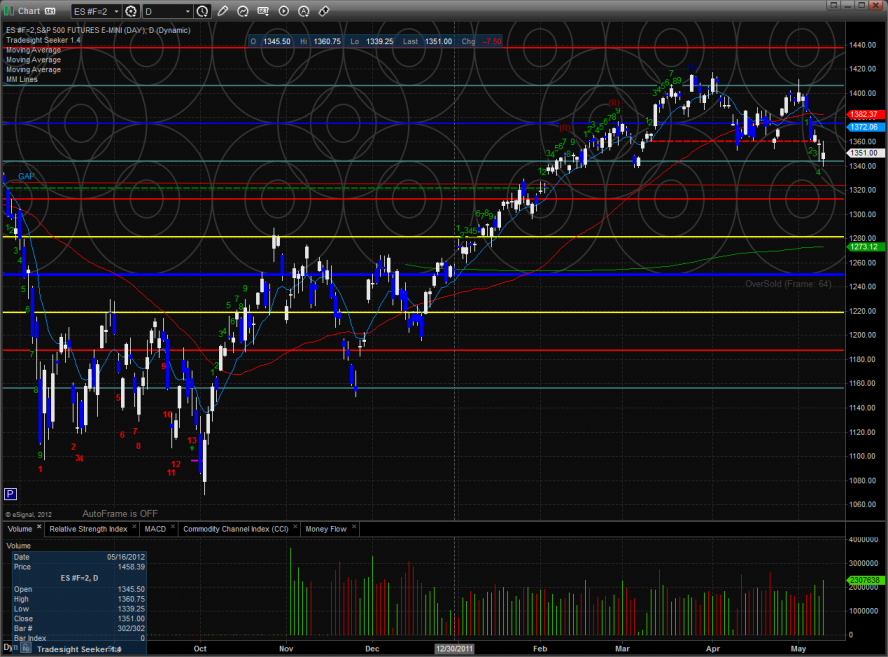

The ES closed right at the key 1352 level which was the intraday low form April. The bullish development was that even though price was lower on the day the close was above the open.

The NQ futures were little changed on the day but closed well above the open. Price was contained within the prior day’s range and the breakout should have some extra punch.

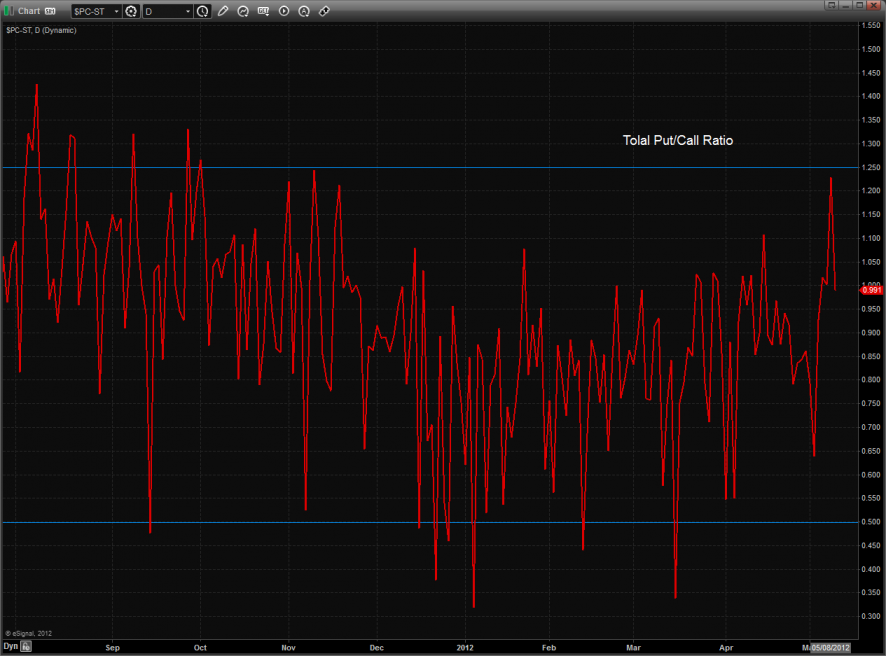

Total put/call ratio:

10-day NYSE Trin:

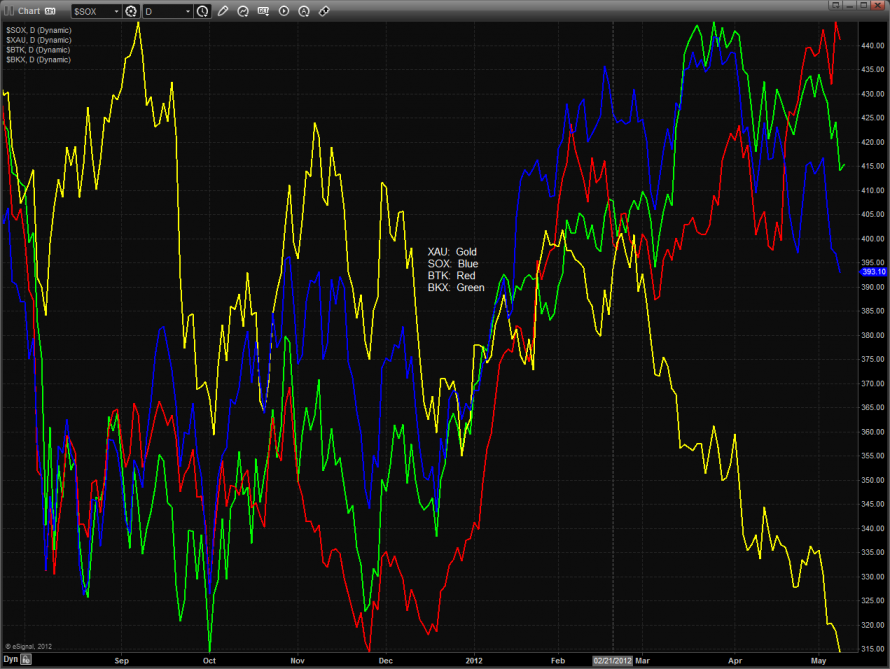

Multi sector daily chart:

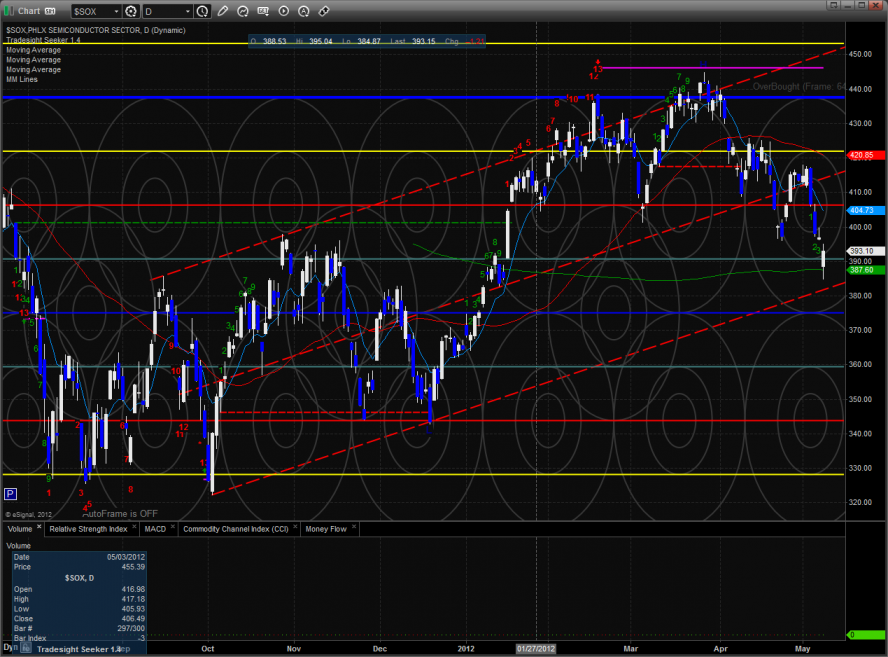

The SOX/NDX cross is hanging on by a thread, see below.

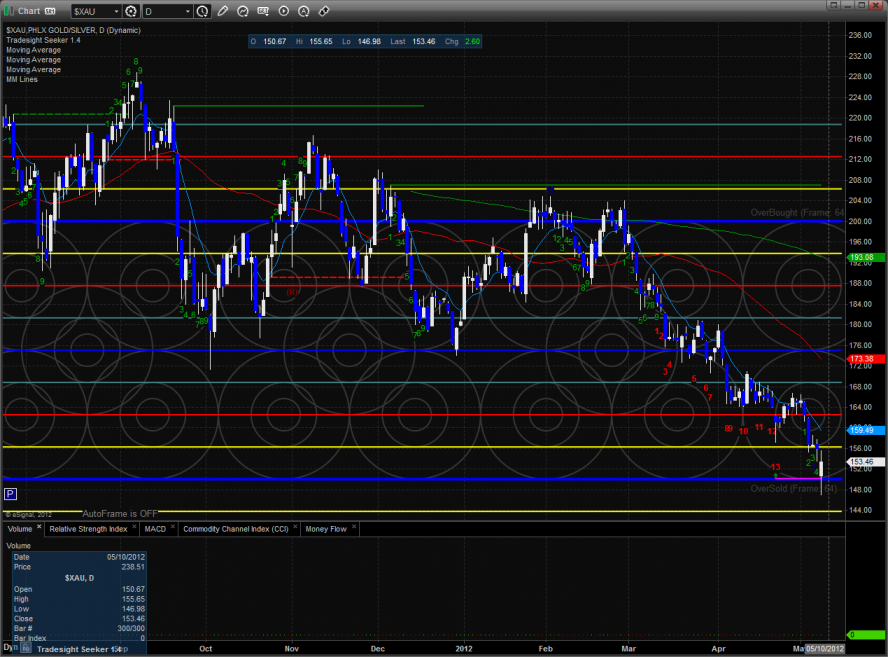

The XAU tested the risk level of the Seeker buy signal and was saved by it. Keep a close eye on this sector the rest of the week and look for reversal setups.

The SOX tested and held above the key 200dma. Keep in mind that this also maintains price above the lower channel boundary.

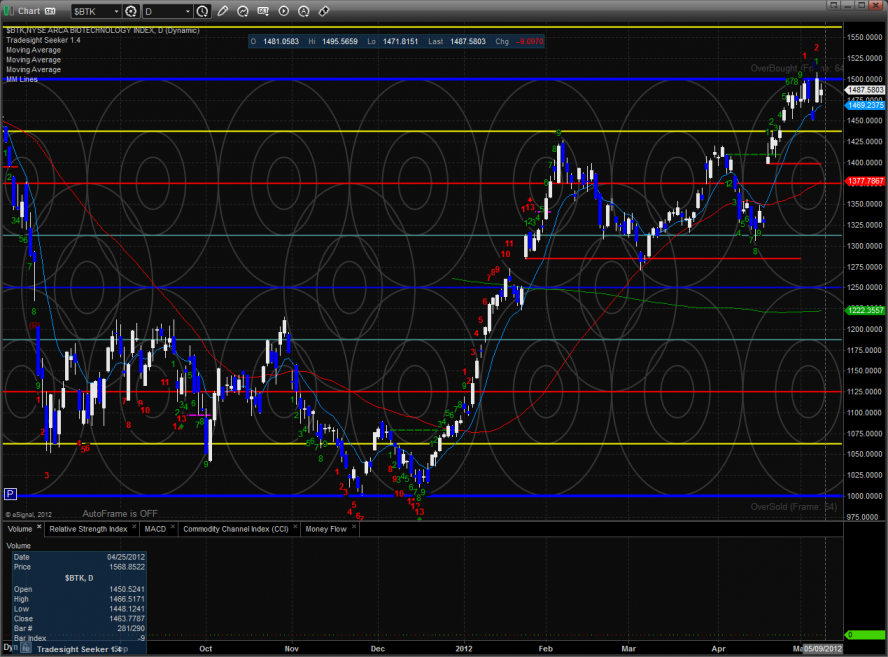

The BTK posted a relatively narrow inside day.

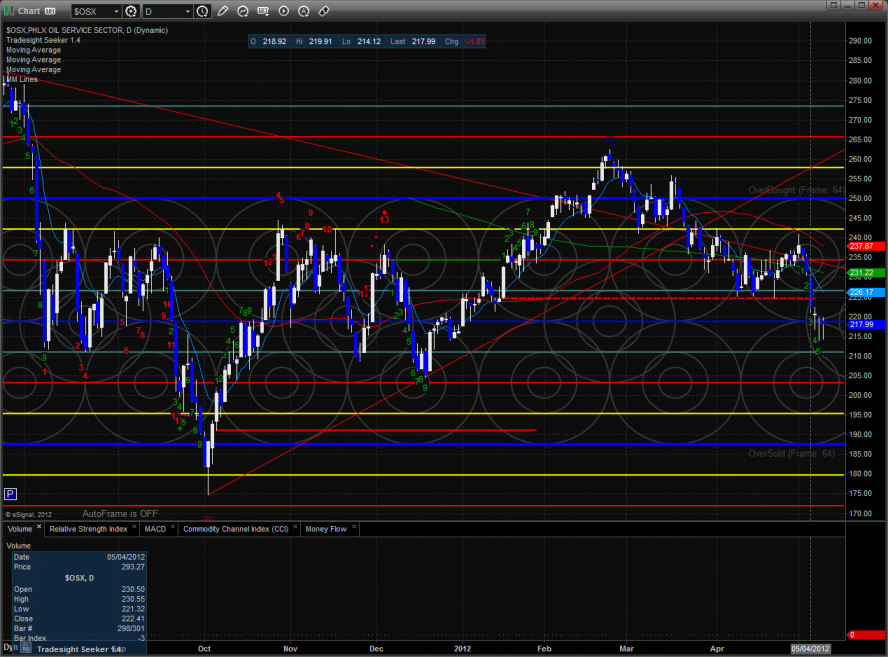

The OSX continues to trace out some bottoming tails on the daily chart and closing at a 3 day high will kick in some short covering.

