The ES posted another inside day, losing a net 6 handles. The mini-pattern is still contained within Friday’s range expansion candle so the resolution of the range should have good punch.

The NQ side had a little relative strength vs. the SP side. As expected the dual overhead of the 4/8 Gann level and 200dma are going to give the trend at least some initial trouble.

Multi sector daily chart:

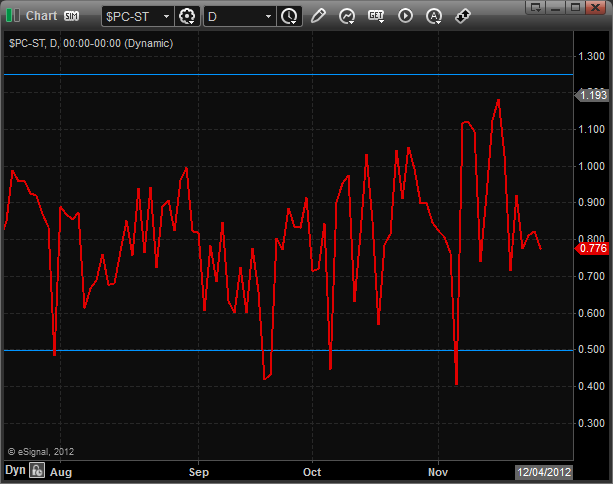

The total put/call ratio remains neutral:

The SPX/TLT cross has rebounded back into the trend channel but the posture remains risk-off until the ratio crosses back above the upper channel boundary.

The SOX was the top major sector on the day but left a gravestone doji on the chart. The intermediate trend remains neutral until the trend line is broken.

The OSX was lower by 2 and used the 10ema for support.

The BKX was much weaker than the broad market and settled below the 10ema.

Oil:

Gold:

Silver: