The ES lost 23 on the day decisively breaking last week’s range and losing the 50dma in the process. Fibs have been added to the chart from the swing low to high of the recent move. A loss of the 50% level would be very bearish and put the October low in play. One small positive is that the MACD is still above the zero line.

The NQ futures used the 3/8 Gann level as support but surrendered the 4/8 Gann level. The breakdown was confirmed on Friday and Today’s price action was genuine follow through. The MACD has bearishly penetrated the zero level. Next support is the active static trend line around 2162 (red line).

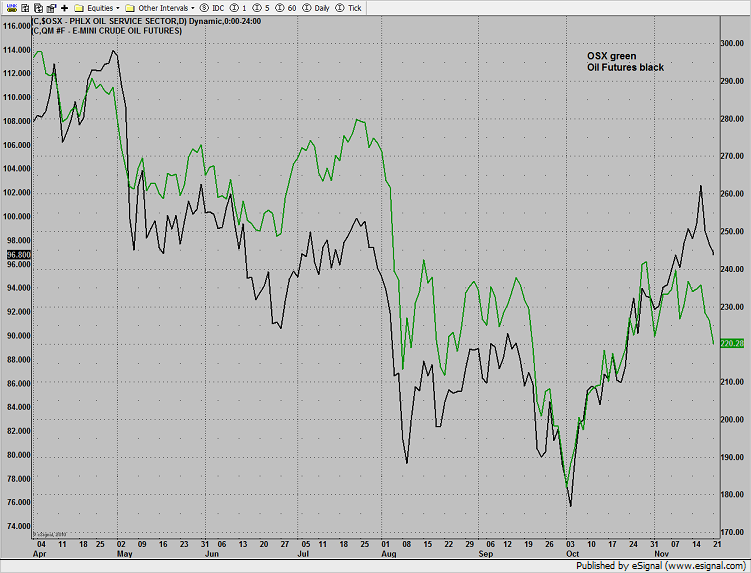

Multi sector daily chart:

The 10-day Trin is getting very oversold. The most recent reading has it at 1.92. This tells us that the market is very short-term oversold and could see a meaningful turn..

The NDX has quickly lost a great deal of its relative strength and the near-term performance of index overweighed AAPL should be watched closely.

The OSX continues to bearishly underperform the crude futures.

There is still a divergence in the XAU/gold cross where the XAU is bearishly underperforming the underlying commodity.

The BTK broke to a new low on the move. Keep a close eye on the Gann 0/8 level at 1k.

The XAU bounced off the active static trend line. This Seeker setup is only 4 days down with the potential for a velocity break of the STL.

The SOX broke back below the 50dma and should find minor support at the 360 level where the trend channel resides.

The OSX has broken the triangle pattern and has minor support at the 50dma. Key support is at the 210 area which is the where the reverse H&S patter traces out.

The BKX was the last laggard on the day losing a full 3%. As long as this sector remains weak the broad market is anchored.

Gold was very weak and a source of funds for the margin sellers. Price settled below the 62% fib and has next support at the 50% level.

Oil also got whacked. The key near-term level is the 200dma and then the active static trend line. Note that the MACD has just rolled over.