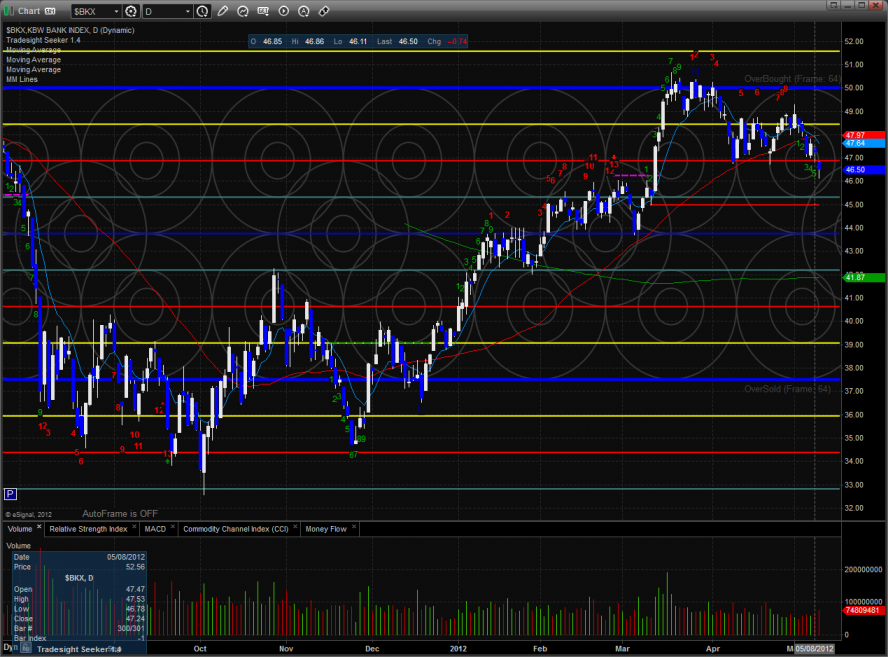

The BKX was the weakest major sector on the day. Price settled below the recent range and continuation will put the static trend line in play.

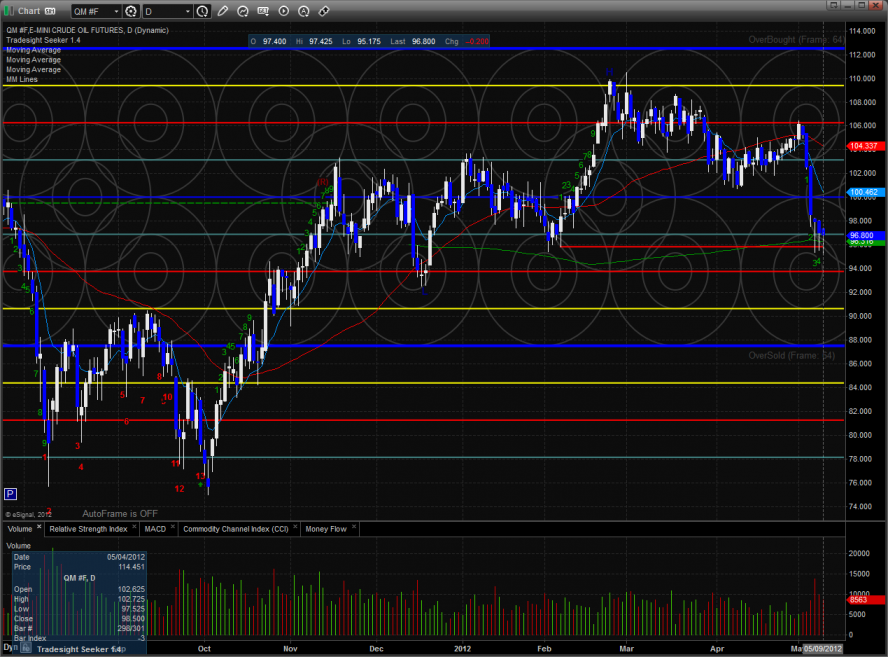

Oil:

Gold:

Silver: