The ES was lower by 8 on the day after completing the 9 bar Seeker setup on Friday. Price is still being rejected by the 50dma that we have been focusing on. Going forward this will be an important point of reference perhaps even more so than the intraday high that was put in place Monday. Note that the CCI has not yet crossed the zero line which is where lasting upside momentum lies.

The NQ’s were only down ½ as much as the SP side but the chart construction is identical. Price opened above the 50dma and as it should have failed. The MACD has the same condition with no penetration of the zero line. The ES, NQ and YM all have downside CPS signals.

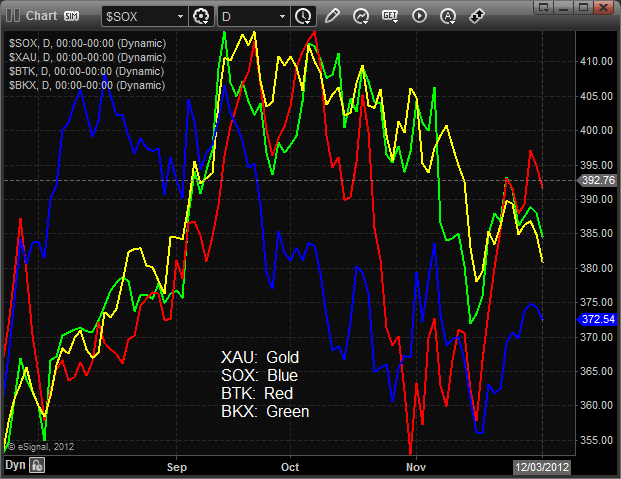

Multi sector daily chart:

The 10-day Trin is below the 1.00 level but not yet in the overbought area of 0.85-.

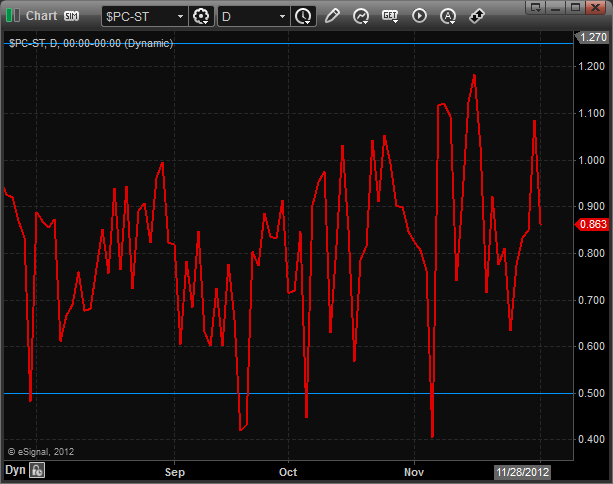

The total put/call ratio is still in the neutral zone.

The relative strength of the NDX/SPX cross has just turned back into the comfort channel. A little more penetration into the channel would be a nice bullish sign for the NDX

The SPX/TLT cross is stuck in the middle of the channel. This is the current midpoint of the risk-on/risk-off measure.

The XAU was the last laggard on the day and continues to bearishly ride the 10ema lower.

The BKX is still pinching between the two big moving averages.

The SOX completed 9 days up in the Seeker and bearishly closed back below the 4/8 level.

The OSX was stronger than the broad market:

Oil:

Gold:

Silver: