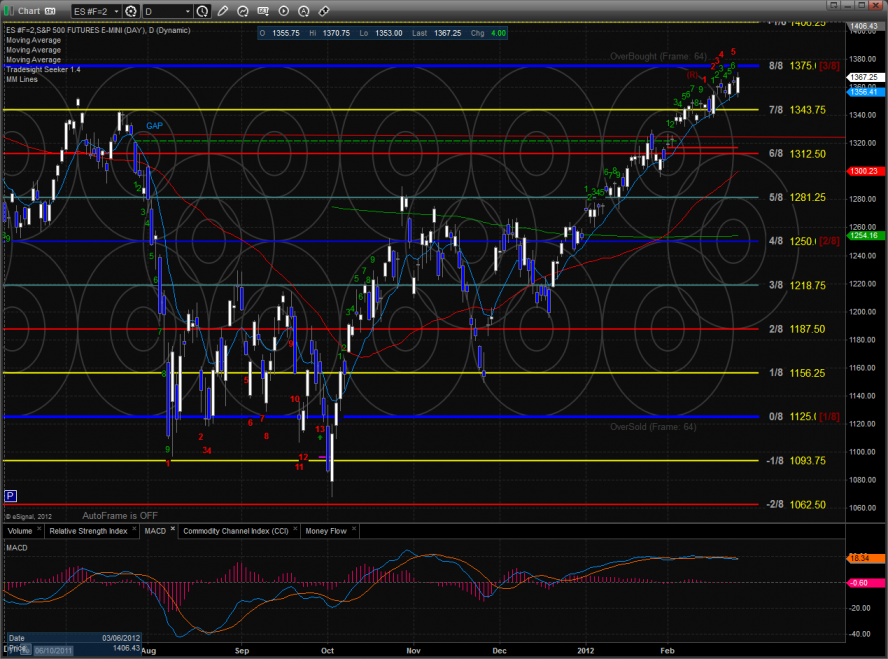

The ES gained 4 handles on the day after recouping a gap down that tested the 10ema. The 10eam has been the defining level since the breakaway gap on the first trading day of the year. Keep a close eye on the 8/8 level just overhead.

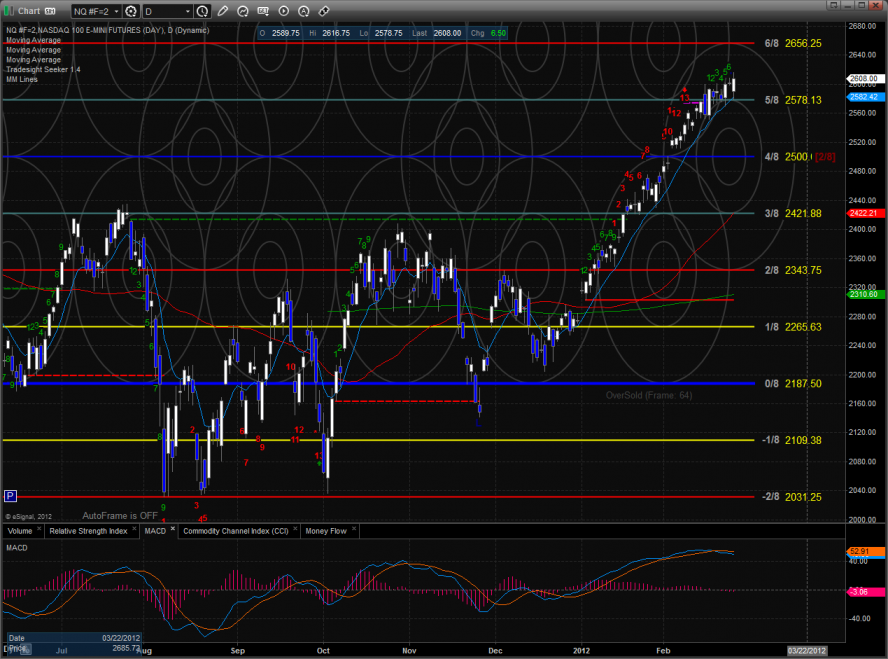

The NQ futures were higher on the day by 6 making both a new high and new high close on the move. Price is extended and the MACD is starting to top off. Mind the 10ema which has defined the trend.

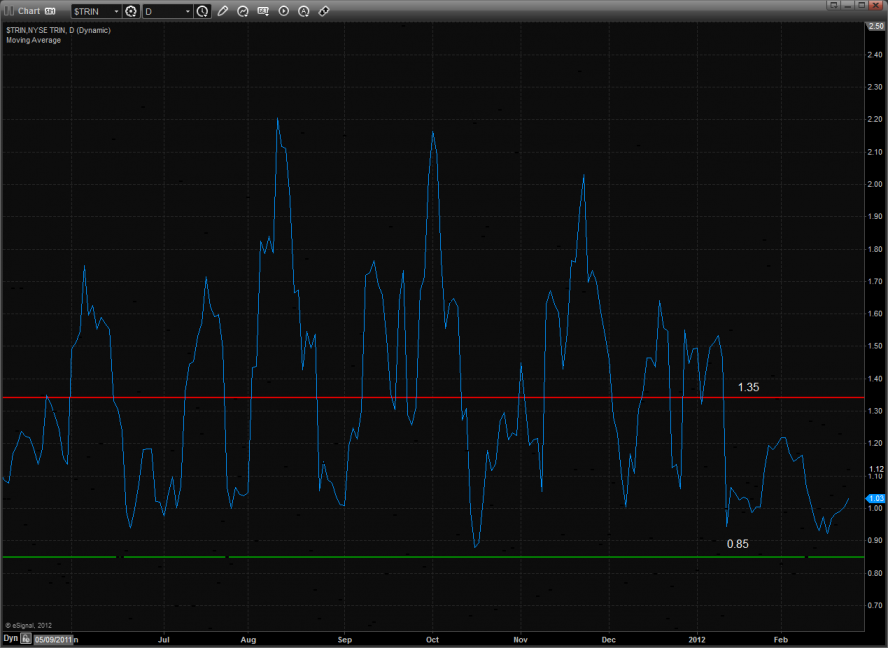

The 10-day Trin is still in the neutral range:

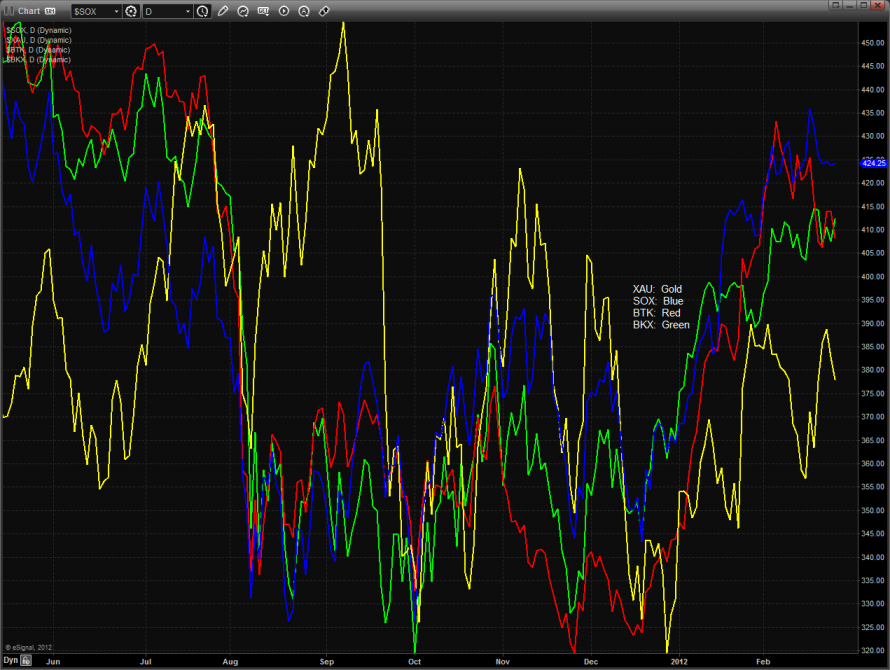

Multi sector daily chart:

The NDX/SPX cross has not made a new high to confirm the new high in the broad market. If it doesn’t happen in the next 48 hours it will be a notable divergence.

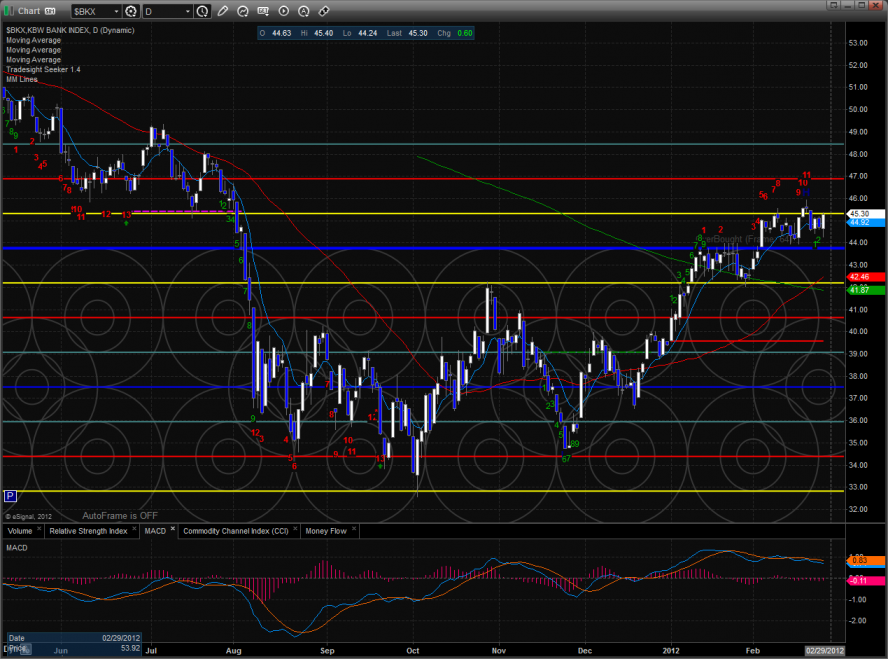

The BKX was the top gun on the day but did not make a new high on the move. Intermediate trends tend to mature when leaders take pause and laggards outperform.

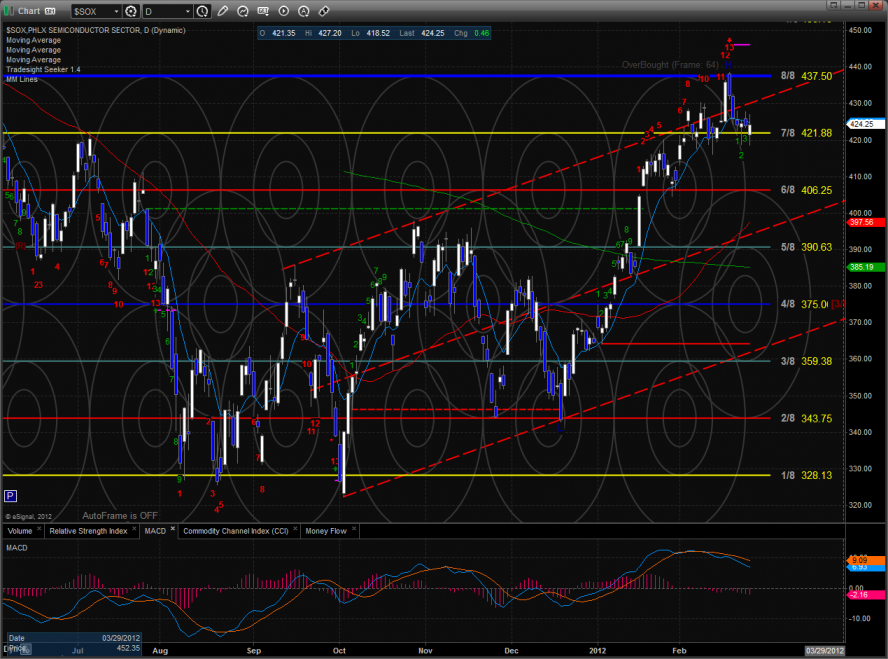

The SOX has a Seeker 13 exhaustion signal in place and hit but retreated from the 8/8 level. Keep a close eye on how the MACD behaves. This move may be mature and ready for a test of the midpoint of the regression channel.

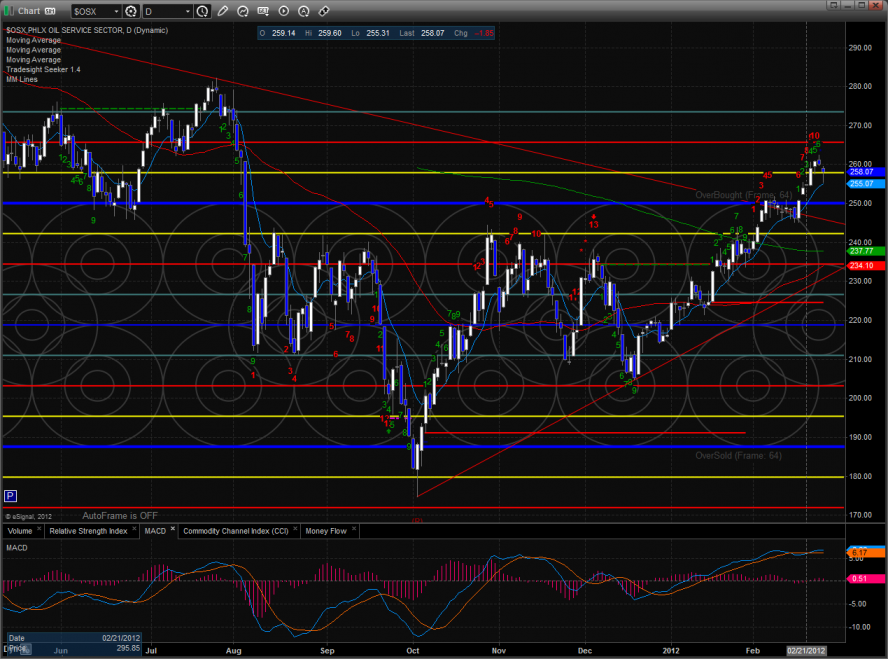

The OSX was weaker than the broad market and is still in the Murrey math overbought territory.

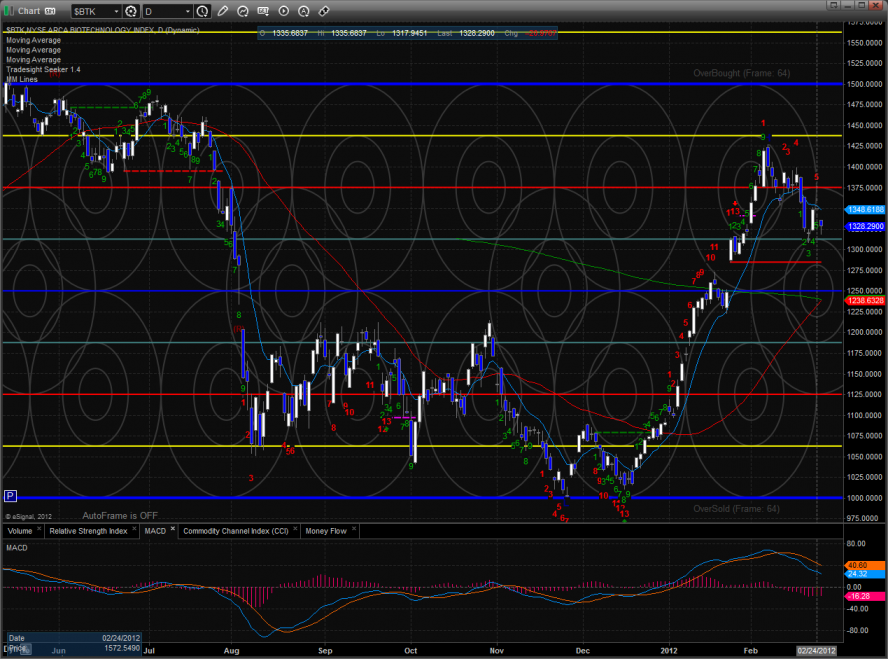

Watch the BTK closely for a break under last week’s low. This was the leading sector and may be ready for a test of the static trend line. The chart pattern has a strong 9-13-9 Seeker setup.

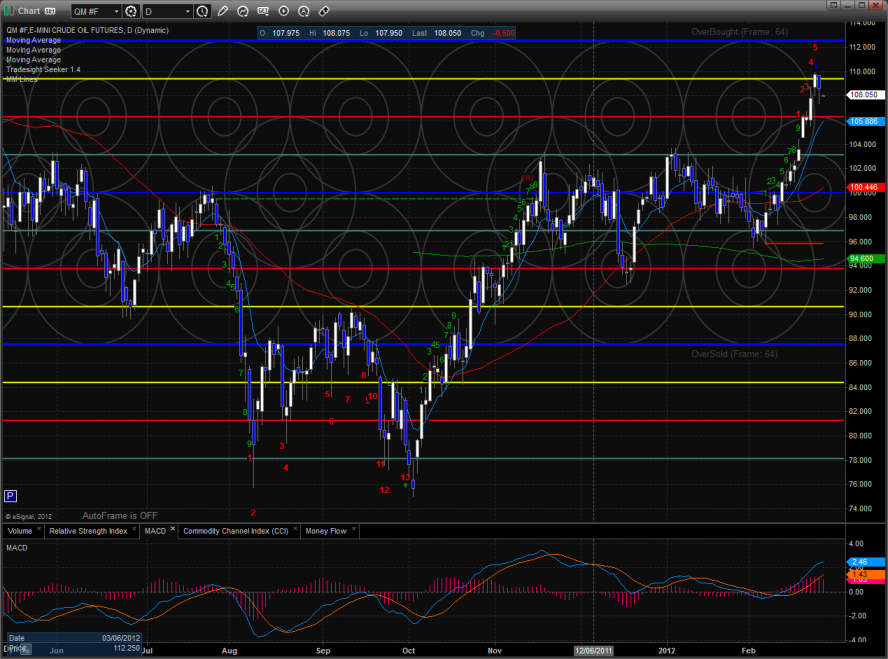

Oil was lower on the day, backing off range high levels.

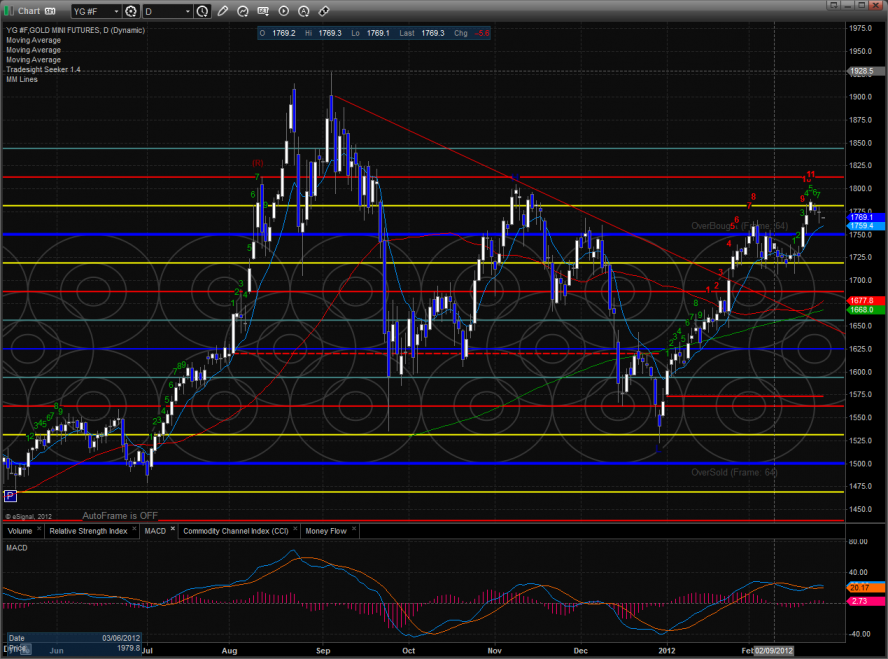

Gold remains in the overbought area of +1/8: