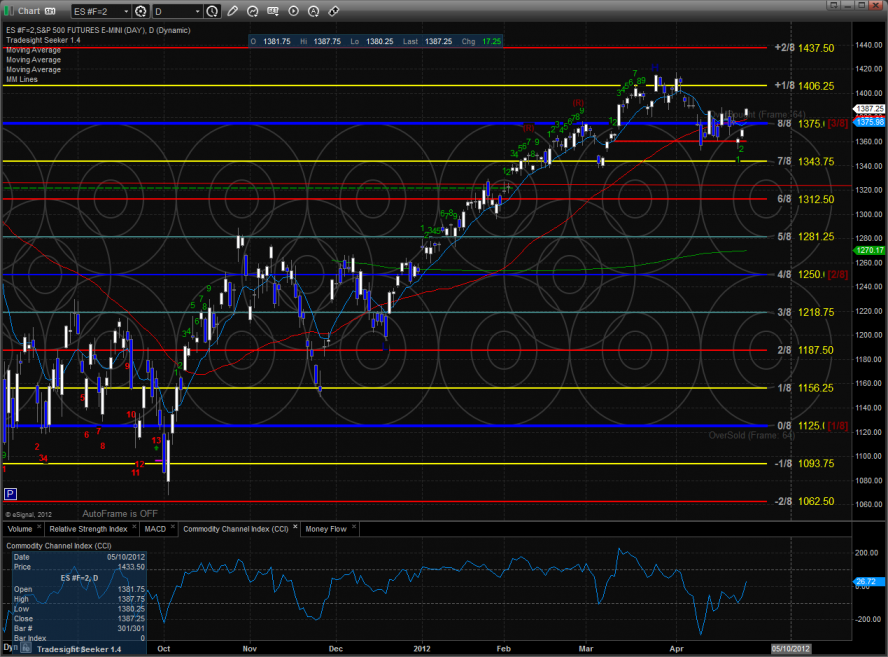

The ES gapped higher and closed at the HOD gaining 17. Price has advanced to the high of the recent range and also the recent breakdown level and gap window.

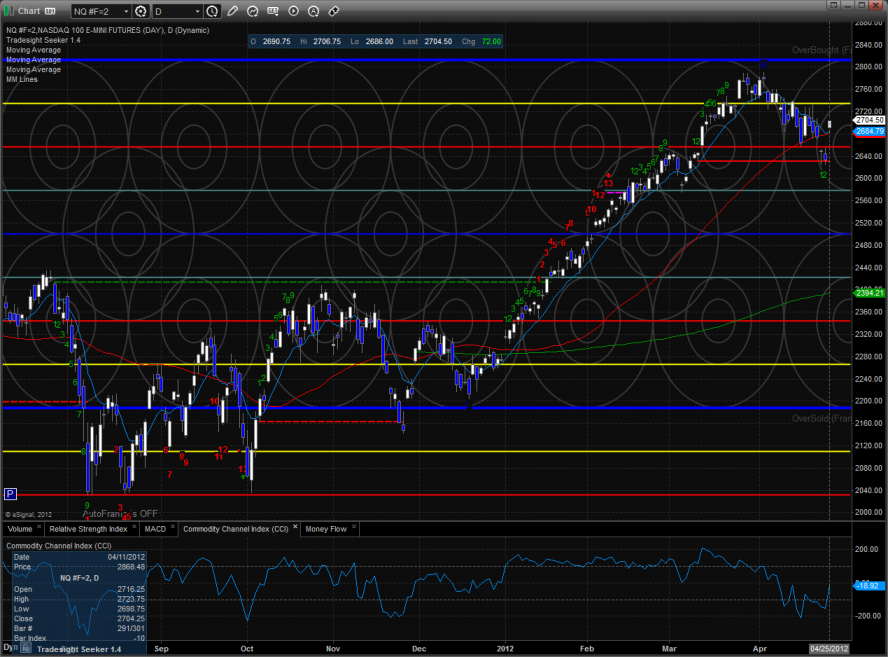

The NQ futures were much stronger than the ES on the day exploding higher by 72 and leaving a small 2 candle island below. Note that price is now back above all the important moving averages.

10-day NYSE Trin:

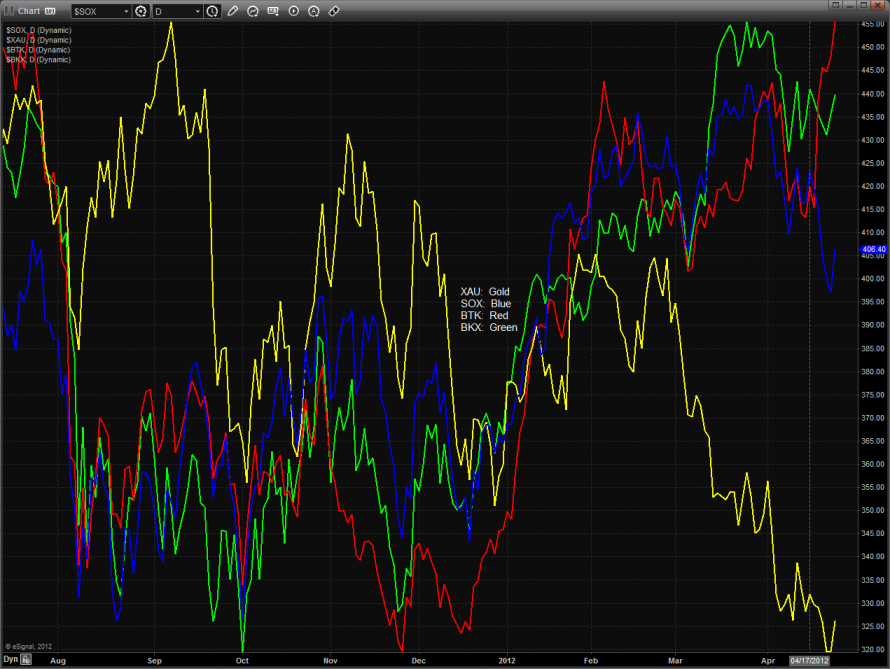

Multi sector daily chart:

The SOX/NDX cross bearishly made a new low on the move:

The NDX is showing very good relative strength and building on it would be very bullish for the overall market.

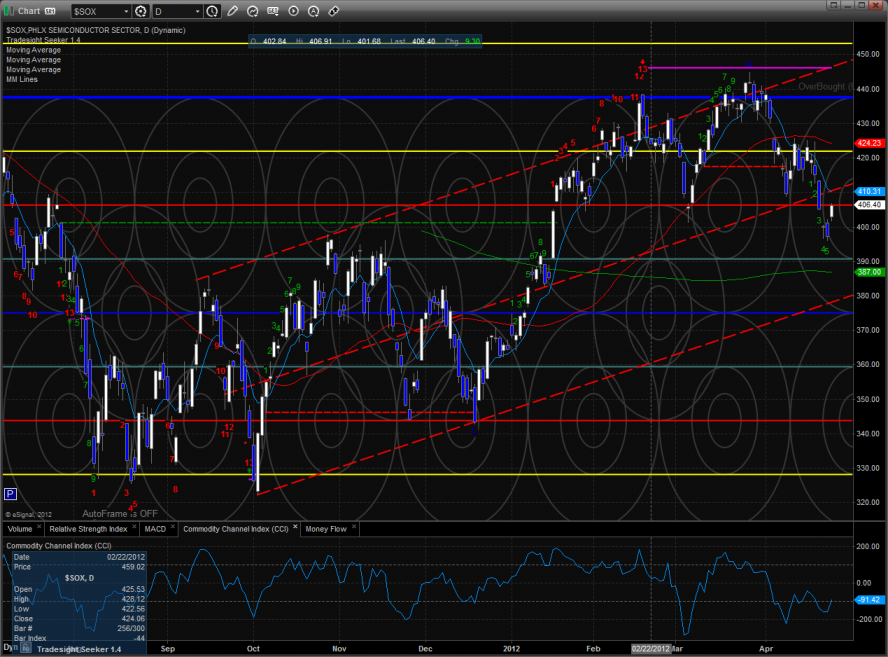

The SOX was strong on the day but underperformed the overall NDX.

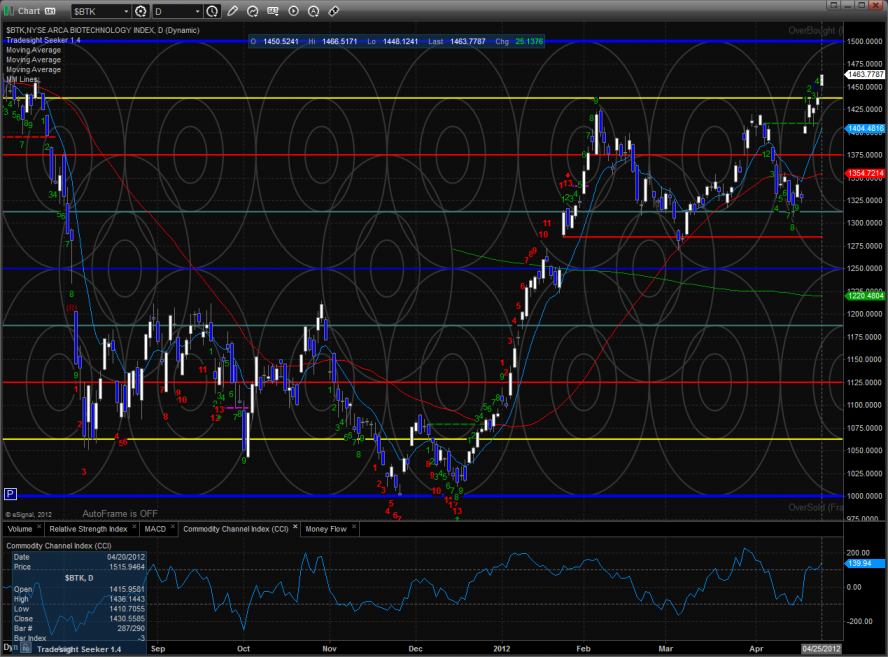

The BTK continues to print new highs and is unencumbered by the Seeker count.

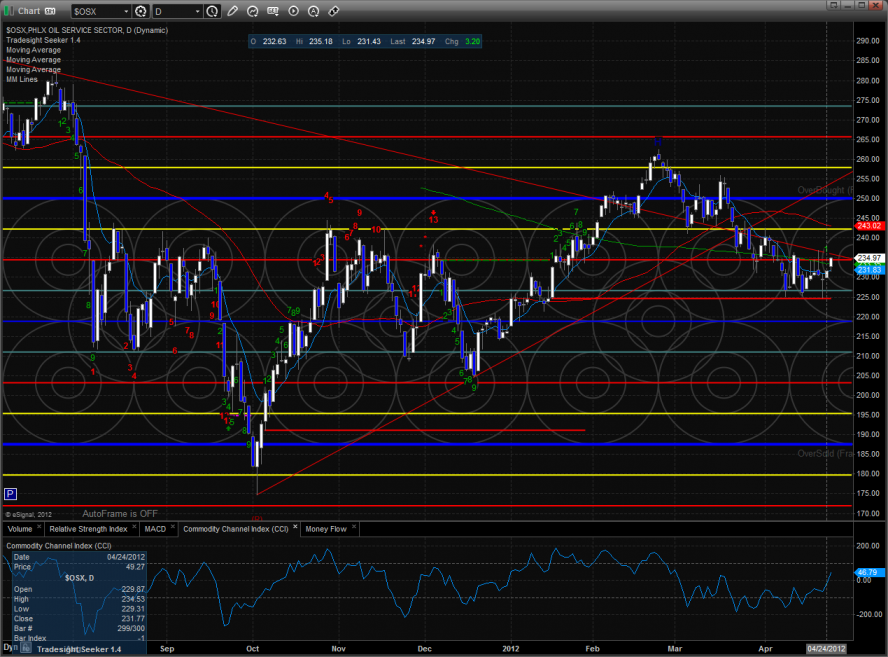

The OSX has rallied to key resistance and a potential short-term breakout level.

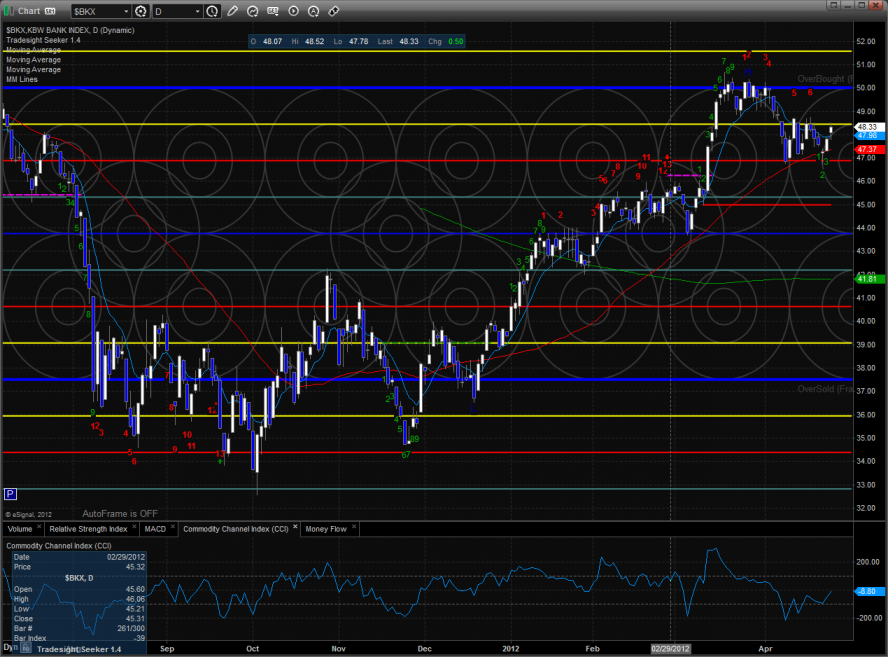

The BKX jumped over the 10ema but was weaker than the broad market. Price is still holding above the 50 and 200 period moving averages.

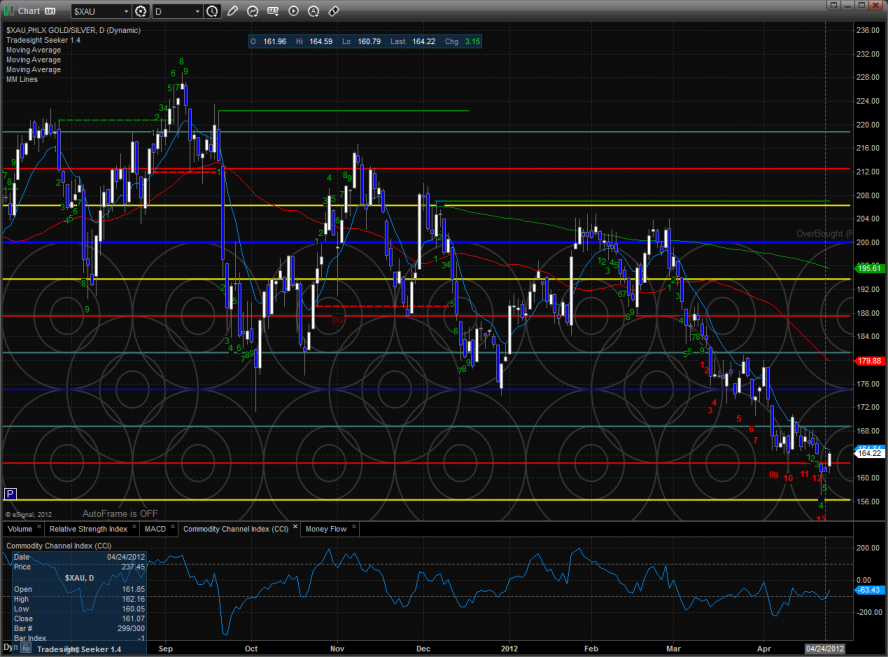

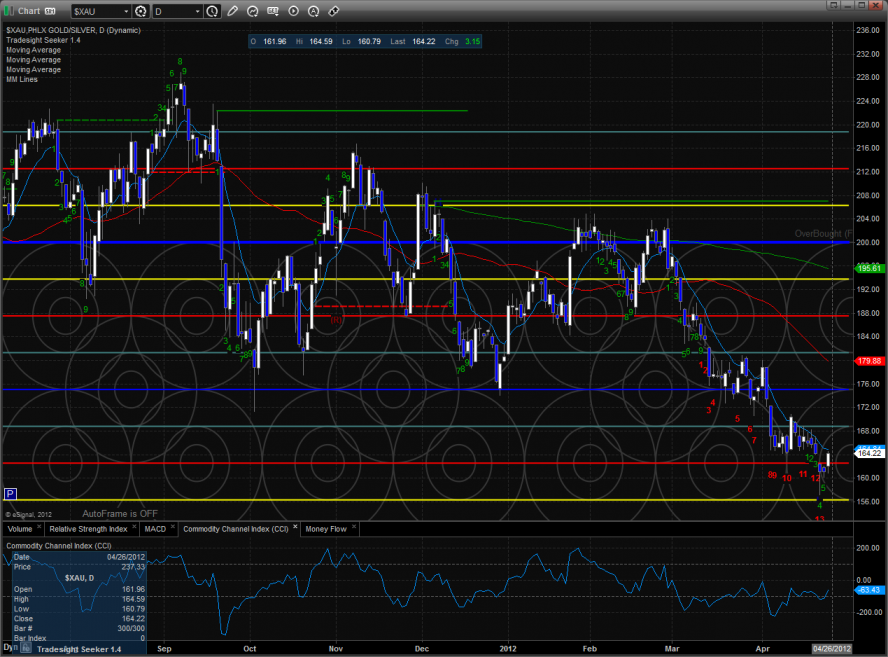

The XAU is trying to make the turn. There is a ton of room for the next upward impulse.

Oil:

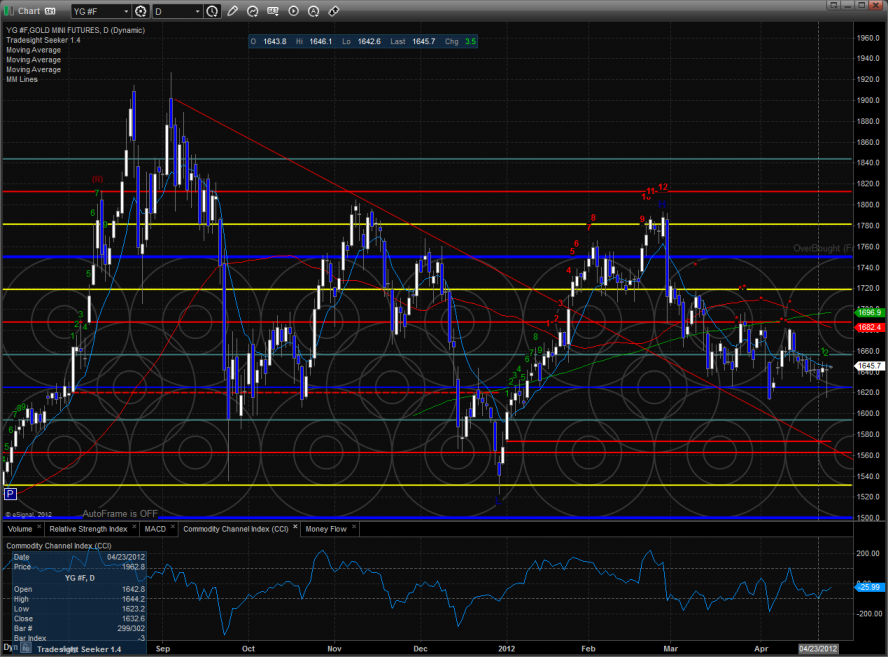

Gold:

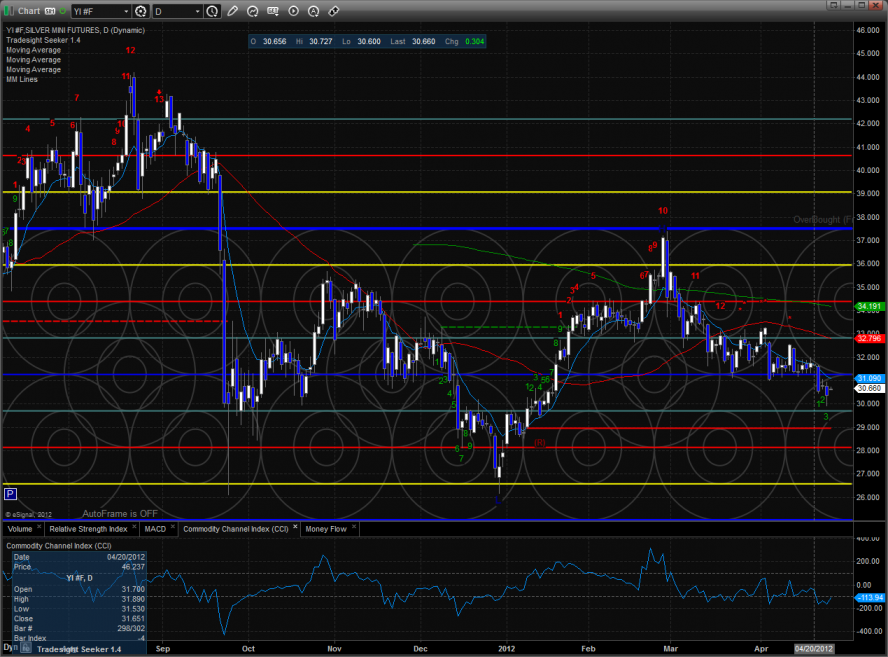

Silver: