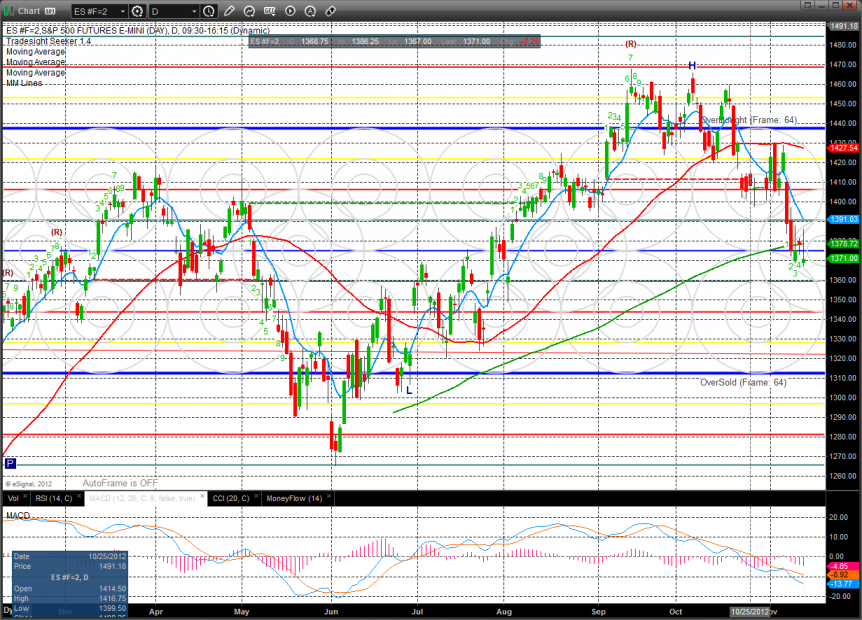

The ES lost 7 on the day which made a new low on the move and matched the low close. Average prices are lower over the course of the expiring option cycle so traders shouldn’t be surprised by the lack of bids. Wednesday is the key day this week ahead of Friday’s expiration and be sure to be ready for a move after 60mins into the day and respect the direction of the move.

The NQ’s were weaker then the broad market futures and decisively made a new low on the move. Keep in mind that both the SP and NQ’s settled above the open which puts in place a camouflage buy condition.

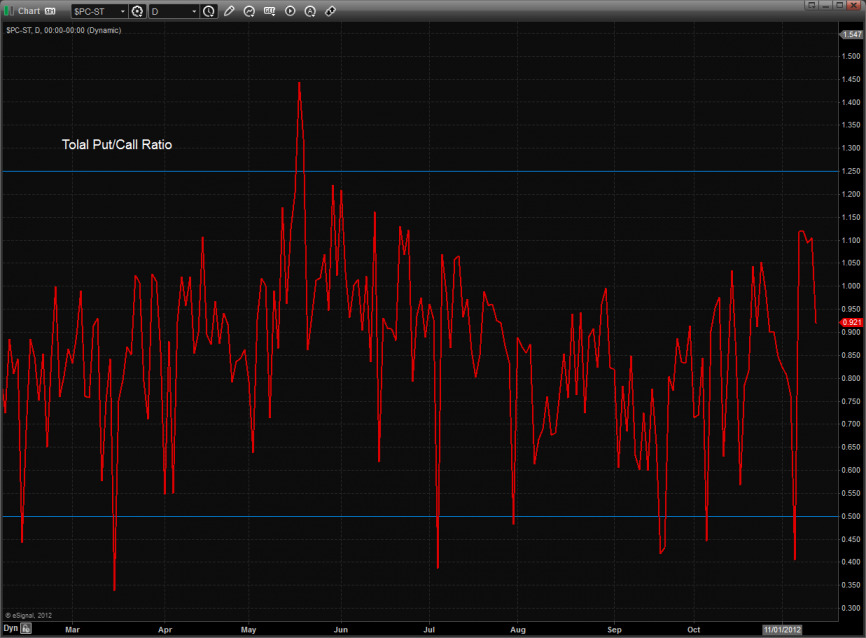

Total put/call ratio:

10-day Trin:

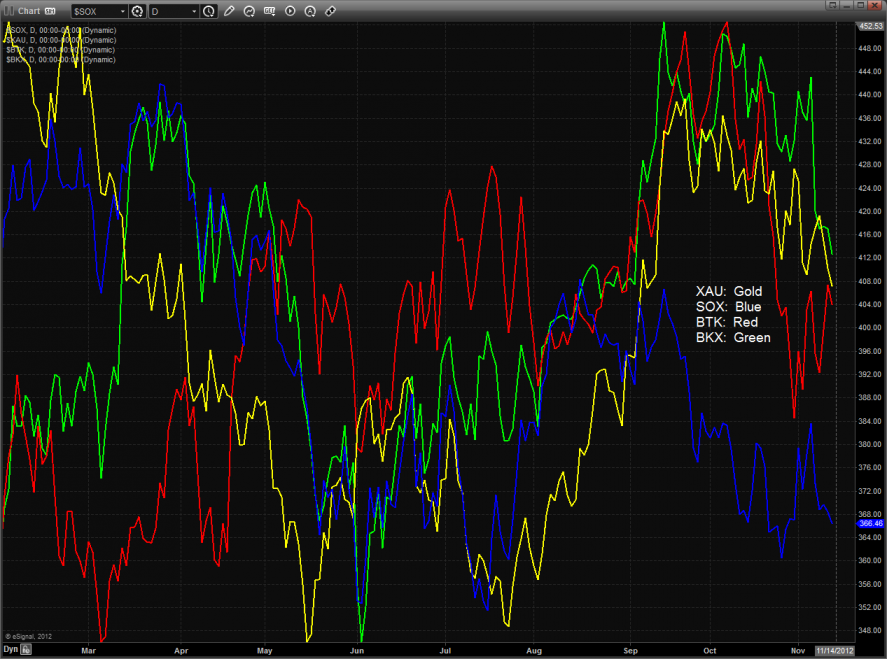

Multi sector daily chart:

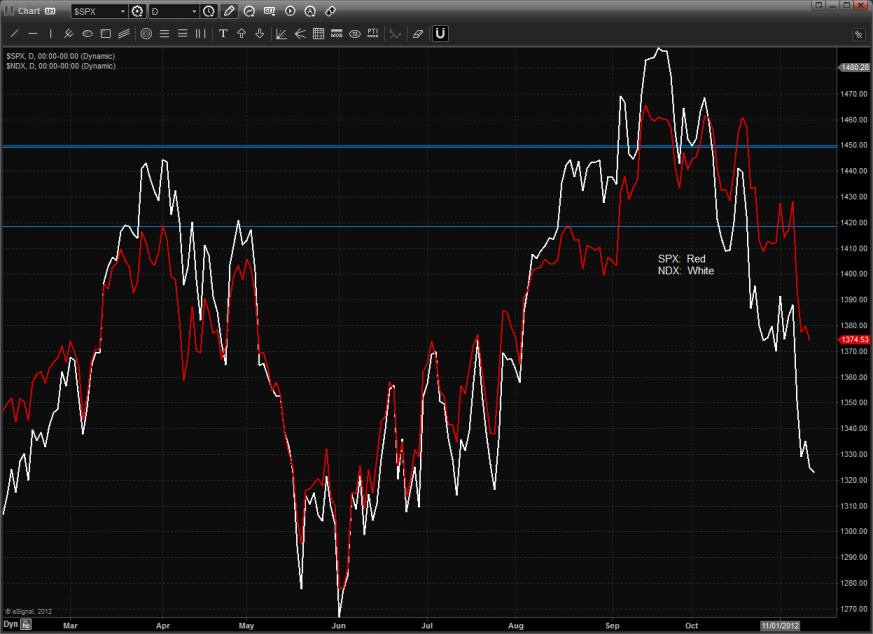

SPX vs. NDX daily comparison chart:

The relative performance chart still shows bearish action from the NDX side.

The BTK was the top performer on the day after recording a flat session.

The OSX posted and inside day with a small gain. Price remains bearishly below all of the major moving averages.

The SOX was weaker than the broad market. Keep a close eye on the MACD for a positive cross above the zero line which would be a game changer for the chart.

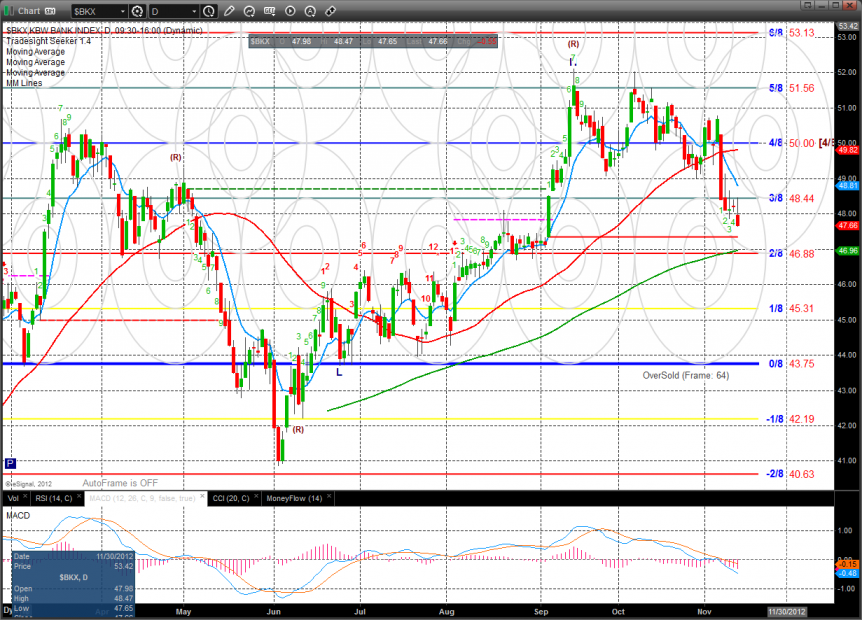

The BKX made a new low on the move. Key support is just below at the static trend line and 200dma. Option expiration could take price down to either level.

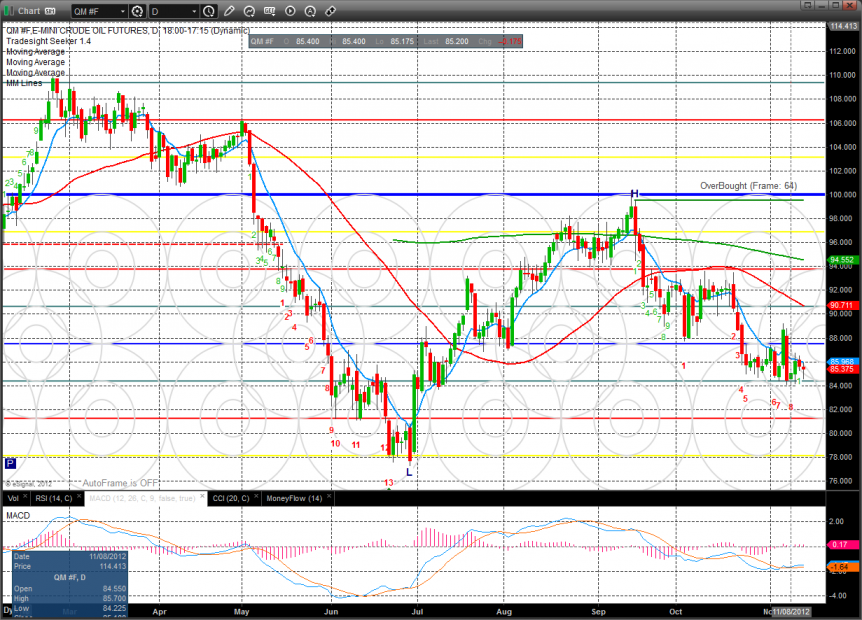

Oil:

Gold:

Silver: