The ES was higher by 9 on the day racing back up to the top of the recent range. The bad news is that the range is still holding and has not yet been resolved.

The NQ futures tested the 200dma and settle up on the day by 19. Keep in mind that this is a key area of resistance at the 4/8 Gann level.

The 10-day Trin is getting very close to the overbought threshold of 0.85:

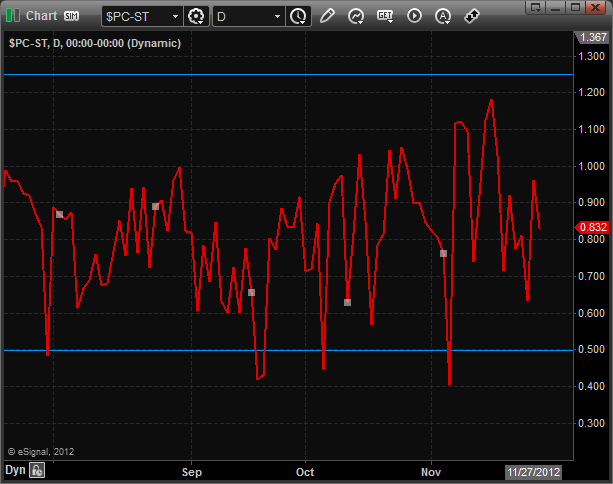

The put/call ratio remains neutral:

Multi sector daily chart:

The NDX/SPX cross is getting close to bullishly challenging the former breakdown:

The broker-dealer index aggressively broke to a new high. Expect resistance at the 8/8 level.

The SOX was stronger than the overall NDX. Layered overhead begins at the 4/8 level.

The OSX is now 12 days down on the Seeker count.

The XAU recouped very steep losses mid-day to finish stronger than the overall market.

Oil:

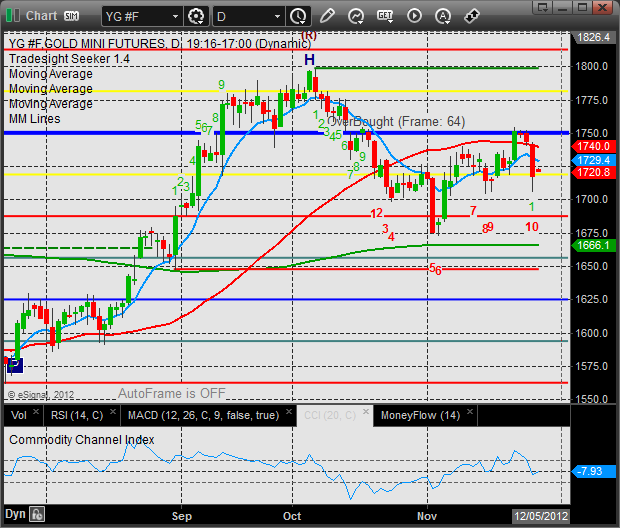

Gold