The SP was little changed on the day still unable to get above the key 50dma. Price used the 10ema for support and the resolution of this mini-range should extra punch.

The NQ futures were lower on the day by 5 and has the same range condition as the SP side. Beware that the 4/8 Murrey math levels is the third strongest of the box.

Multi sector daily chart:

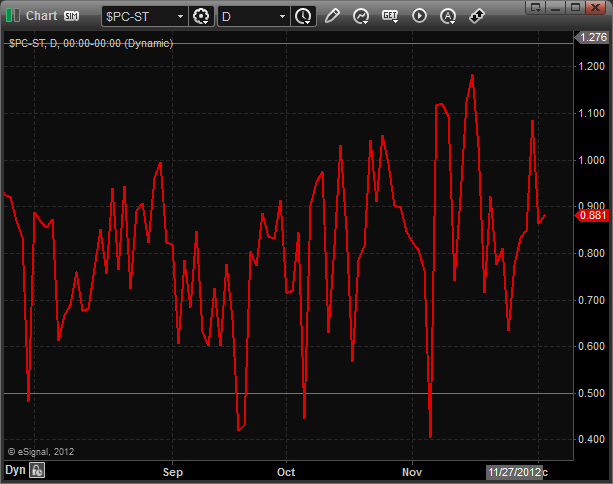

The total put/call ratio remains neutral:

10-day Trin:

The SPX/TLT ratio took a turn in favor of risk off and is still unable to challenge the upper half of the trading range.

The OSX was top gun on the day and closed at a new high on the move. Note that the 50 and 200dma’s will be strong overhead.

The SOX was notable stronger than the overall NAZ.

The XAU was flat on the day after recouping a big loss. This has the potential to be an important higher low.

The BTK is still contained by the active static trend line but above all the major moving averages.

The BKX was the last laggard on the day and has troubling looking construction. Note that there has been no 9 bar seeker setup buy to support it.

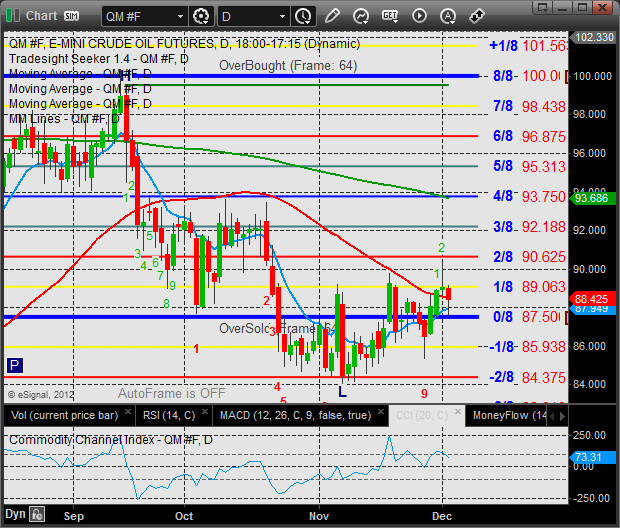

Oil:

Gold:

Silver: