The ES sprinted higher by 14 handles leaving an open gap. The 10ema has been reclaimed by the bulls and the chart is now above all the major moving averages.

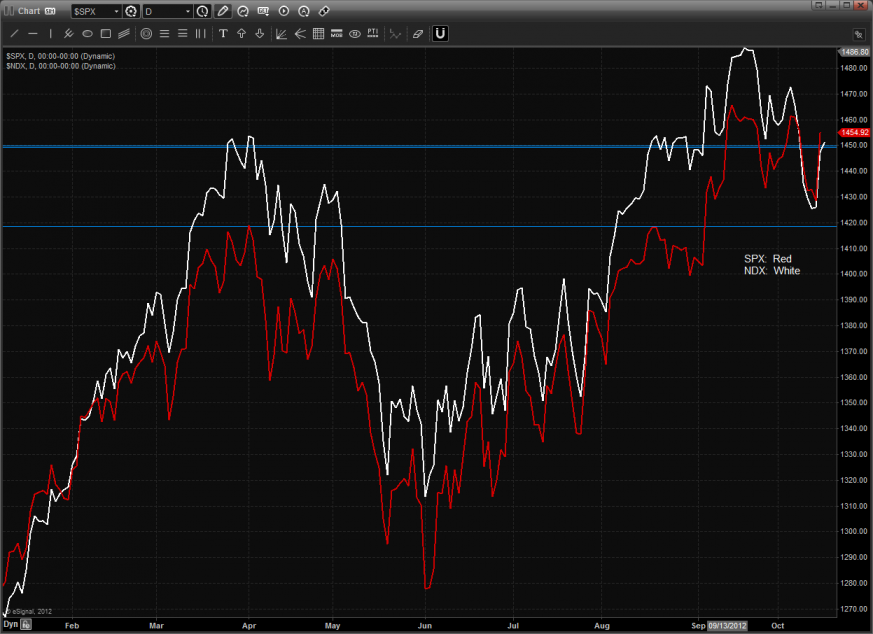

The NQ futures were higher by 34 on the day and finally shook off, at least for a day, the persistent relative weakness. If the up move continues, the 50dma and 8/8 levels overhead are all big.

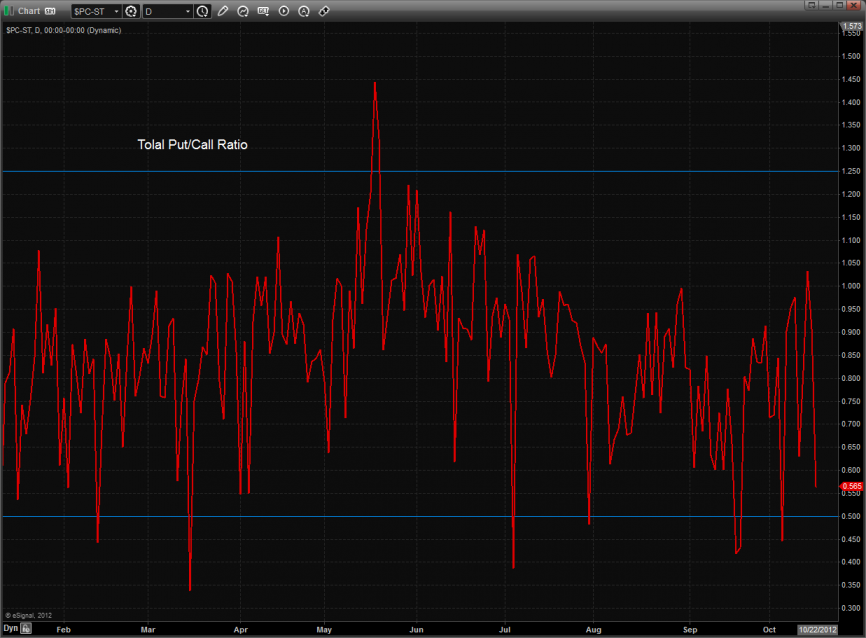

The total put/call ratio is moving towards but not yet at a climatic reading.

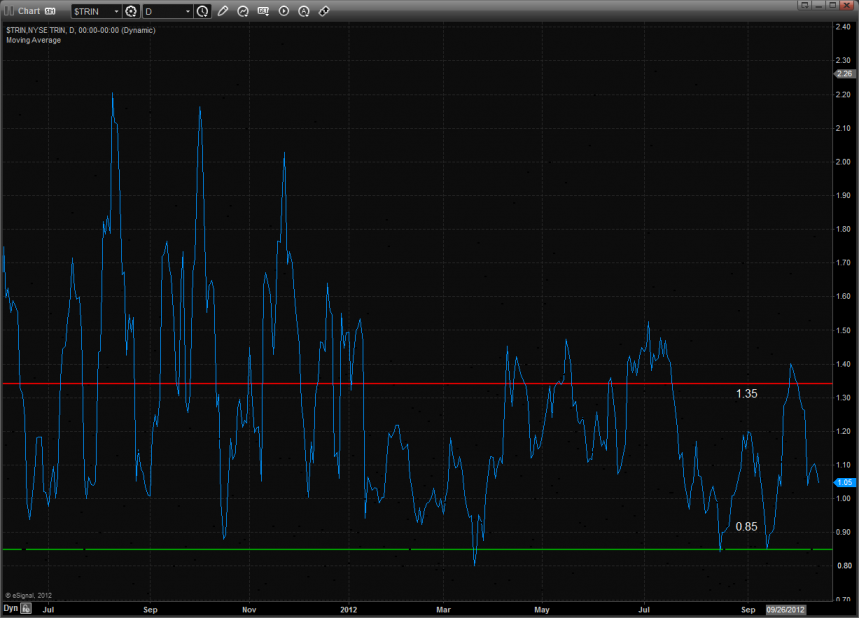

The 10-day Trin is neutral:

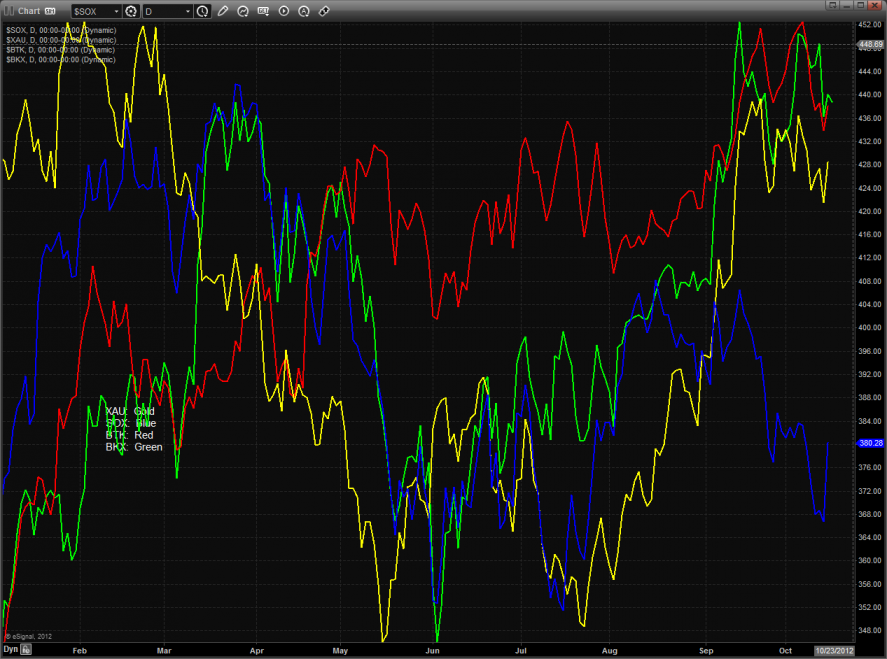

Multi sector daily chart:

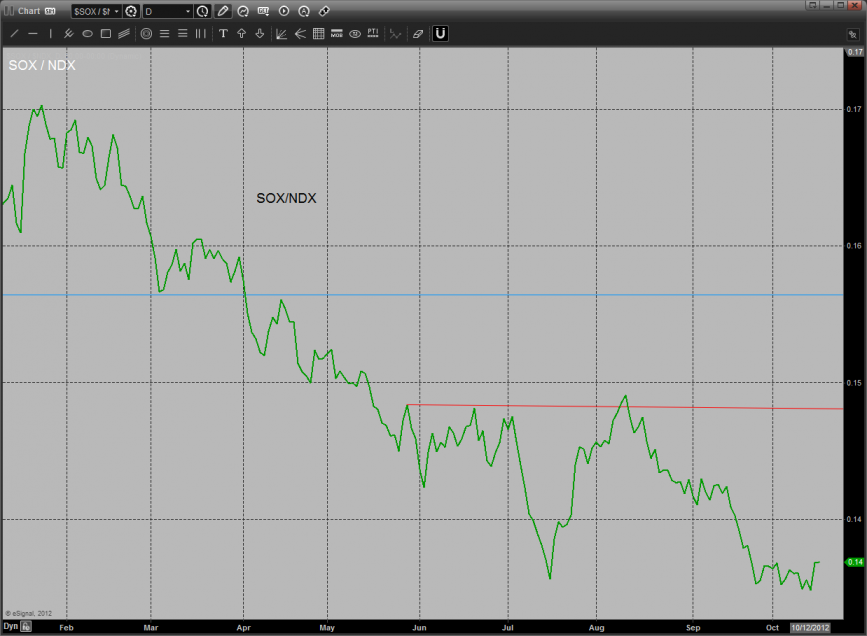

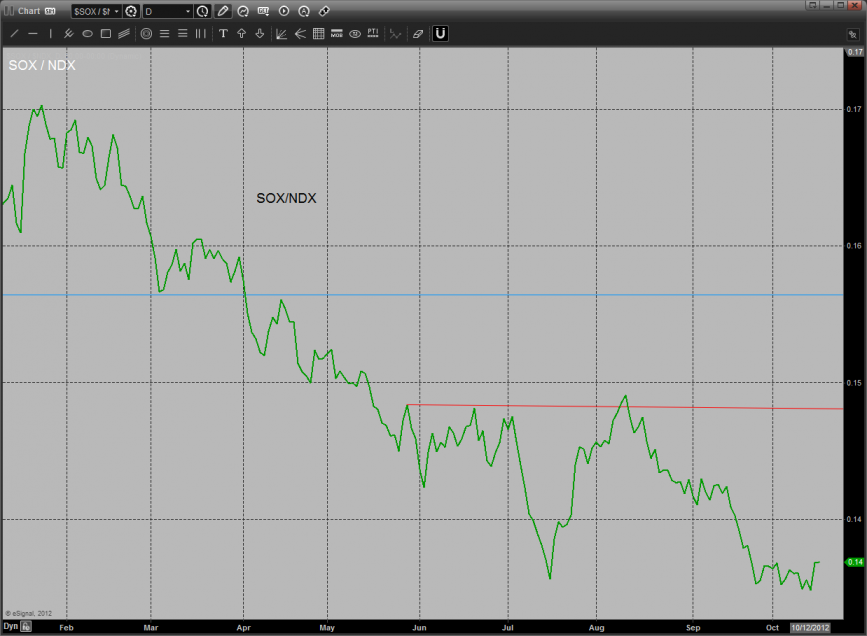

The SOX finally showed some relative strength and has yet to break.

The NDX/SPX cross is still holding onto key support.

Note in the SPX/NDX comparison chart that the NDX is back at the key breakout level. This could provide resistance in the next couple of sessions and is the first area that qualifies as a retest of the current high.

The SOX was the top gun on the day and closed above the 10ema for the first time in weeks.

The defensive XAU was suspiciously strong. Yes this index is seasonally strong now but the underperformance in the banks is not what the bulls were hoping for.

The OSX is trying to pivot but will need another day to prove itself.

The BTK posted an indecisive inside day.

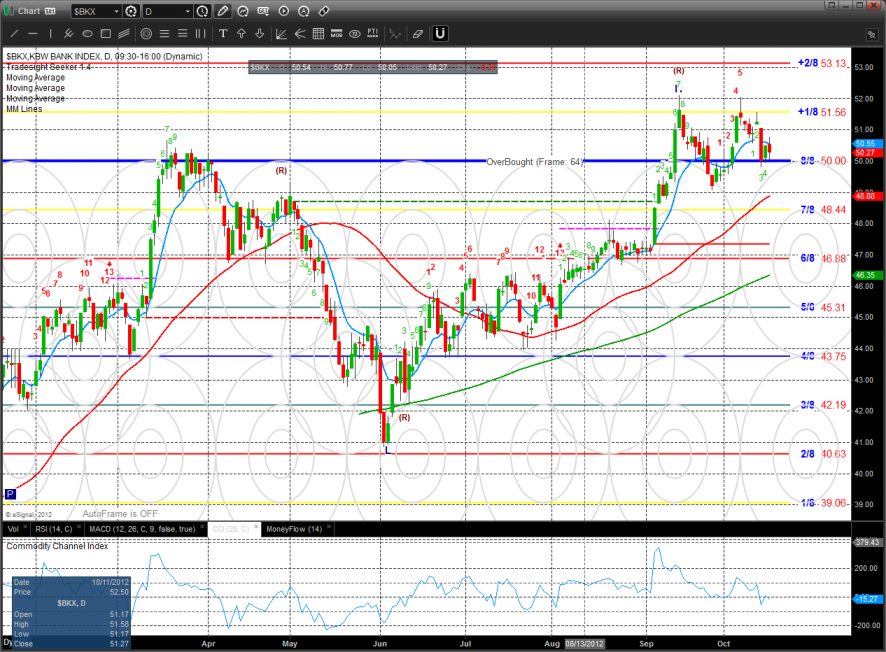

The BKX was the last laggard by a wide margin and was the only major sector down on the day. Key support remains at the 8/8 level.

Oil:

Gold:

Silver: