The SP made a new high and new high close on the move adding 10 handles. The 13 exhaustion signal is still active until price exceeds the risk level (magenta). Expect a gap tomorrow morning after the ADP number is released premarket.

Naz advance 21 making a new high on the move. The Seeker is 8 days up in a new setup which means that if the pattern prints the 9th candle the chart will have a 9-13-9 in place. The typical setup for a reversal is just the 1-9 setup phase, followed by the 1-13 countdown phase. After the completion of the two phases price will usually reverse. However, sometimes in a very bullish move, just the two phases are not enough to reverse a very strong trend. This is when the first two phases need reinforcement from a third phase. A third, reinforcing phase is about to complete and will do so as soon as the 9th green bar prints and completes the third phase of the run.

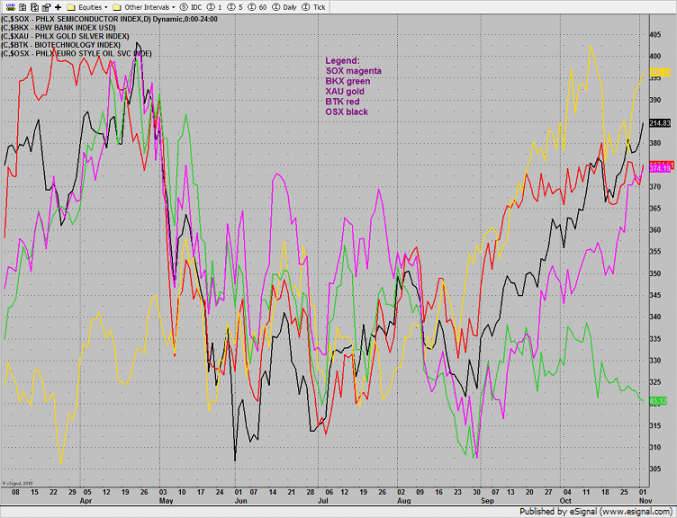

Multi sector daily chart:

Just for perspective, take a look at the very long term monthly chart of the Dow. The Dow has major, major resistance at the 11,500 area. At all three points on the chart, A, B and C this area is stiff resistance and is also the real breakout. A new secular bull market will be in the delivery room above 11,500 and born when a new high above 14.192 is recorded.

The OSX was top gun on the day, plowing new high ground. The next level that will come into play is the 2009 high just overhead.

Nothing much to take away from the action in the BTK, the pattern is still range bound.

The Dow Jones transport index is right at the prior high. The Dow Theory crowd will be monitoring this closely.

The SOX posted a small gain on the day. Set an alarm for a break over the Q2 highs 377.50 (arrows). Since price is coming into a static trend line and is also 8 days up, this is a very likely area for some corrective activity.

The XAU is now 10 days up in the exhaustion countdown.

The BKX was last laggard and remains a source of funds. Keep in mind that when the dollar sees some strength again they will come for the bank stocks.

Oil closed near the high of the recent range and also recorded a new high close for the move.

Gold continues to grind in the area of the retest of the prior high. The 13 exhaustion signal remains on deck.