The ES was lower on the after posting an inside day. The light volume advance on the shortened Friday session likely kept trader’s european wallets in their pockets to measure off the half session. The resolution of the inside day should have some punch, especially it is to the upside and keeps short from the initial breakaway gap trapped. The next important level is the 50dma overhead.

The NQ’s had relative strength vs. the broad market all session on the strength of mega-member AAPL. The Naz was higher by 12 on the day, which unlike the SP side, was range expansion rather than a measuring day. There is a big level overhead where the 4/8 Gann line meets the 200dma.

Keep a close eye on the 10-day Trin which is quickly approaching an overbought reading.

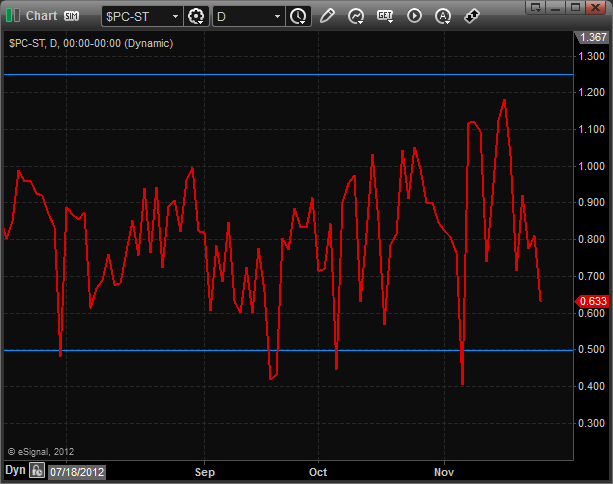

The total put/call ratio is still neutral:

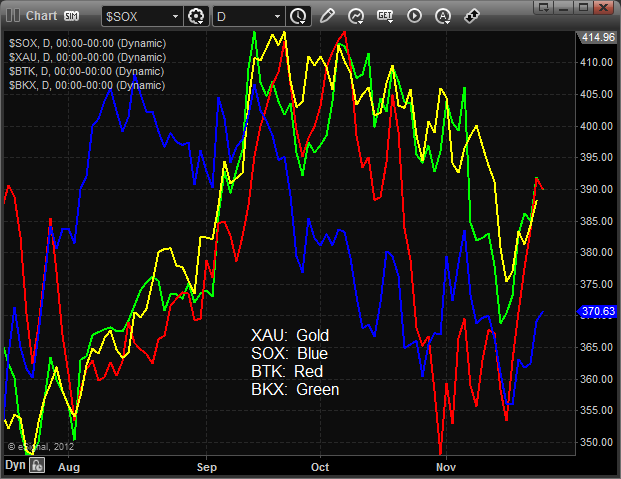

Multi sector daily chart:

The NDX/SPX cross is still bearishly below the breakdown level. The overall market will not find confirmed upside momentum until this level is reclaimed by the NDX coming on with sustained relative strength.

With the strength in AAPL it’s no surprise that the Computer Hardware index was the top gun on the day. Expect overhead at the 4/8 level.

The SOX will have overhead where the 50dma, 4/8 level and trend channel meet.

The XAU was mid-range performance wise. Note the 4/8 level just overhead.

The BTK posted an inside day. Price is back above all of tte major moving averages. The active static trend line is the next upside level.

The OSX was the last laggard on the day. Price touched but didn’t break below the 10ema. If price crosses back below the 10ema it will turn the chart back to short-term negative and be in position to complete the unfinished Seeker buy countdown.

Oil:

Gold:

Silver: