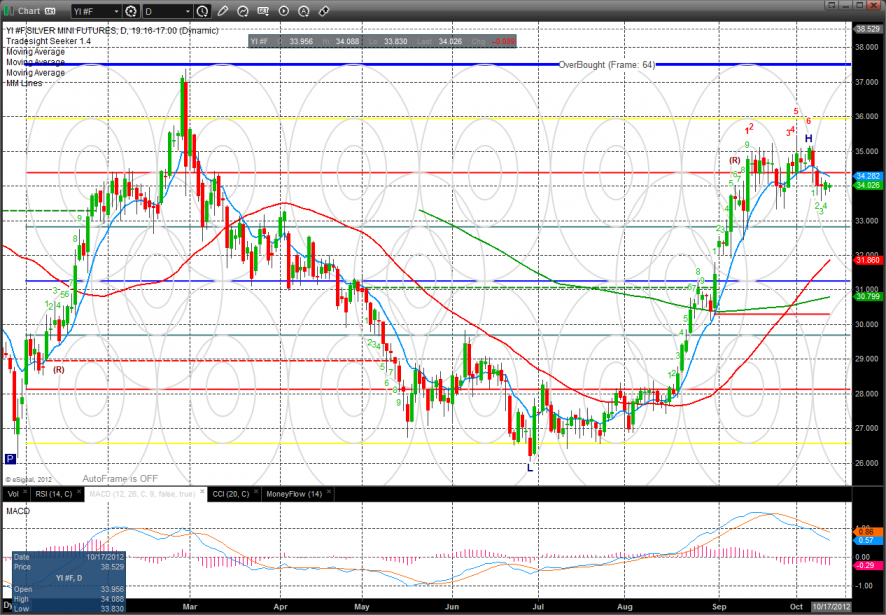

Silver: